Campus Activewear Limited (“Campus”), incorporated in 2008, is one of India’s largest and fastest-growing sports and athleisure footwear brands. The company designs, manufactures, and distributes a wide portfolio of footwear categories including running shoes, walking shoes, casual shoes, floaters, slippers, flip flops, and sandals. With strong presence across online marketplaces and more than 19,000 multi-brand retail outlets, Campus has built a dominant position in India’s affordable athleisure footwear market. Presenting below its Q1 FY26 Earnings Results.

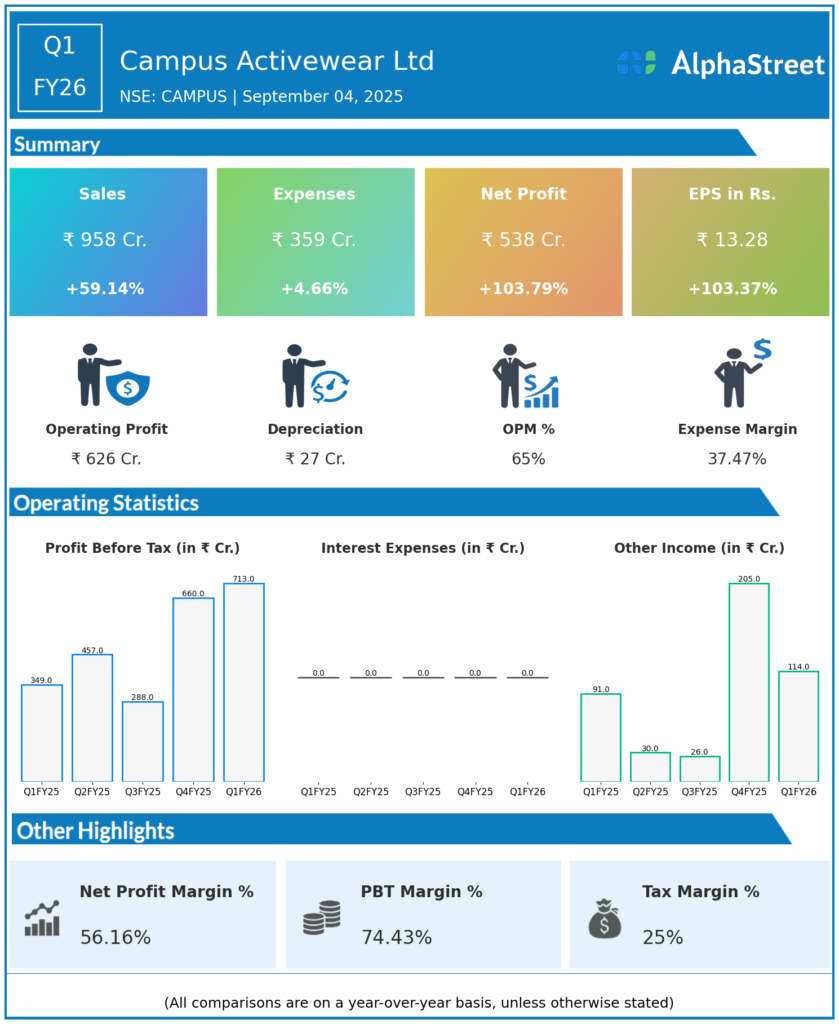

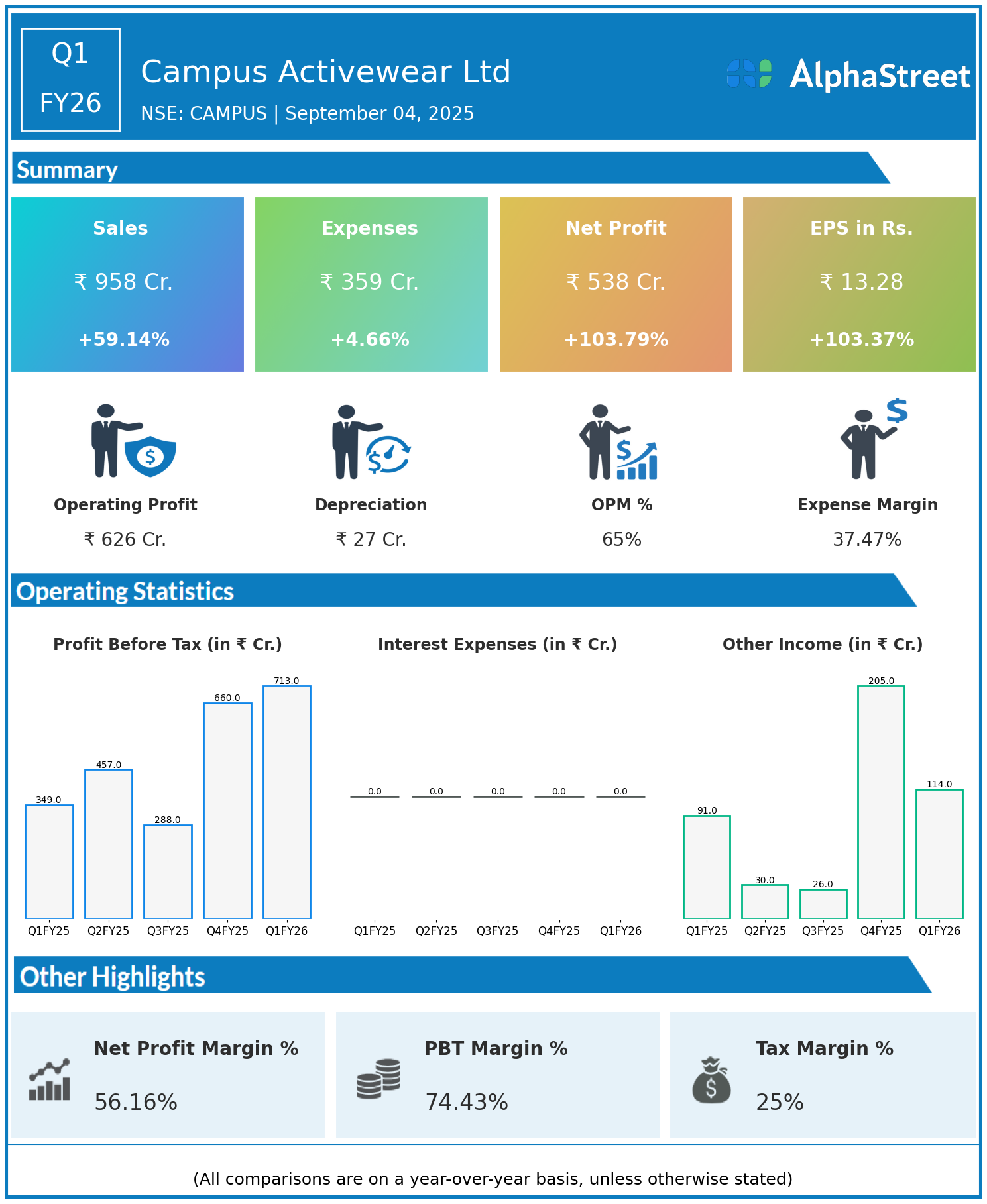

Q1 FY26 Earnings Summary

- Revenue: ₹958 crore, up 59.14% year-on-year (YoY) from ₹602 crore in Q1 FY25.

- Total Expenses: ₹359 crore, up 4.66% YoY from ₹343 crore.

- Consolidated Net Profit (PAT): ₹538 crore, up 103.79% YoY from ₹264 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹13.28, up 103.37% from ₹6.53 YoY.

Operational & Strategic Update

- Revenue Growth: Strong double-digit growth across both retail and online channels, supported by rising consumer demand for athleisure products and wider distribution reach.

- Cost Efficiency: Expenses grew modestly despite steep revenue growth, providing significant operating leverage and boosting profits.

- Profitability Surge: Net profit more than doubled on the back of robust topline expansion, better product mix (premium footwear gaining share), and efficiency gains.

- Distribution & Market Penetration: Growth driven by strong traction in Tier-II and Tier-III cities along with deeper penetration in online marketplaces.

- Brand Building: Increased marketing spend toward celebrity endorsements, influencer campaigns, and digital-first brand outreach strengthened consumer connect.

- Product Innovation: Ongoing investments in footwear technology, comfort, and design innovation to capture the growing athleisure demand in India.

Corporate Developments

Campus’ Q1 FY26 results demonstrate strong revenue momentum and exceptional profitability growth, underscoring its successful strategy of tapping into India’s vast mid-market footwear demand. The company’s ability to grow across both offline and online distribution while maintaining sharp cost discipline highlights its resilience and scalability.

Looking Ahead

The company plans to further scale premium product offerings, expand its omni-channel strategy with more exclusive brand outlets (EBOs), and continue investing in design innovation. With India’s increasing adoption of athleisure and casual footwear, alongside rising incomes and urbanization, Campus Activewear is well positioned for sustained double-digit growth in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.