Pondy Oxides and Chemicals Ltd. has provided a one-year return of around 190%, significantly up when compared to its peers such as Guj Alkali and Solar Ind, among others.

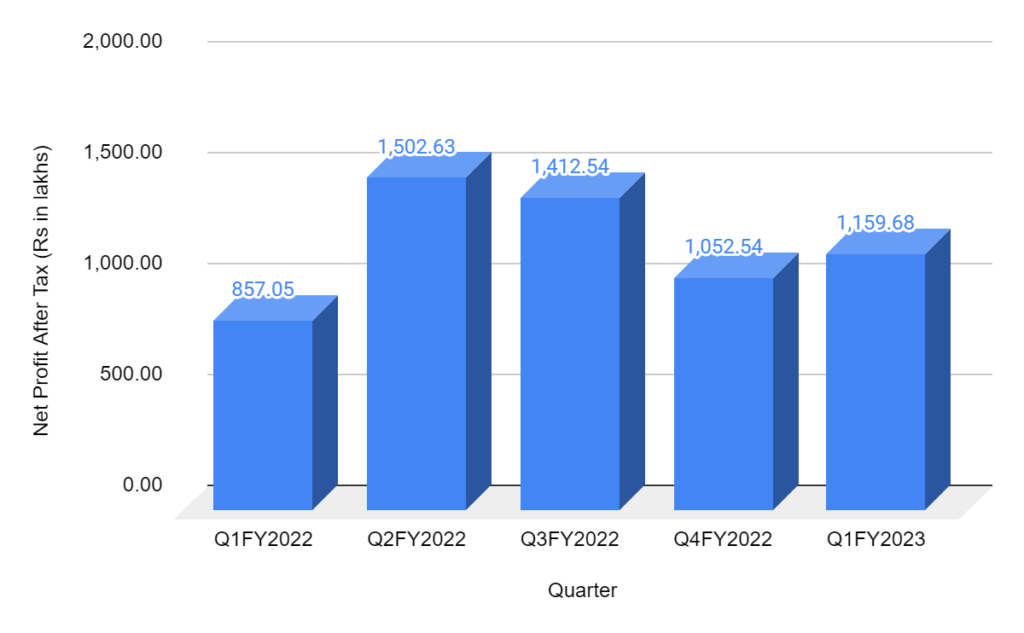

Macroeconomic uncertainty has caused constant volatility in the market, resulting in a slowdown in infrastructure, automotive, and various other sectors affecting the stocks. Nevertheless, Pondy Oxides has emerged triumphant with consistent strong quarterly numbers over the past few quarters riding on a rise in sales coupled with higher margins.

Though a rise in costs of production has impacted profitability to some extent, the company’s expansion and recycling initiatives, along with a diversified business model have borne fruit.

The company is India’s leading non-ferrous recycling company and the largest secondary lead metal manufacturing company. It recycles lead, copper, zinc, and plastic in various forms. Incorporated in March 1995, the company has established its brand globally and is listed on the Bombay stock exchange (BSE). Currently, Pondy Oxides is planning to expand its capacity in Lead and Lead Alloys, with the establishment of another state-of-the-art smelter in South India.

As a result, with the Indian lead market projected to grow at a CAGR of 6.5% during the period FY2021-2027, Pondy Oxides is poised to grow. Additionally, the transformation toward electric vehicles due to rising fuel prices is likely to augment market growth on the rising demand for recycled lead.

In the recent quarterly earnings release, Pondy Oxides Managing Director Ashish Bansal commented, “Pondy Oxides and Chemicals Ltd. has delivered a healthy quarterly result with a growth rate of 49.2% on the year on the top line and has delivered earnings before interest tax, depreciation and amortization (EBITDA) of INR 17.75 crores for the first quarter 2023 vs Rs 14.56 crores previous year showcasing a growth rate of 22%. The future outlook of the industry remains relatively positive status quo.”

Annual General Meeting

Pondy Oxides will hold its 27th Annual General Meeting (AGM) on September 21, 2022, on a remote basis.

The meeting’s agenda includes:

- The adoption of annual audited financial statements of FY2021-2022.

- Declaration of the final dividend of Rs 5 per equity share for shareholders of record as of September 14, 2022.

- Approval for bonus shares on the equity shares of the company in the ratio of 1:1 through capitalization of reserves on the revised record date as of September 29.

- Certain management and other changes

Our View

In the fast-growing world, the company reflects strong business momentum with the move towards newly defined verticals, operational efficiency, and financial stability. As a result, long-term investors might consider the stock as an attractive investment opportunity.