Burger King India Ltd is an international QSR chain in India. It started operations in 2014 and has established ~681 restaurants across major cities in India & Indonesia. The company is an Exclusive National Master Franchisee of Burger King in India and its subsidiaries are Exclusive National Master Franchisee of the brands Burger King and Popeyes in Indonesia

Q2 FY26 Earnings Results:

-

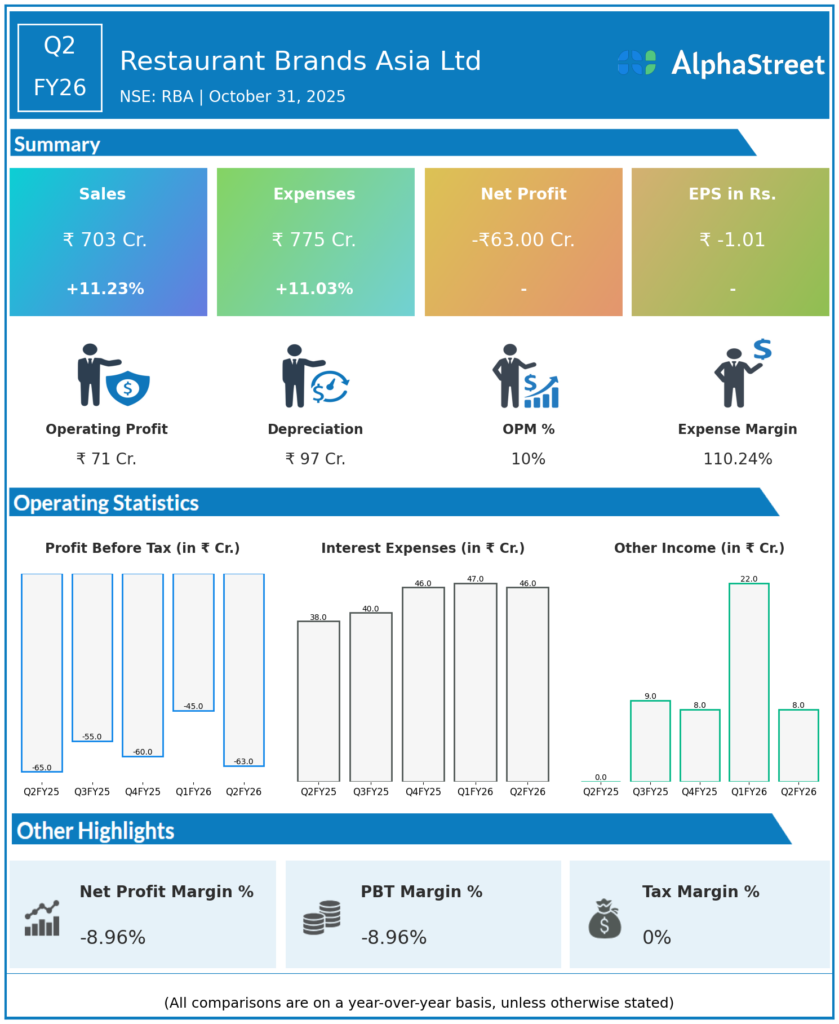

Revenue increased by 15.6% YoY to ₹568.7 crore, with a 0.82% QoQ growth, reaching ₹703.43 crore in September 2025.

-

EBITDA stood at ₹813 crore, showing a 16.3% rise YoY and a marginal decline QoQ to ₹777 million.

-

Same-Store Sales (SSS) grew by 2.8%, driven by value offerings, menu innovation, and operational efficiencies.

-

The company added 14 new Burger King stores, raising the total to 533 outlets.

-

Gross margin expanded to 68.3%, contributing to healthier profitability.

Profitability & Market Dynamics:

-

Despite revenue growth, the company reported a net loss of ₹58.59 crore for Q2 FY26, although this loss narrowed from ₹60.17 crore in the previous quarter.

-

The stock has experienced volatility, affected by margins pressures and market sentiment, but the company is on a growth trajectory with ongoing store expansion and operational focus.

Management & Strategic Outlook:

-

The management remains optimistic about growth driven by value focus, menu innovation, and technology investments.

-

The company targets opening 60-80 new stores annually in India, aiming for 800 outlets by FY29.

-

Strategic focus on increasing same-store sales, improving margins, and expanding geographic footprint continues.

Q1 FY26 Earnings Results:

-

Revenue was ₹698 crore, a 7.9% YoY increase.

-

Net loss narrowed to ₹41.94 crore from ₹49.36 crore YoY.

-

Growth driven by store expansion and increased customer footfall.

-

Share price responded positively, rising about 5-7% post-results as investor confidence improved.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.