Being ranked among India’s most preferred brands and providing a diverse portfolio of products, Bajaj Electricals Limited (NSE: BAJAJELEC) serves consumers with unique and innovative consumables. The company’s financials reflect steady profits and revenues with some exceptions, rising demand, and a robust cash position. Also, stable cost levels reflect operational efficiency. Despite competitive pressure and macro uncertainties, the company is focused on aggressive growth plans and margin expansion. Therefore, based on the company’s strong fundamentals, long-term growth prospects, and significant returns over the last three years, investors may build a position in the stock at the current level. Moreover, the company’s net debt-free status and sound dividend policy indicate financial stability.

Overview

Bajaj Electricals Limited (BEL), an Indian consumer electrical equipment manufacturing company, is a Mid Cap company that operates in the Consumer Durables sector. It is a part of the Bajaj Group and operates its business through 20 branch offices and about 500 customer care centres.

With a market capitalization of about Rs 13,423 crore, Bajaj Electricals business is spread across – Consumer Products (Appliances, Fans, Lighting), Exports, and EPC (Illumination, Transmission Towers, and Power Distribution). Having a presence in premium home appliances and cookware segments, the company is listed both on the BSE (Bombay Stock Exchange) and the NSE (National Stock Exchange) in India.

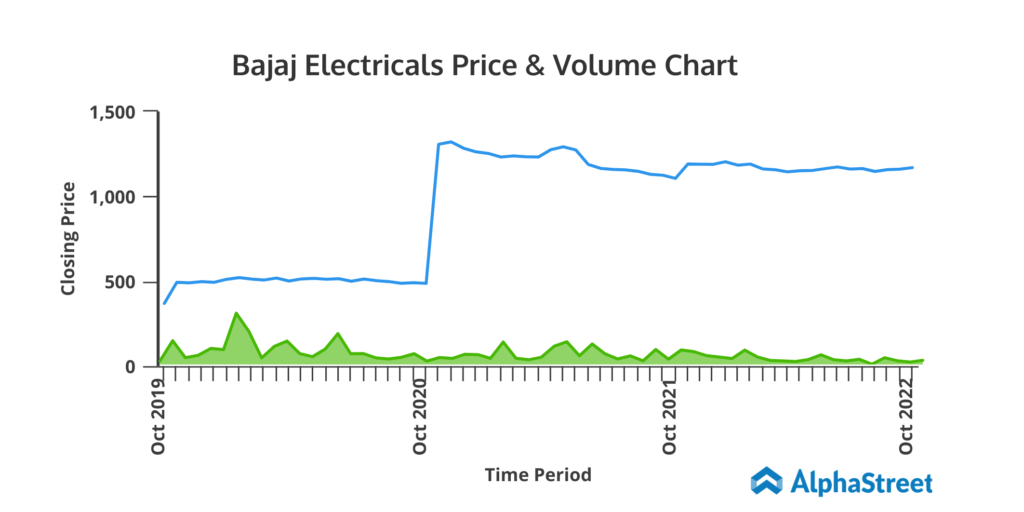

Recent Share Price Insights

- With the price of Rs 1,169.05 (as of October 31), BEL depicts an upside potential of more than 18% compared to the high of its 52-week range of Rs 858.55 – Rs 1,380.

- The stock recorded a 3-year return of 210.92% as compared to the Nifty Midcap 100 return of 84.34% on the booming consumer durables market due to the pandemic.

