“As we move forward, we see that there is a significant opportunity to continue to expand and evolve the products and services within our core business. The continued investment in our mutual fund business to the innovations that we bring to our trading systems and market data products, BSE is well positioned for long-term success and growth, I’m really focused on doing this in a way that helps BSE as well as the market participants, and this will stay our theme for the years to come and will make BSE more vibrant. We are set up well to build on this work in 2024 as we continue investing for future growth while remaining focused on delivering strong financial performance.”

– Sundararaman Ramamurthy, Managing Director & Chief Executive Officer

Stock Data

| Ticker | BSE |

| Industry | Finance |

| Exchange | NSE |

Share Price

| Last 1 Month | 8.3% |

| Last 6 Months | -0.3% |

| Last 12 Months | -23.6% |

Business Basics

BSE Limited, formerly known as the Bombay Stock Exchange, is the oldest stock exchange in Asia and one of the leading stock exchanges in India. Established in 1875, BSE serves as a primary platform for trading equities, derivatives, debt instruments, and mutual funds, facilitating capital formation and investment opportunities for market participants. BSE operates as a self-regulatory organization, providing a fair, transparent, and efficient marketplace for securities trading. The exchange offers a wide range of products and services to cater to the diverse needs of investors and issuers. It serves as a platform for companies to list their securities, enabling them to raise capital from the public and provide liquidity to shareholders.

The equity segment of BSE is the most prominent, with numerous companies listed on the exchange. It provides a platform for trading shares of large-cap, mid-cap, and small-cap companies, offering investors the opportunity to participate in the growth and performance of various sectors of the Indian economy. BSE’s equity segment is known for its robust regulatory framework, market surveillance mechanisms, and investor protection measures.

Apart from trading services, BSE provides various other value-added services to market participants. These include data dissemination, indices creation and management, clearing and settlement services, and investor education programs. BSE’s indices, such as the S&P BSE Sensex and S&P BSE 500, are widely recognized benchmarks for the Indian stock market and are used by investors, researchers, and market participants for performance measurement and portfolio construction. BSE has embraced technology to enhance its operations and services. The exchange has implemented advanced trading systems, risk management systems, and surveillance mechanisms to ensure the integrity and efficiency of the market. BSE’s technological initiatives have resulted in improved transparency, faster order execution, and enhanced market access for participants.

