Computer Age Management Services Ltd (CAMS) operates as a registrar and transfer agent for mutual funds, providing investor services, distributor services, and asset management company support.

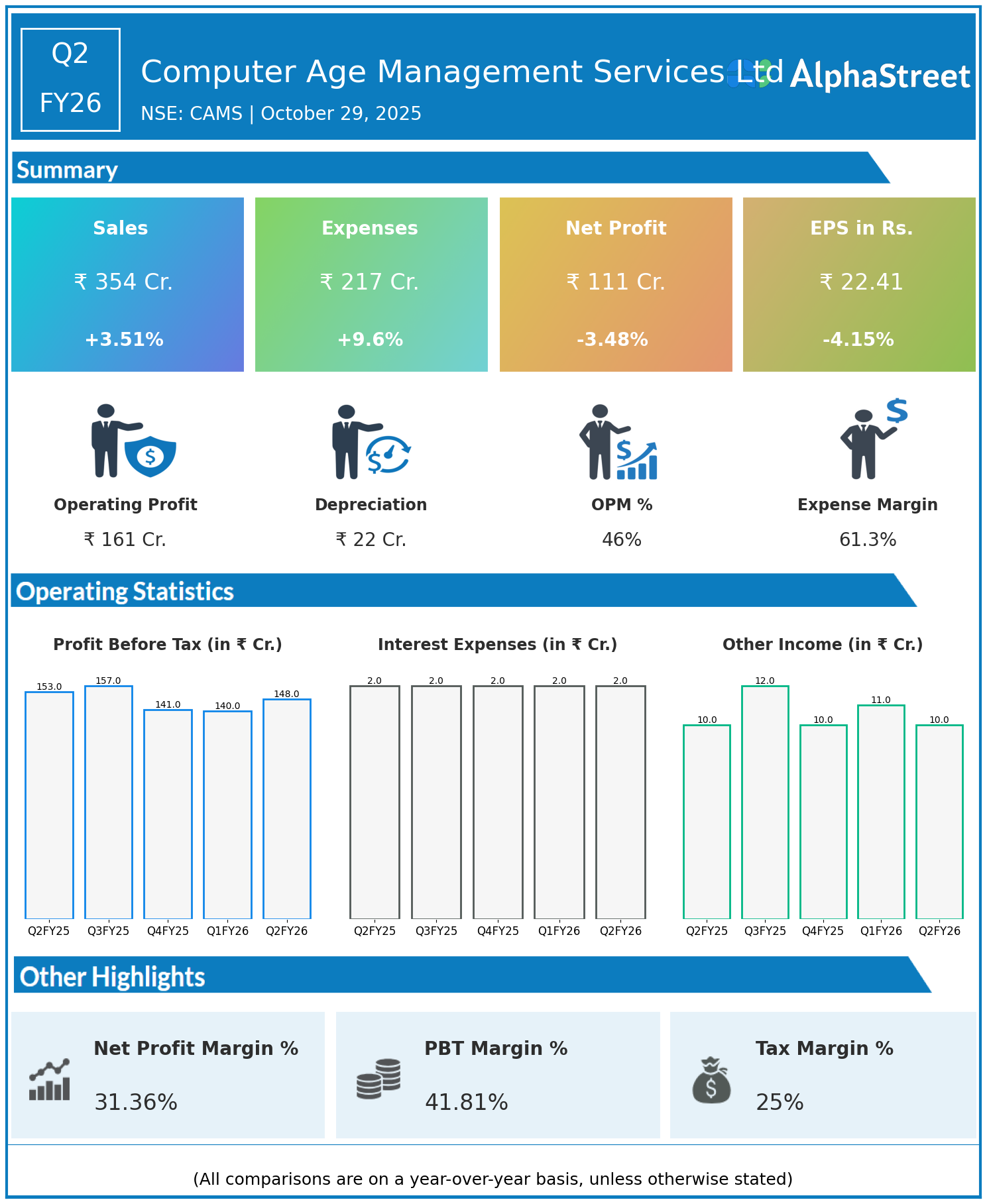

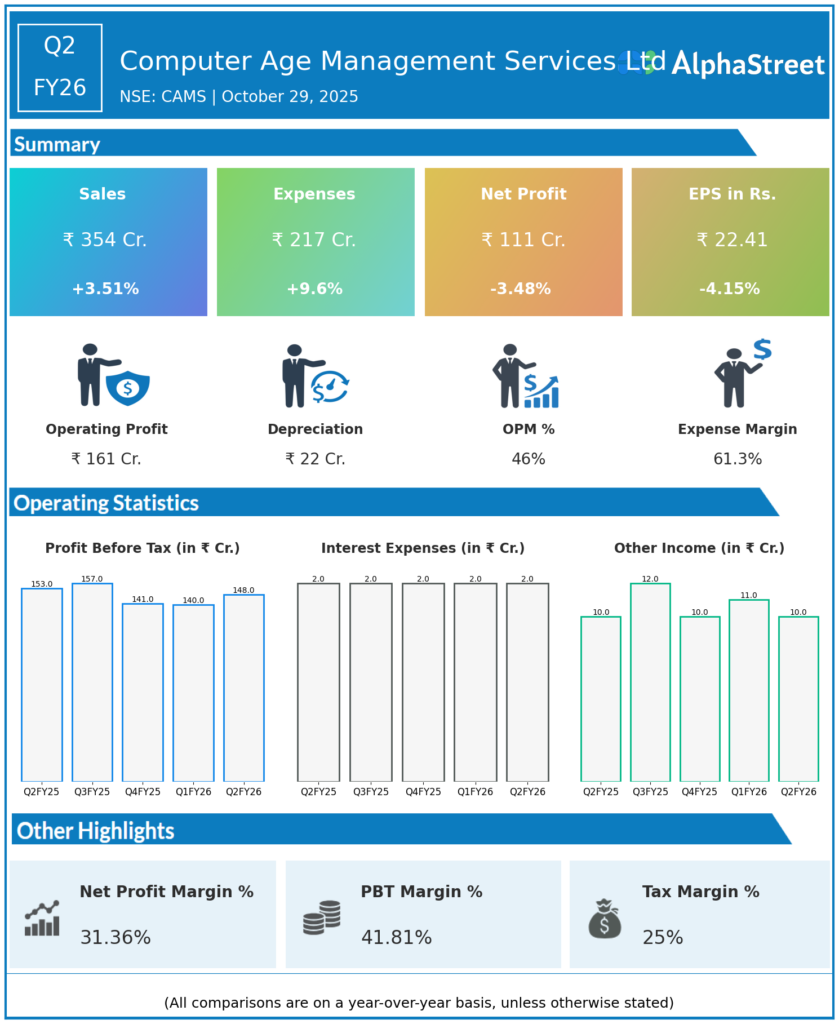

Financial Results (Q2 FY26):

- Revenues increased 3.51% year on year to ₹354 crore from ₹342 crore.

- Total expenses rose 9.6% to ₹217 crore from ₹198 crore.

- Consolidated net profit decreased 3.48% to ₹111 crore from ₹115 crore.

- Earnings per share (EPS) declined by 4.15% to ₹22.41 from ₹23.38.

Key Highlights:

- CAMS posted its highest-ever quarterly revenue reflecting robust business expansion and enhanced service capabilities.

- Asset under Management (AUM) in the mutual fund segment grew, with CAMS retaining a dominant market share around 68%.

- The slight dip in profit was primarily influenced by a marginal increase in operating expenses and investment in growth initiatives.

- CAMS secured new registrar and transfer agency mandates further expanding its client base.

Outlook:

CAMs remains focused on consolidating its market leadership through technology-driven innovations, scalable business models, and expanding service offerings to asset managers and investors.

The marginal decline in profits amidst revenue growth highlights continued strategic investment while sustaining a strong position in India’s mutual fund servicing industry.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.