Financial Snapshot

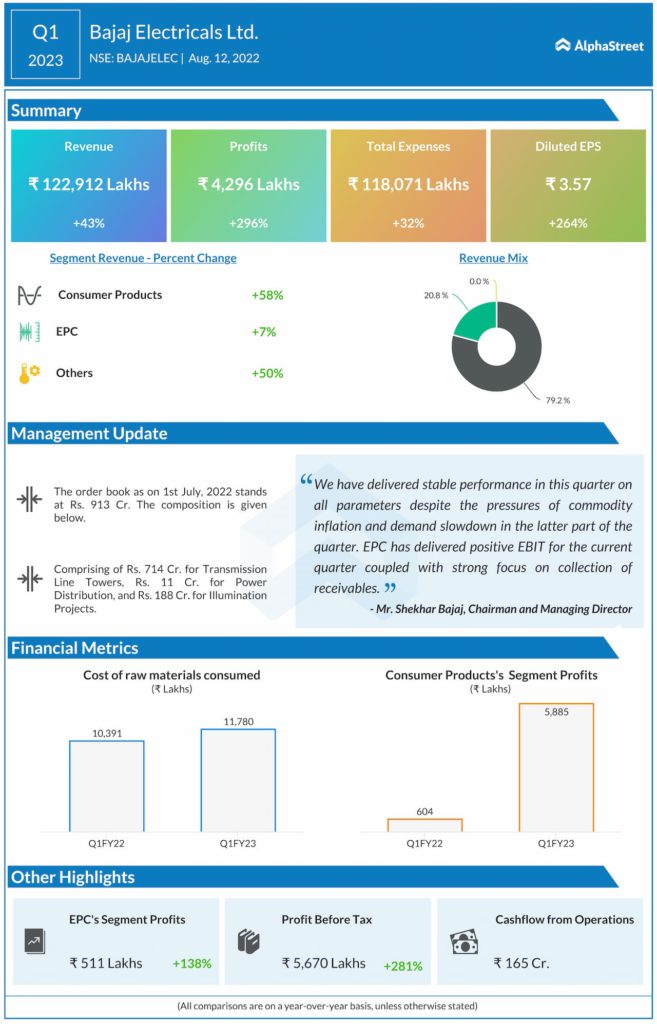

In August, Bajaj Electricals reported its financial results for the quarter ended June 30, 2022. BEL reported revenue from operations of Rs 1,229 crore in Q1 FY2023, up 43% YoY driven by broad-based growth in major segments.

Profit after tax (PAT) came in at Rs 41 crore, compared to the loss of Rs 25 crore in the prior-year quarter. Additionally, earnings per share (EPS) were Rs 3.57, compared to the loss of Rs 2.18 in the prior-year quarter.

On a segment basis, CP and EPC recorded revenue growth of 58% and 7%, respectively. Remarkably, EPC recorded a profit of Rs 5 crore as against a loss of Rs 13 crore in the comparable quarter last year.

Total expenses stood at Rs 1,181 crore, up 32% YoY. As of July 1, 2022, the order book stood at Rs 913 crore.

As of June 30, 2022, cash and cash equivalents along with investments were Rs 254 crore, while cash flow from operations came in at Rs 165 crore.

Commenting on the strong quarterly results, Mr. Shekhar Bajaj, Chairman and Managing Director of Bajaj Electricals Limited said, “We have delivered stable performance in this quarter on all parameters despite the pressures of commodity inflation and demand slowdown in the latter part of the quarter. EPC has delivered positive EBIT for the current quarter coupled with strong focus on collection of receivables.”

