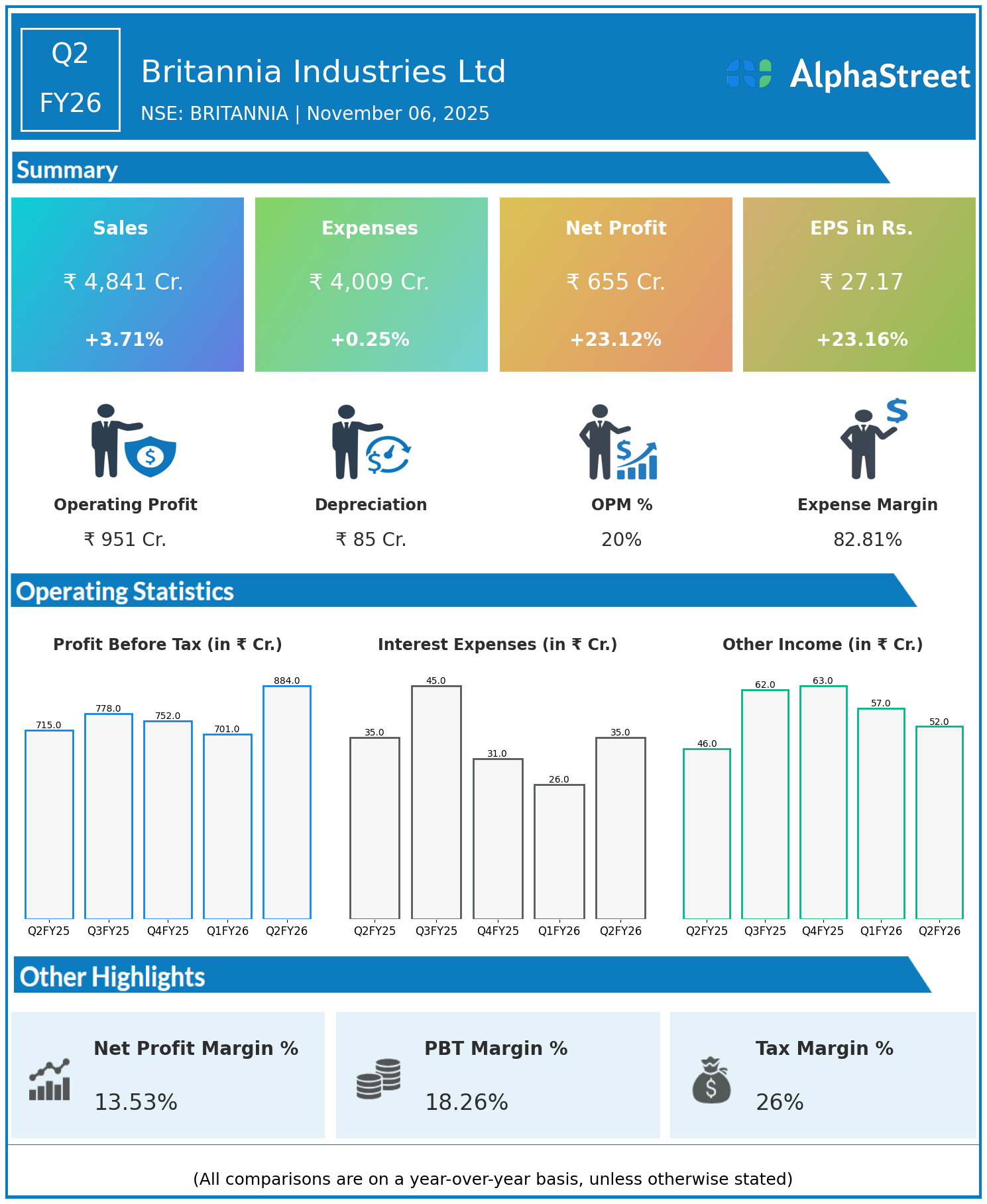

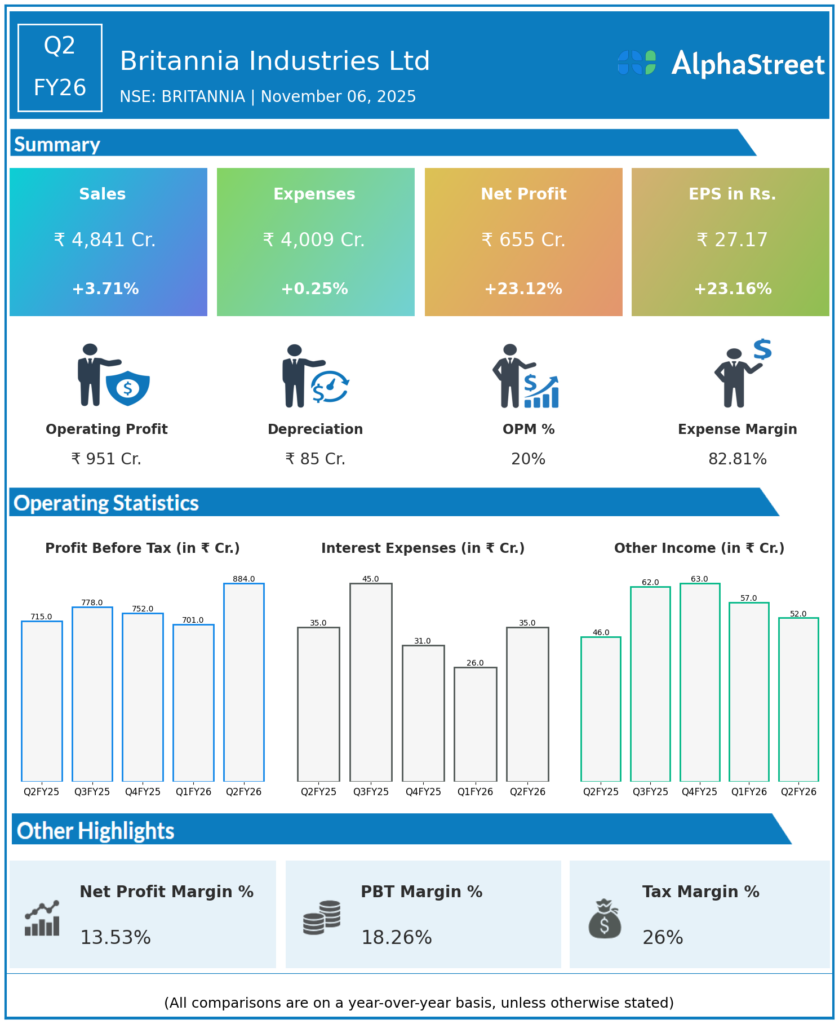

Britannia Industries Ltd, a leading food company in India with a century-long legacy, reported strong Q2FY26 financial results marked by a 23% rise in consolidated net profit to ₹655 crore. This growth was driven by stable commodity prices, effective cost optimization, and premium product demand, despite some transitional GST-related challenges.

Key Highlights:

- Revenue: Britannia’s revenue from operations grew 3.7% year-on-year to ₹4,841 crore, supported by steady demand in key bakery and biscuit categories and double-digit growth in adjacent bakery verticals like rusk, wafers, and croissants.

- Profit: Consolidated net profit increased 23.12% from ₹532 crore in Q2FY25 to ₹655 crore in Q2FY26. Earnings per share rose in tandem to ₹27.17 from ₹22.06.

- Expenses: Total expenses remained stable at around ₹4,009 crore, reflecting tight cost control measures.

- Segment Strength: Momentum in e-commerce and in-home consumption of indulgent and impulse products helped sustain growth amid a challenging macroeconomic environment.

- Management Commentary: Varun Berry, Vice Chairman and Managing Director, cited balanced growth driven by cost optimization and stable input prices. The recent GST rate rationalization is expected to support consumer demand and economic sentiment going forward.

Strategic Outlook

Grasim is driving its next phase of growth through sustainability, digital transformation, and capacity expansions. Its focus on integrating building solutions, expanding clean energy initiatives, and leveraging group synergies sets a strong growth trajectory across sectors.

This diversified business model coupled with investments in innovation and technology positions Grasim Industries as a formidable player in India’s industrial landscape, committed to value creation for stakeholders and sustainable industrial leadership.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.