Q4 FY23 Financial Performance

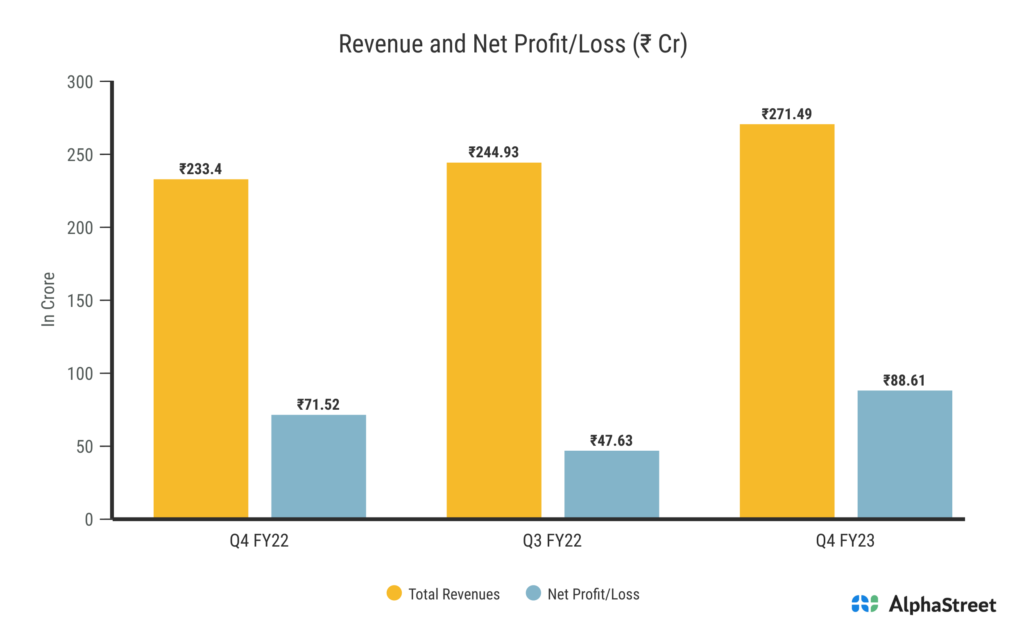

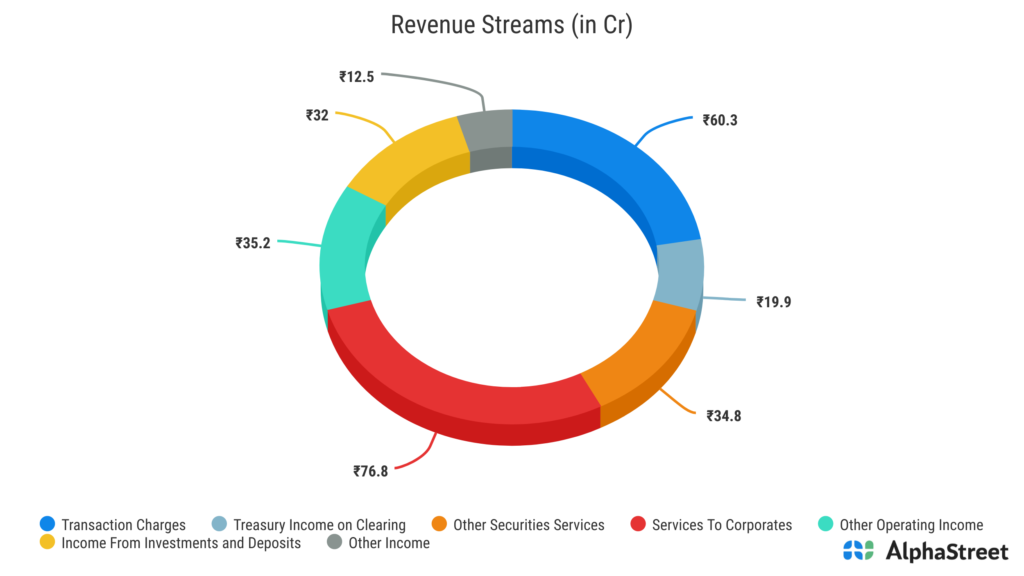

BSE Limited reported Revenue from Operations for Q4 FY23 of ₹271.49 Crore up from ₹233.40 Crore year on year, a growth of 16.3%. The Other Income for this quarter increased by 145.6% up to ₹12.53 Crore. The consolidated Net Profit of ₹88.61 Crore, up 23.9% from ₹71.52 Crore in the same quarter of the previous year. The Earnings per Share is ₹6.64 for this quarter.

Company’s Diversified Business Line

BSE Limited, in addition to being a leading stock exchange in India, operates across diversified business lines to cater to various market needs. These business lines include:

Trading & Clearing: BSE provides a robust trading platform for equities, derivatives, currency derivatives, and interest rate derivatives. It offers a transparent and efficient marketplace for investors to buy and sell securities. BSE’s trading segment is supported by state-of-the-art technology and risk management systems. The exchange also operates a clearing and settlement mechanism to ensure smooth and secure transaction settlements.

Distribution: BSE is actively involved in the distribution of financial products, particularly through its BSE StAR MF platform. The platform enables investors and distributors to transact and manage mutual fund investments. It simplifies the mutual fund investment process and enhances accessibility to a wide range of mutual fund schemes.

Services to Corporates: BSE provides a range of services to corporates, facilitating their interactions with the capital market. These services include listing of securities, such as equity shares and debt instruments, enabling companies to raise capital from the public. BSE also supports corporates in their corporate actions, such as bonus issues, stock splits, and rights issues. The exchange ensures compliance with regulatory requirements and provides a platform for transparent and efficient corporate actions.

Other Services: BSE offers various other services that add value to market participants. These services include data dissemination, indices creation and management, and investor education programs. BSE’s data services provide real-time market information, historical data, and analytics to help investors make informed decisions. The exchange is renowned for its indices, such as the S&P BSE Sensex, which serve as important benchmarks for the Indian stock market. BSE also conducts investor awareness programs to educate investors about market dynamics, investment strategies, and risk management.

Introduction of BEAM

BSE E-Agricultural Markets Limited (BEAM) is a subsidiary of the BSE Investments Limited (wholly owned subsidiary of BSE) the fastest stock exchange in the world. It is an electronic spot platform for agricultural commodities launched by BSE, India’s premier and most diversified exchange. This platform functions as a national level, institutionalized, electronic, transparent commodity spot trading platform. The platform facilitates spot agricultural commodities transactions across value chain consisting of producers, intermediaries, ancillary services and consumers. The value chain has now enrolled 1,342 members and executed trades were Rs. 148 crores in Agri and steel segments on the platform during the year. Some other products include, Cereals and Pulses, Oil and Oilseeds, Fibres, Sugar, Dry fruits, Spices and Condiments, Dairy and Dairy products.

BEAM facilitates Storage, Assaying, and other market support services through its ecosystem partners. Moreover, the company is working very closely with several governments and their agencies for direct procurement and disposal of commodities.