Factors to Consider

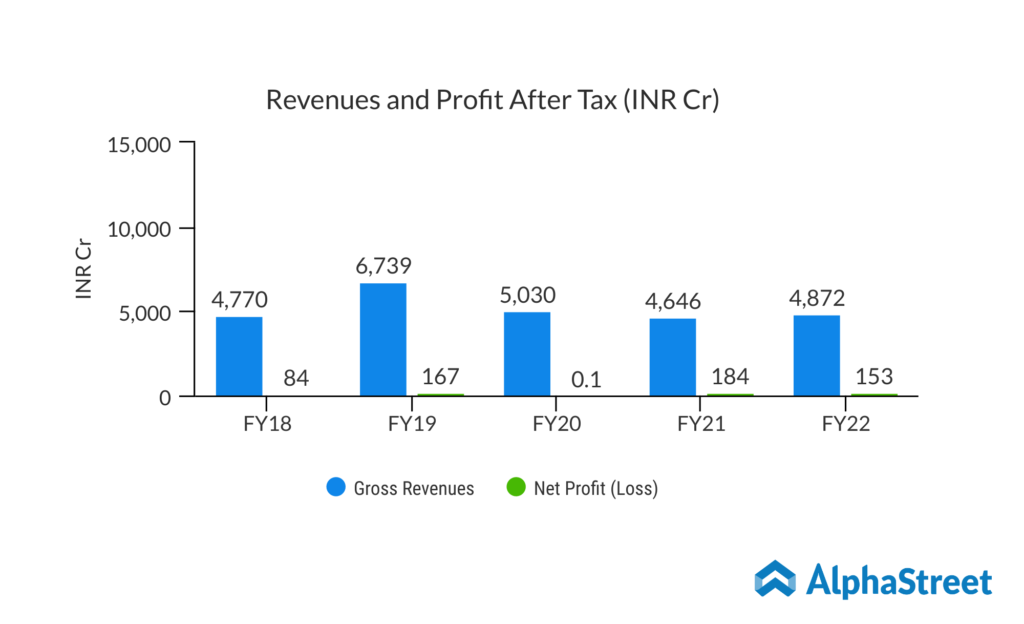

Revenues and Profits: Despite the pandemic and challenging operating environment impacted by elevated inflation and supply chain constraints in 2022, the company’s prudent operational performance and disciplined execution delivered steady performance on revenues and profitability (except in 2020 when it reported loss). Grabbing a high market share, BEL recorded decent revenue and profit growth over the past five years. The uptrend continued in the first quarter of Fiscal 2023 as well, which is expected to trend higher on strong demand.

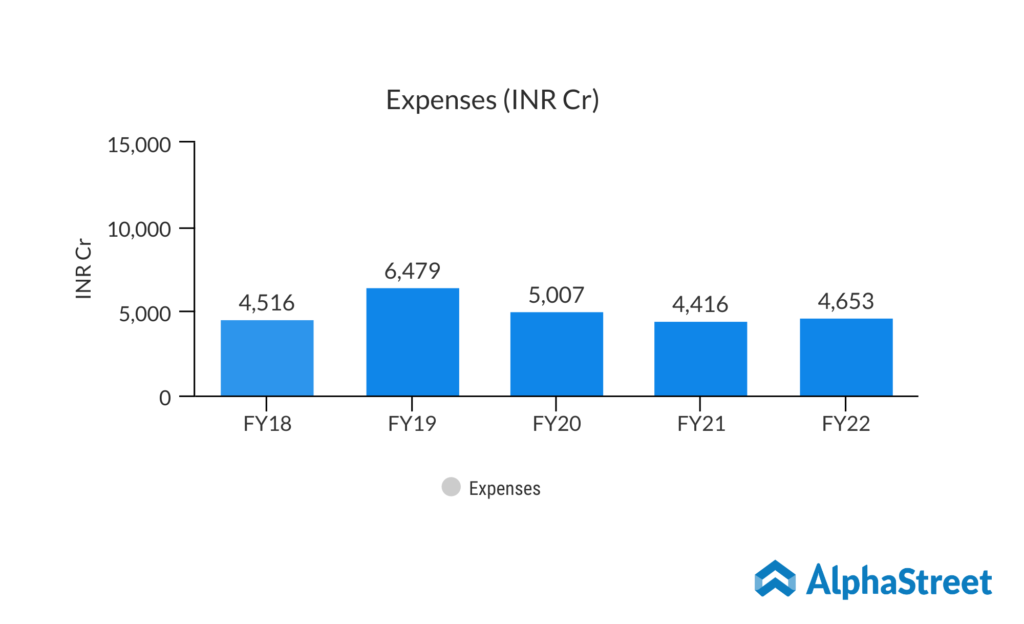

Expenses: Braving global hues and other factors, the company has managed its expenses well. The operating margin has remained in the range of 4%-7% over the past few years. Interestingly, the company’s target of recording double-digit margins in the CP segment soon indicates long-term growth prospects. Notably, the segment recorded an operating margin of 6% in Q1FY2023.

Innovation: Technology advancement is the key to success. BEL has succeeded in being competitive in the market with consistent innovative products. The company provides a wide range of indoor and outdoor lighting solutions to meet the illumination requirements of different industries. As a result, BEL is striving to provide crafting solutions for new India from streetlights to innovative lights.

