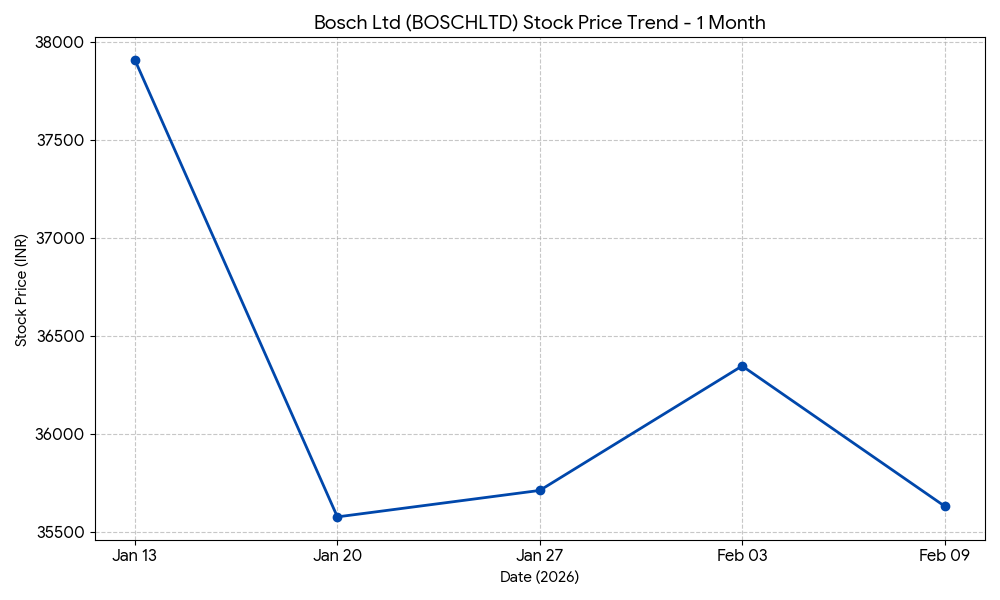

Bosch Limited (BOSCHLTD:NSE/BSE) shares closed at ₹35,630.00 today, marking an intraday decline of -1.95%. The price movement followed the company’s release of its financial results for the quarter ended December 31, 2025.

Market Capitalization

As of February 9, 2026, the company’s market capitalization is ₹1.05 trillion (approximately USD 12.6 billion).

Latest Quarterly Results

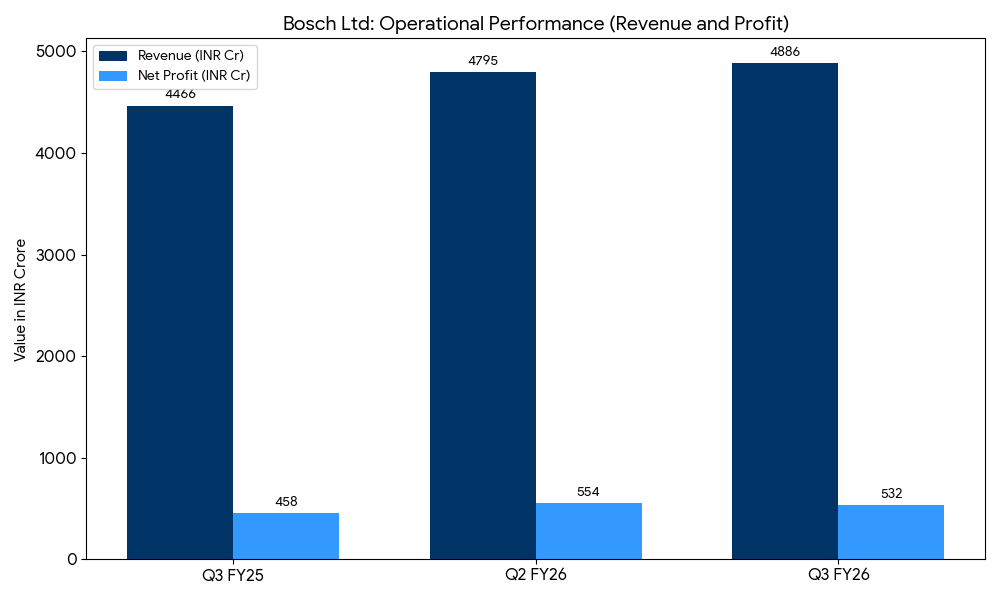

For the third quarter of fiscal year 2026, Bosch Limited reported consolidated revenue from operations of ₹4,886 crore, representing a 9.4% increase from ₹4,466 crore in the same period last year. Consolidated net profit for the quarter rose 16.1% year-over-year to ₹532 crore.

Performance by segment for the quarter was as follows:

- Automotive Products: Revenue increased 13.4% year-over-year to ₹4,416 crore, supported by demand in passenger cars and off-highway sectors.

- Two-Wheeler Business: Sales grew 58.3%, attributed to the ramp-up of exhaust gas sensors for OBDII norms.

- Power Solutions: Revenue rose 19.5%, driven by the heavy commercial vehicle and tractor segments.

- Mobility Aftermarket: Segment revenue increased 5.3% on account of GST reforms and growth in braking and diesel systems.

- Beyond Mobility: Net sales declined 23.3% following the divestment of the communication systems and video solutions business in May 2025.

FINANCIAL TRENDS

Nine-Month View

For the nine-month period ended December 31, 2025, consolidated revenue reached ₹14,469 crore, a 9.8% increase year-over-year. Net profit for the period stood at ₹2,202 crore, reflecting a 50.8% growth compared to the previous year. This nine-month performance includes an exceptional gain of ₹556 crore from the sale of the consumer security business.

Business & Operations Update

Bosch Limited reported a preliminary financial impact of ₹20.6 crore under employee benefit expenses related to the new labor code assessment. The company is currently increasing capacity for exhaust gas sensors to meet regulatory requirements effective April 2025.

M&A or Strategic Moves

The company completed the sale of its “Video solutions, Access and Intrusions and Communication systems” business on May 1, 2025. On February 6, 2026, the Board approved the appointment of Sanmay Dasgupta as Vice President of Power Tools, effective February 1, 2026.

Question-and-Answer Focal Points

During the earnings call, management addressed the following operational and financial inquiries:

- Two-Wheeler Segment Growth: Leadership attributed the 58.3% revenue surge to the mandatory production ramp-up of exhaust gas sensors required for OBDII regulatory compliance starting April 2025.

- Labor Code Provisions: Management clarified that the ₹20.6 crore impact on employee benefit expenses represents a preliminary assessment of liabilities under the upcoming new labor codes.

- Beyond Mobility Contraction: The 23.3% decline in this segment’s revenue was confirmed as a direct result of the divestment of the communication and video solutions business completed in May 2025.

- Profitability Drivers: Inquiries regarding the 6.7% increase in profit before tax (excluding exceptional items) were met with citations of a favorable product mix and ongoing expense optimization across automotive divisions.

- Inventory and OE Demand: Analysts questioned the impact of passenger vehicle inventory levels, with management pointing to consistent demand in the passenger car and off-highway sectors during the reporting period.

Guidance & Outlook

Management stated it anticipates continued momentum in the automotive sector. Key monitorables include the synchronization of vehicle production with festive cycles and the impact of increased competitive pricing. No specific numerical revenue guidance was issued for the remainder of the fiscal year.

Performance Summary

Bosch Limited shares decreased 1.95% to ₹35,630.00 today. Q3 revenue grew 9.4% and net profit increased 16.1%. Automotive and two-wheeler segments reported growth, while the beyond mobility segment contracted following a business divestiture.