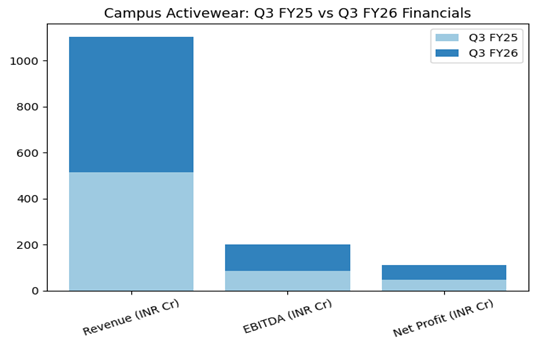

Campus Activewear Limited (NSE: CAMPUS) reported on Monday a 37.0% increase in consolidated net profit for the third quarter ended Dec. 31, 2025. The company recorded a profit after tax (PAT) of INR 63.7 Cr, up from INR 46.5 Cr in the same period the previous year.

Latest Quarterly Results

Consolidated revenue from operations for the quarter rose 14.3% year-over-year to INR 588.6 Cr. Earnings before interest, tax, depreciation, and amortization (EBITDA) stood at INR 115.8 Cr, representing an increase of 34.8% from INR 85.9 Cr in Q3 FY25. The EBITDA margin expanded to 19.5% from 16.6% in the prior year’s corresponding quarter.

The company sold 8.3 million pairs of footwear during the quarter, an 8.6% increase compared to 7.6 million pairs in Q3 FY25. The average selling price (ASP) per pair rose 5.2% to INR 711, compared to INR 675 in the year-ago period.

Segment Highlights

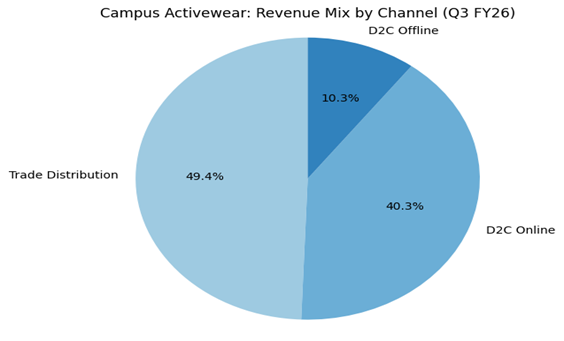

Revenue for the quarter was distributed across three primary channels:

• Trade Distribution: Contributed 49.4% of revenue, compared to 55.6% in Q1 FY26.

• Direct-to-Consumer (D2C) Online: Accounted for 40.3% of revenue, an increase from 34.8% in Q2 FY26.

• Direct-to-Consumer (D2C) Offline: Represented 10.3% of revenue.

Geographically, the North region led revenue at 46.8%, followed by the East at 21.1%, the West at 17.3%, and the South at 7.3%.

Full-Year Results Context

For the full fiscal year 2025, Campus Activewear reported revenue of INR 1,593.0 Cr, a growth of 10.0% over the previous year. Net profit for FY25 was INR 121.3 Cr. For the first nine months of FY26, revenue rose 11.1% to INR 1,318.5 Cr, while net profit increased 23.0% to INR 106.0 Cr.

Business & Operations Update

Campus Activewear announced the stabilization of its Paonta Sahib manufacturing facility, which is dedicated to upper manufacturing. In January 2026, the company commenced commercial production of premium uppers at its Pant Nagar facility.

The company expanded its product portfolio into the athleisure apparel category in January 2026. Marketing activities during the quarter included the ‘You Go, Girl!’ campaign featuring actor Kriti Sanon, which the company stated influenced the women’s category mix. As of Dec. 31, 2025, the company operates seven manufacturing facilities with an annual assembly capacity of 30.7 million pairs.

M&A or Strategic Moves

There were no new mergers or acquisitions announced during the period. The company continues to operate with institutional backing from TPG and QRG Enterprises.

Guidance & Outlook

The company identified several factors for market monitoring:

• The scaling of premium upper production at the Pant Nagar site to meet sneaker demand.

• The impact of the January launch into athleisure apparel on overall store productivity.

• The continued impact of GST rationalization on consumer demand.

Performance Summary

Revenue increased 14.3% and net profit rose 37.0% in Q3 FY26. Sales volume reached 8.3 million pairs with an ASP of INR 711. The company commenced athleisure apparel production and expanded manufacturing capacity to 30.7 million pairs annually.