Stock Data:

| Ticker | NSE: BROOKS & BSE: 533543 |

| Exchange | NSE & BSE |

| Industry | PHARMACEUTICALS & BIOTECHNOLOGY |

Price Performance:

| Last 5 Days | -1.49% |

| YTD | -39.27% |

| Last 12 Months | -33.95% |

Company Description:

Brooks Laboratories Ltd is a contract-based pharmaceutical manufacturing company with a diversified product portfolio that includes dry powder injections, liquid injections, carbapenem dry power injectables, tablets, and oral suspensions used in various therapeutic segments. The company owns two manufacturing plants in Baddi, Himachal Pradesh, and Vadodara, Gujarat, with a total manufacturing capacity of around 31.1 crore units p.a. The company has a highly concentrated customer base with the top five customers contributing approximately 77% of the total revenues in FY21.

The Vadodara plant started commercial production in March 2017, but sales have been slow due to delays in regulatory approvals from different countries. To resolve this issue, the company has entered into two joint ventures with SteriScience Pvt Ltd, controlled by Strides Pharma. The first JV, Brooks Steriscience Ltd, will focus on making the Vadodara plant USFDA compliant, attaining additional regulatory approvals, and adding new products. The second JV, SteriBrooks Penems Pvt Ltd, aims to market the products of Brooks Steriscience Pvt Ltd in the export markets. The company’s Vadodara unit obtained EU-GMP certification in December 2017, and both of its units are WHO-GMP certified. The company’s product portfolio finds application in various therapeutic segments such as anti-bacterial, antibiotics, anti-gastric, anti-malarial, and life-saving drugs. The company’s manufacturing capabilities include dry powder injections, liquid injections, tablets, and oral suspensions with a total capacity of around 31.1 crore units p.a.

Critical Success Factors:

- Brooks Laboratories Ltd (BLL) has several key strengths that make it a competitive player in the pharmaceutical industry. One of its major strengths is its experienced management team. The directors collectively have an industry experience of around two decades each, and they are supported by a team of well-versed professionals. This gives the company a competitive edge as it can leverage the expertise and experience of its management team to make informed decisions and drive growth.

- Brooks Laboratories Ltd has been diversifying its business in the B2C segment by launching new products, which requires comparatively higher marketing costs. The company has booked great revenue from these new products, and the revenue is gradually picking up. Expanding the product portfolio can help the company tap into new markets and attract new customers.

- Research and development (R&D) are critical for pharmaceutical companies to stay competitive and bring new and innovative products to market. Brooks Laboratories Ltd has a strong focus on R&D, with a team of well-versed professionals having rich experience in their respective fields. This can help the company stay ahead of the curve in terms of product innovation and quality.

- The pharmaceutical industry is highly regulated and competitive, and companies often face risks and liabilities associated with the products and their manufacturing. Brooks Laboratories Ltd is engaged in the manufacturing of pharmaceutical formulations and has a presence across various geographies. This can help the company diversify its risk and reduce its dependence on any particular market.

- Regular compliance with product and manufacturing quality standards of regulatory authorities is critical for selling products across various geographies. Brooks Laboratories Ltd has received USFDA approval for their Vadodara Plant and has established robust quality management systems to ensure compliance with regulatory requirements. This can help the company maintain a good reputation in the industry and attract more customers.

Key Challenges:

- Despite the strengths of Brooks Laboratories Ltd (BLL), there are also risks and concerns that investors should consider. One significant risk is the highly regulated nature of the pharmaceutical industry. The company must comply with stringent quality standards and regulations set by regulatory authorities to manufacture and sell its products. Failure to comply with these regulations could result in legal, financial, and reputational consequences for BLL. Additionally, the industry is highly competitive, with numerous small and large players, which may limit BLL’s market share and pricing power.

