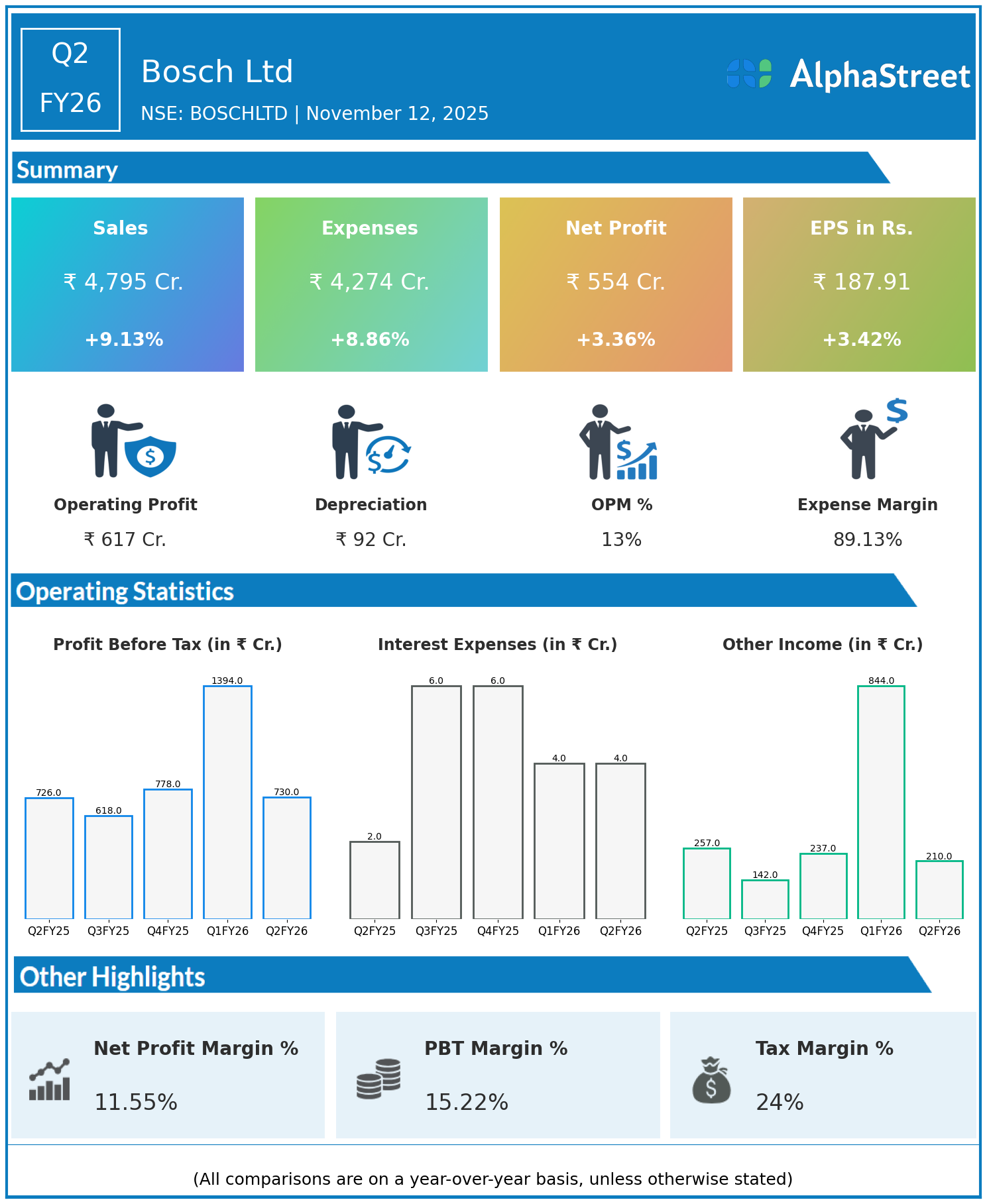

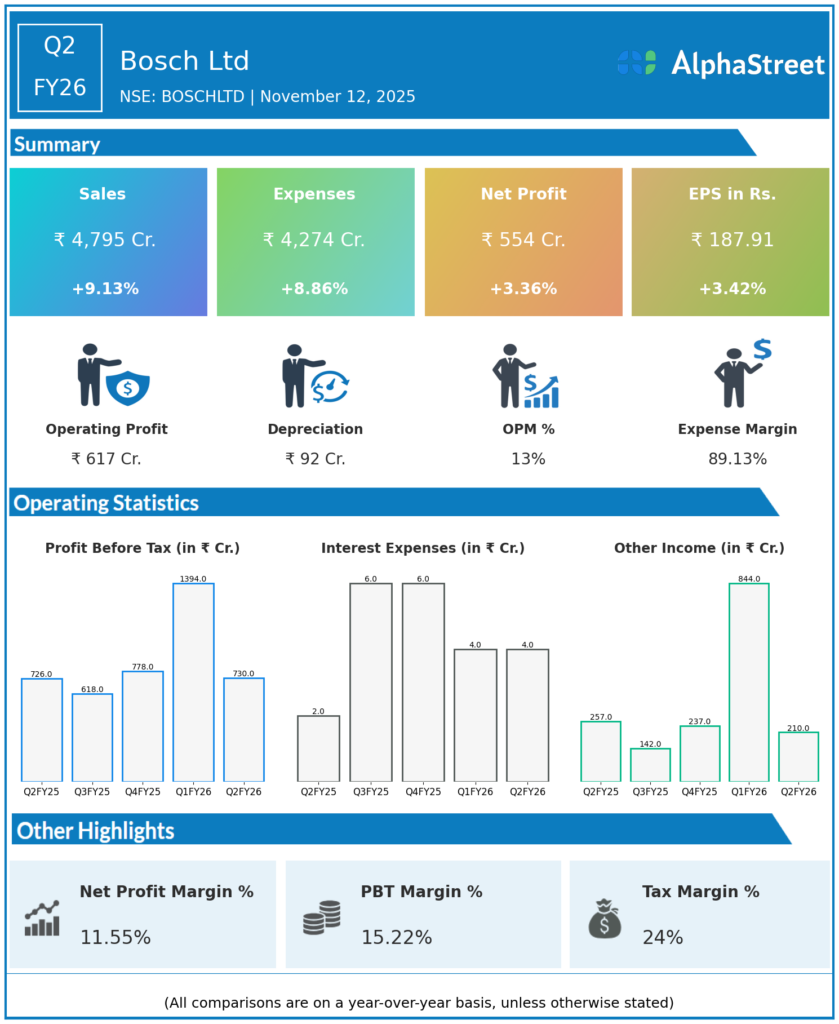

Bosch Ltd, with a significant presence across automotive technology, industrial technology, consumer goods, and energy and building technology, reported a moderate increase in profits alongside robust revenue growth for Q2FY26.

Financial Highlights:

- Revenues rose 9.13% year-on-year to ₹4,795 crore from ₹4,394 crore.

- Total expenses increased 8.86% to ₹4,274 crore from ₹3,926 crore.

- Consolidated net profit climbed 3.36% to ₹554 crore from ₹536 crore.

- Earnings per share improved 3.42% to ₹187.91 from ₹181.70.

The top-line growth was driven by higher sales in automotive and consumer segments, while operating efficiency supported bottom-line expansion despite rising expenses.

Outlook:

Bosch remains focused on innovation, technology investments, and operational improvements to further drive revenue and improve margins in a competitive market. The company’s diversified portfolio positions it to benefit from ongoing demand in core sectors.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.