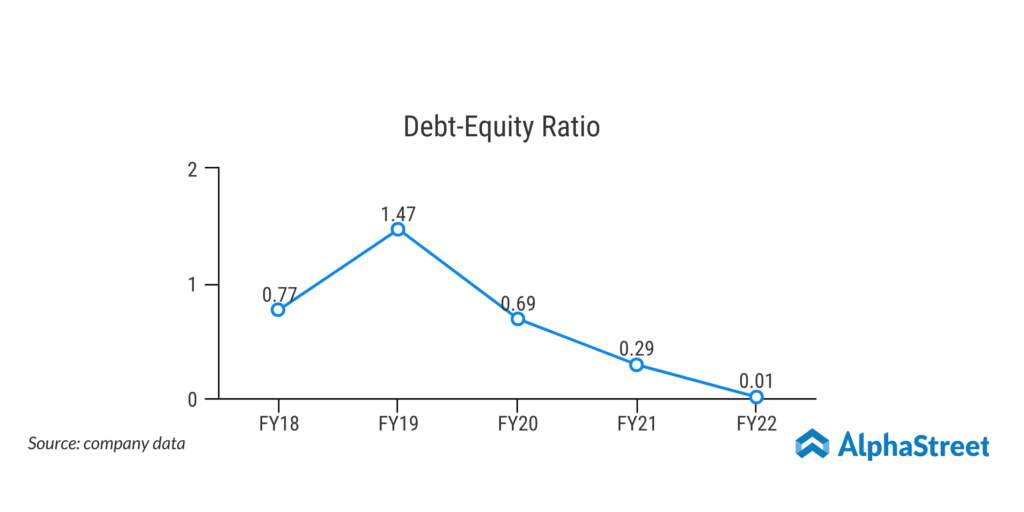

Strong Liquidity: With a very strong cash flow from operations, the company achieved a significant milestone of net debt-free status as of March 31, 2022. The debt-equity ratio fell to nil from 0.77 in FY18. Also, ROCE has remained in the range of 12%-19% over the past few years (except in 2020). Such achievements depict a strong cash position of the company and signal a constant return of value to shareholders.

Dividend Payouts: The company proposed a dividend of Rs 3 per share in 2022 after two years, indicating the company’s efforts to return value to shareholders. Prior to this, sound dividend payouts were reflected. Currently, the annual dividend yield stands at 0.26%.

Growth Plans: BEL is focused on aggressive growth across its businesses. As a result, it has undertaken several initiatives including acquisitions and demerger plans, along with its significant transformation journey. This has resulted in the reorganization and strengthening of the company’s leadership, which, in turn, will make it easier to execute growth plans.

ESG Initiatives: Bajaj Electricals has established major businesses in India, and now has been consistently working towards creating a positive impact on the environment and communities. It is strategically integrating ESG aspects into the company’s core business strategy and will map a comprehensive road ahead fundamentally.

Industry Analysis

The Indian consumer durables market is mainly divided into urban and rural markets. A favorable population composition and rising disposable income mainly drive the growth in India’s consumer market. Along with urban areas, development in rural areas and increased usage of online sales are expected to grow demand. Due to the pandemic, work-from-home and increased staying at home augmented the need for consumer durables. Interestingly, the Indian appliances and consumer electronics industry came in at $9.84 billion in 2021 and is estimated to reach Rs 1.48 lakh crore ($21.18 billion) by 2025. With government support and favorable regulations, and increasing per capita income followed by economic recovery, the Indian appliance, and consumer electronics (ACE) market is likely to increase at 9% CAGR to Rs 3.15 trillion in 2022.

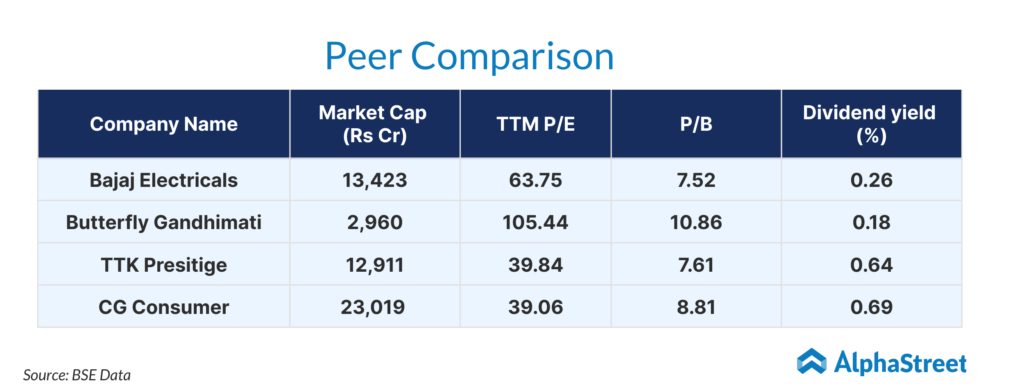

Peer Comparison

In terms of market capitalization and valuation, BEL ranks decently among its peers. As a result, based on strong fundamentals, the dividend-yielding nature of the company, and long-term growth prospects, investors can consider Bajaj Electricals as a long-term bet.