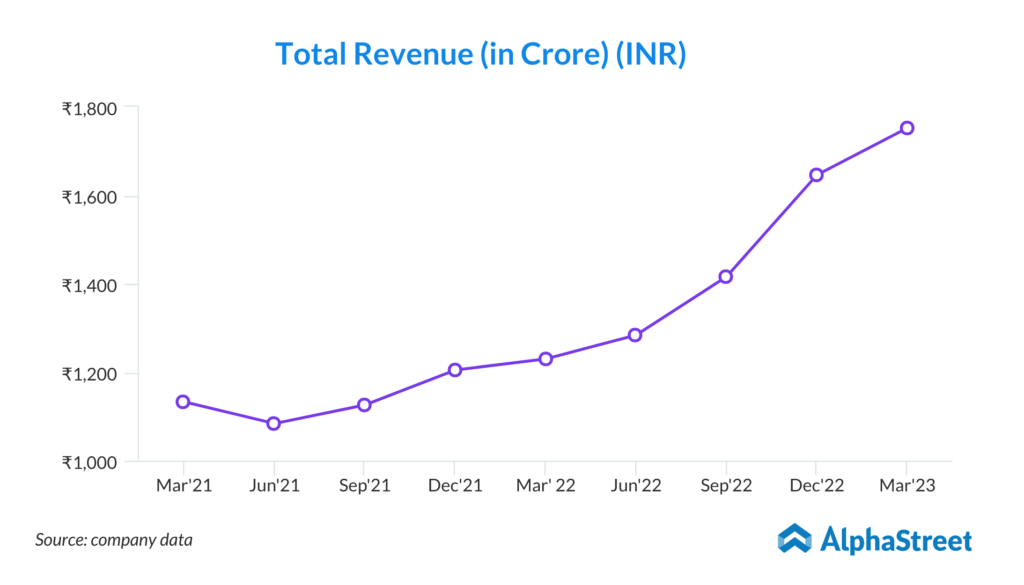

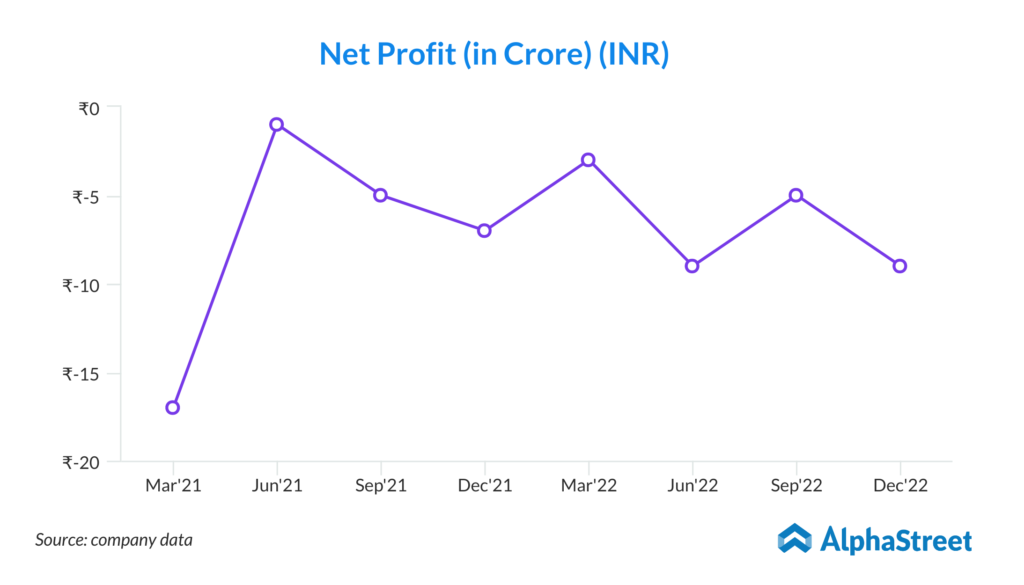

- Another concern for BLL is its small scale of operations. While the company has been growing, its revenues remain relatively small, and it operates at a modest level compared to other players in the industry. The operating losses incurred until FY21 were due to a loss-making unit in Vadodara, Gujarat, which was subsequently transferred to Brooks Steriscience Ltd (BSL) in a slump exchange basis, resulting in BLL’s profitability in FY22. However, the company is still in the process of launching new products and expanding its B2C segment, requiring comparatively higher marketing costs, leading to current operating losses. If BLL cannot effectively grow its operations and increase revenue, it may continue to face financial challenges in the future.

- BLL’s joint ventures with Steriscience Specialties Private Limited also pose a potential risk for the company. While the joint ventures may provide opportunities for BLL to expand its product offerings and reach new markets, they also require funding support from BLL. The requirement of funding support for these joint ventures in the future may impact BLL’s financial stability and cash flows, particularly if the ventures do not generate the expected revenue or profitability.