Canara Robeco Asset Management Company Ltd (BSE: 544580 / NSE: CRAMC) continues to scale its asset management platform through a combination of equity-led asset growth, expanding distribution reach, and rising systematic investments, with Q3 FY26 disclosures highlighting the interplay between industry trends and company-level execution.

As of December 2025, the company reported assets under management (AUM) of ₹1,199 billion and quarterly average AUM (QAAUM) of ₹1,223 billion, supported primarily by equity assets of ₹1,106 billion. The company reported total income of ₹1,215 million and profit after tax of ₹528 million for Q3 FY26.

Equity-led asset composition

Canara Robeco’s AUM profile remains predominantly equity-oriented. Equity assets accounted for ₹1,106 billion of QAAUM, while debt assets stood at ₹117 billion.

This asset mix reflects broader industry trends, where equity AUM growth has outpaced debt amid rising participation from retail and high-net-worth investors. The company’s equity-heavy portfolio structure indicates greater sensitivity to market movements, while also positioning it to benefit from sustained equity inflows.

Distribution footprint and investor base

The company’s distribution network comprised 29 branches and 55,191 distributors as of December 2025.

The investor base stood at 5.07 million folios, with individual investors accounting for 87% of monthly average AUM (MAAUM).

The company also reported B-30 MAAUM of ₹289 billion, representing 23.9% of total MAAUM, indicating continued penetration beyond the top 30 cities.

These metrics highlight the role of distribution reach and retail participation in sustaining asset growth.

Systematic investment dynamics

Systematic investment activity remained a key contributor to asset accumulation. Monthly SIP contributions stood at ₹7.55 billion, while SIP month-end AUM was ₹404 billion.

The number of outstanding SIP accounts stood at 2.10 million.

These indicators reflect the growing role of systematic flows in stabilising asset growth and reducing reliance on lump-sum investments.

Financialisation and industry context

Industry data presented in the company’s disclosures shows mutual fund industry closing AUM of ₹81,009 billion as of December 2025, compared with ₹68,617 billion a year earlier.

Industry SIP AUM rose to ₹16,634 billion, while monthly SIP flows reached ₹310 billion.

This backdrop underscores the structural expansion of India’s mutual fund industry, within which Canara Robeco operates.

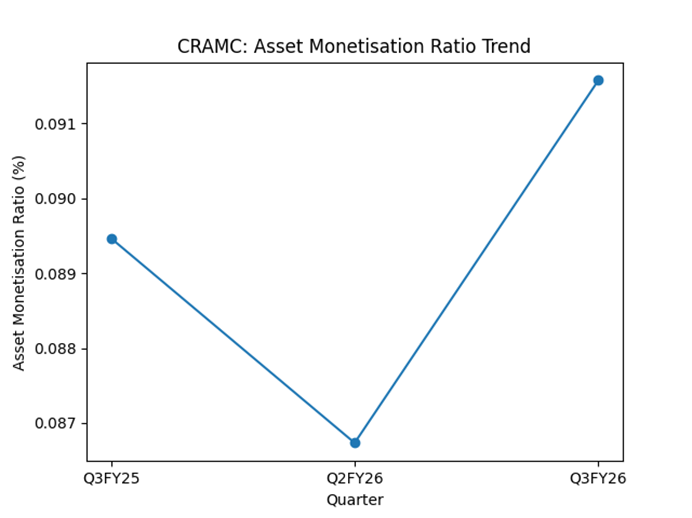

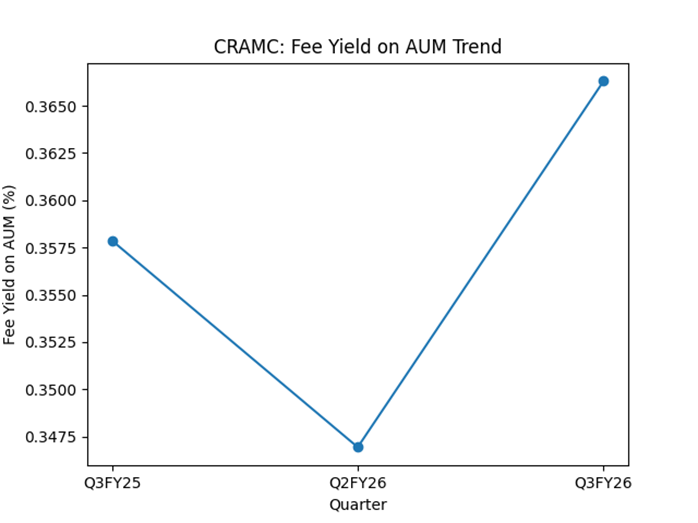

Cost structure and operating leverage

For Q3 FY26, total expenses increased to ₹510 million, driven by higher employee costs and operating expenses.

The company’s profit before tax stood at ₹705 million, reflecting the relationship between asset growth, fee income, and operating costs.

These metrics illustrate the operating leverage inherent in asset management businesses, where incremental AUM growth can influence profitability over time.

Platform perspective

Canara Robeco’s Q3 FY26 disclosures indicate that its business trajectory is shaped by three structural factors: equity-led asset growth, expansion of distribution reach, and rising systematic investments. Together, these factors define the platform economics of the company’s asset management model.

Overall perspective

Based on disclosures, Canara Robeco’s performance reflects a combination of industry-wide financialisation trends and company-specific distribution expansion. The company’s asset composition, distribution footprint, and systematic investment flows collectively shape its long-term earnings profile and competitive positioning within India’s asset management industry.