Britannia Industries is one of India’s foremost food companies with a legacy spanning 100 years and annual revenues exceeding ₹16,000 crore. Renowned as a trusted brand, Britannia’s portfolio includes popular staples such as Good Day, Tiger, NutriChoice, Milk Bikis, and Marie Gold. The company’s products span biscuits, bread, cakes, rusk, and dairy items including cheese, beverages, milk, and yoghurt, serving millions of households across India. Presenting below are its Q1 FY26 Earnings Results.

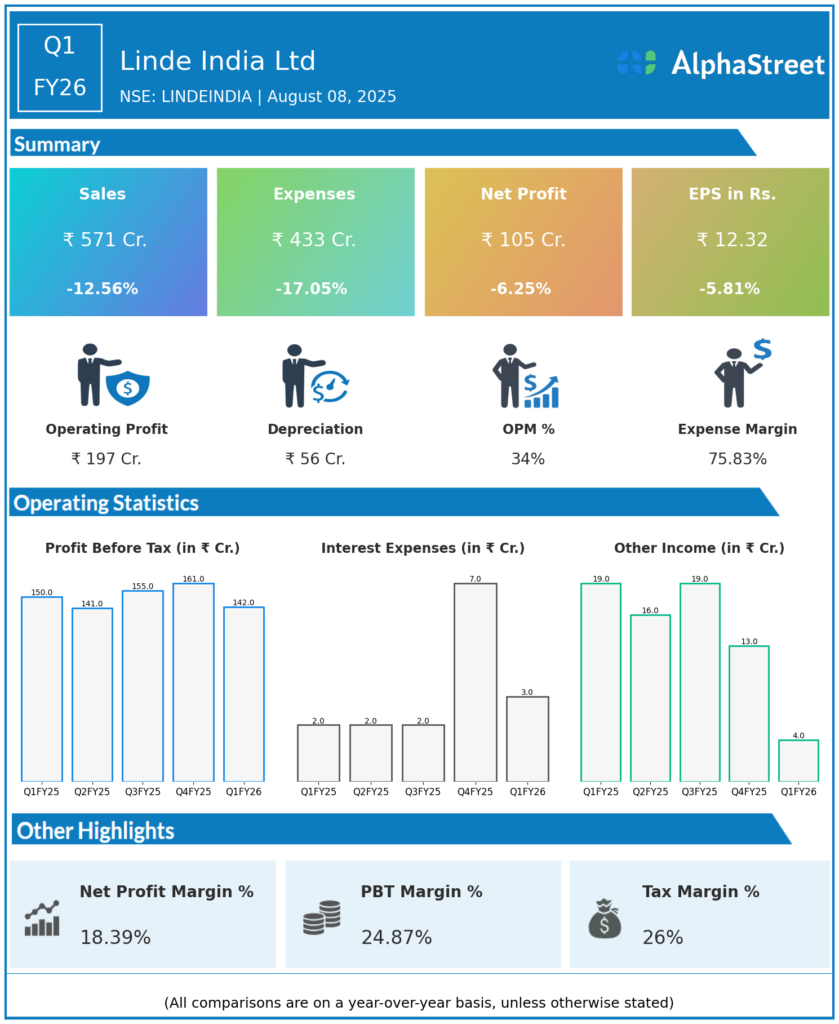

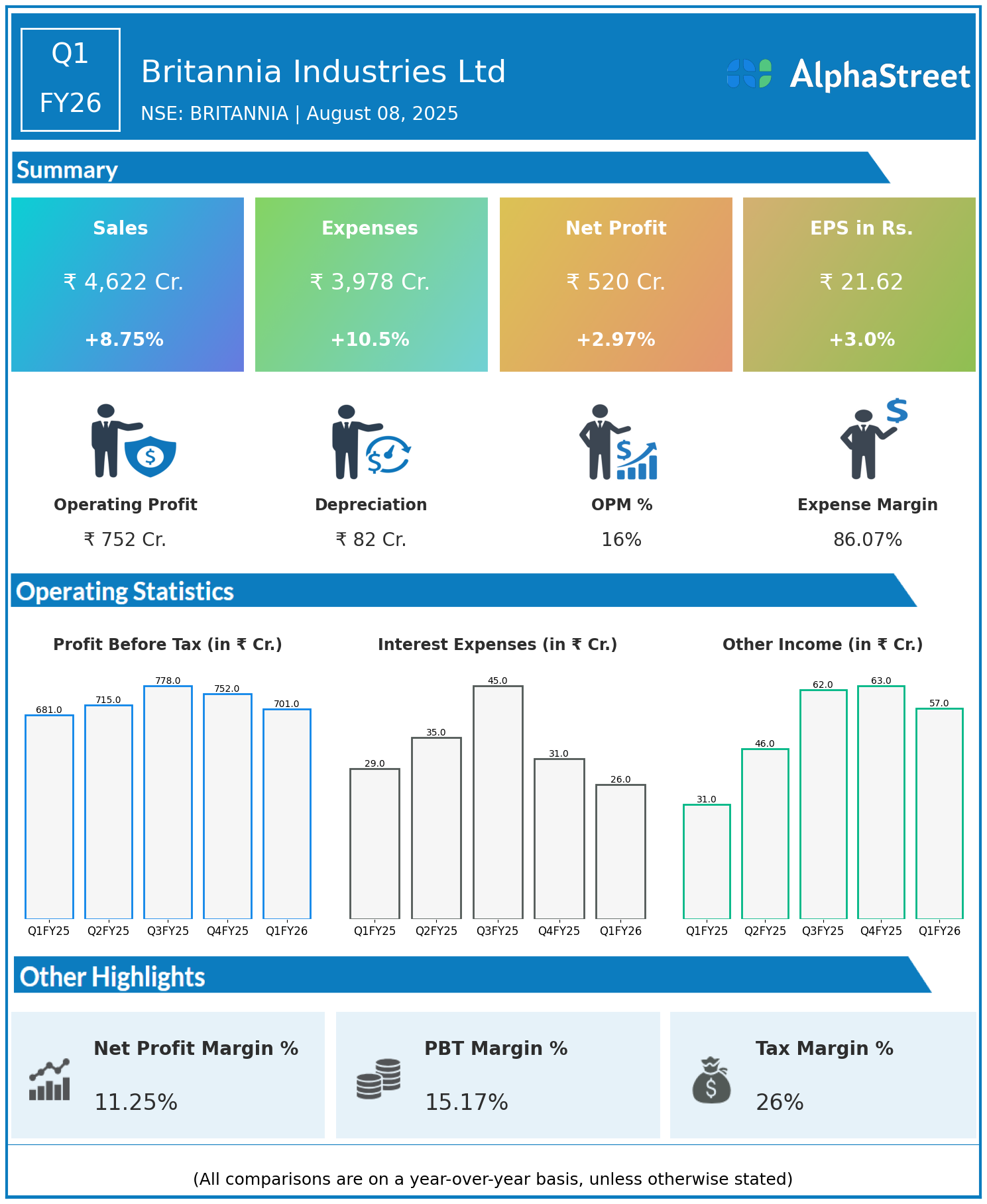

Q1 FY26 Earnings Results

- Revenue: ₹4,622 crore, up 8.75% year-on-year (YoY) from ₹4,250 crore in Q1 FY25.

- Total Expenses: ₹3,978 crore, up 10.5% YoY from ₹3,600 crore.

- Consolidated Net Profit (PAT): ₹520 crore, up 2.97% from ₹505 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹21.62, up 3.00% from ₹20.99 YoY.

Operational & Strategic Update

- Revenue Growth: Britannia posted healthy revenue growth driven by sustained demand for its core biscuit and dairy products, buoyed by new product launches and market expansion.

- Expense Increase: Total expenses rose at a higher pace than revenues, primarily due to inflationary pressures on raw materials, packaging, distribution costs, and promotional investments.

- Profitability Moderation: Net profit and EPS growth were modest, reflecting margin pressure as expense growth outpaced top-line gains, leading to some profitability compression.

- Product & Market Focus: Britannia continues to deepen penetration in the biscuits segment while expanding dairy product offerings. Focus on premiumization, innovation, and widening rural reach supports long-term growth.

- Strategic Initiatives: The company emphasizes cost management, supply chain efficiency, digital marketing, and strengthening distribution networks to mitigate input cost challenges and sustain market leadership.

- Brand Equity: Britannia’s strong brand recognition and consumer loyalty underpin its competitive positioning in a dynamic and evolving food market.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results demonstrate Britannia Industries’ resilience amid rising cost challenges, maintaining steady revenue and profit growth. Strategic investments in product innovation and market expansion continue to drive sustained consumer engagement and business resilience.

Looking Ahead

Britannia Industries is expected to capitalize on evolving consumer preferences, rural market opportunities, and innovation-driven portfolio expansion. Continued focus on cost optimization, premiumization, and supply chain agility will be vital to improve margins and shareholder value through FY26 and beyond.

To view Britannia Industries’ previous results: Click Here