Borosil Renewables Limited is India’s only manufacturer of extra clear patterned glass and low-iron solar glass, which are critical components for photovoltaic panels, flat plate collectors, and greenhouses. The company plays a vital role in India’s renewable energy ecosystem by supplying high-quality solar glass to module manufacturers, thereby contributing to the country’s clean energy transition. Presenting below its Q1 FY26 Earnings Results.

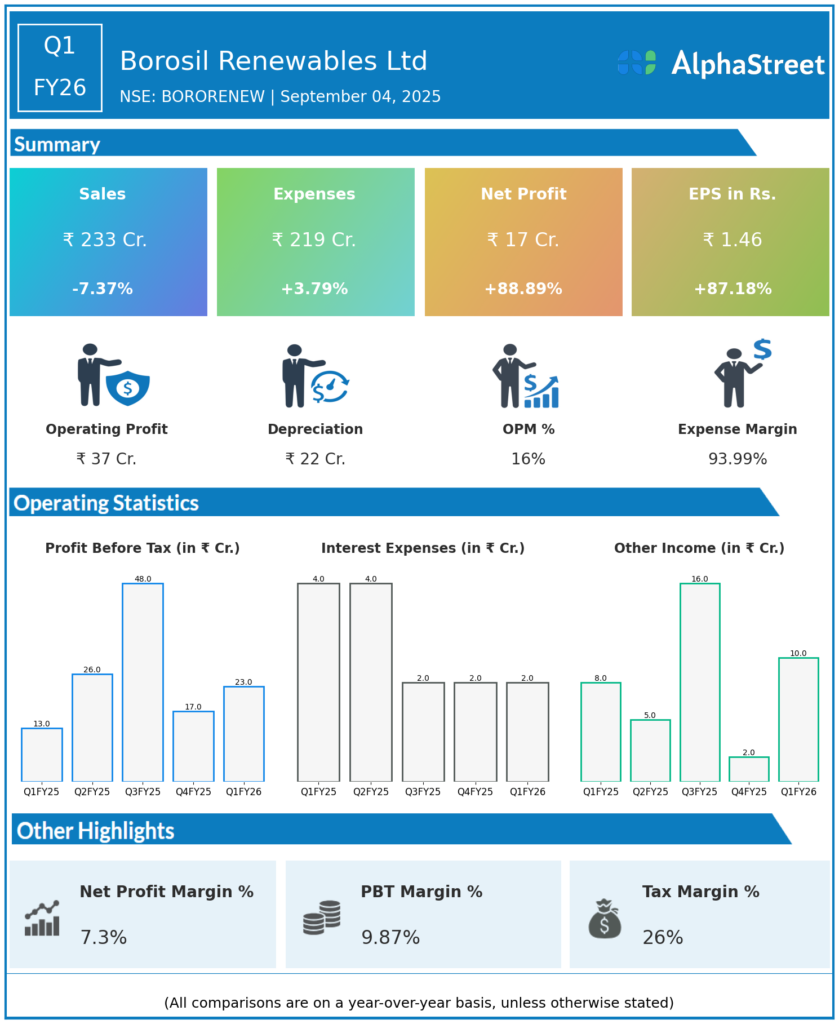

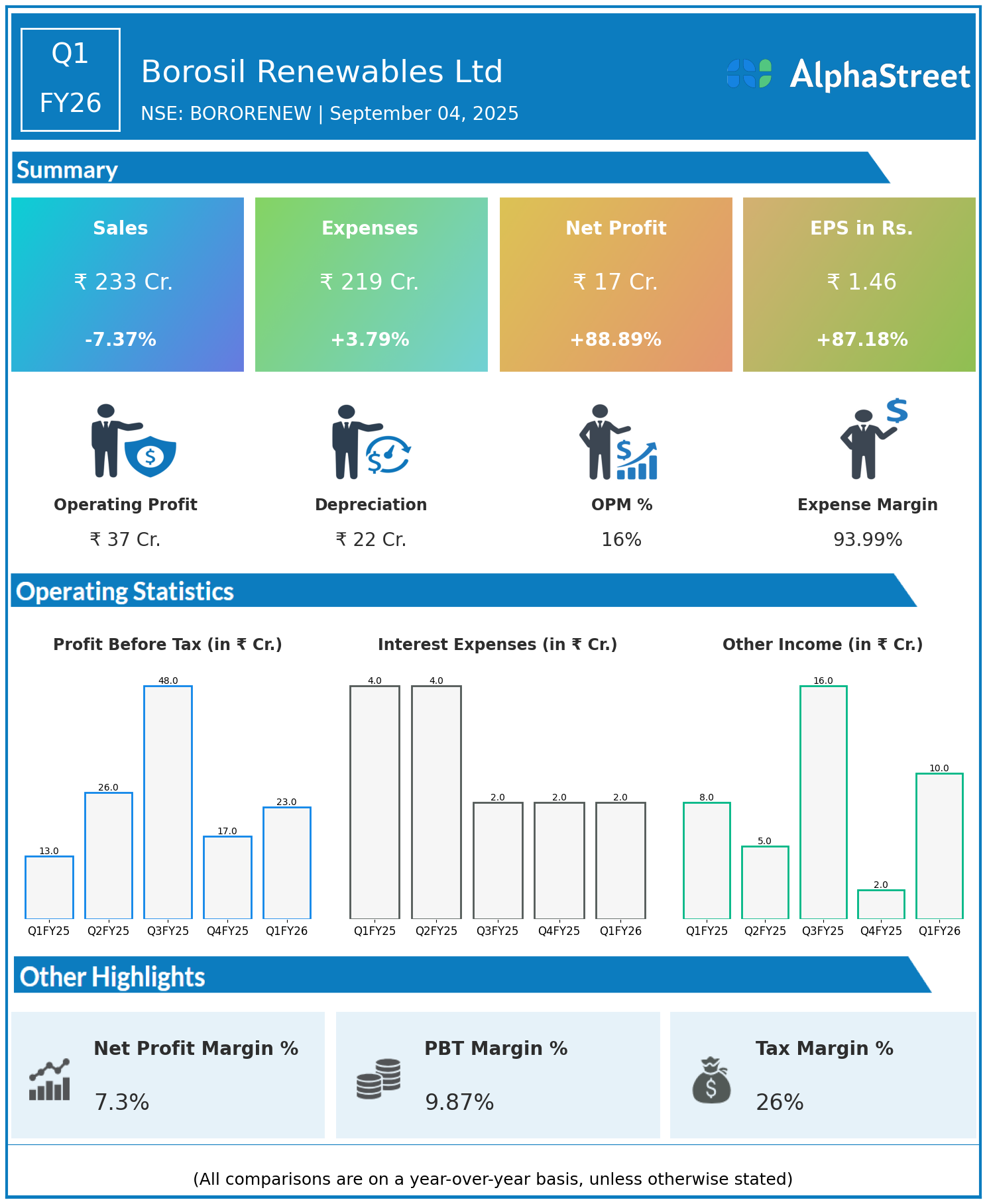

Q1 FY26 Earnings Summary

- Revenue: ₹233 crore, down 37.2% year-on-year (YoY) from ₹371 crore in Q1 FY25.

- Total Expenses: ₹219 crore, up 3.79% YoY from ₹211 crore.

- Consolidated Net Profit (PAT): ₹17 crore, up 88.89% YoY from ₹9 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹1.46, up 87.18% from ₹0.78 YoY.

Operational & Strategic Update

- Revenue Decline: The revenue contraction was attributed to weaker demand conditions in export markets, coupled with pricing pressures in the solar glass segment.

- Cost Efficiency: Despite higher input and energy costs, Borosil Renewables managed to limit overall expense growth to under 4%, reflecting prudent cost management.

- Profitability Surge: Net profit nearly doubled as the company benefitted from better operating leverage, favorable product mix, and disciplined overhead control.

- Industry Context: The broader solar glass industry faced demand fluctuations and pricing volatility; however, Borosil Renewables’ ability to improve margins amid revenue decline underscores strong operational resilience.

- Sustainability & Innovation: Continued focus on R&D for high-transmission solar glass products and energy-efficient manufacturing processes strengthens the company’s competitive advantage.

Corporate Developments

Borosil Renewables’ Q1 FY26 results reflect a paradox of top-line pressure with bottom-line strength. While revenues contracted sharply due to industry headwinds, the company’s cost-control measures and margin improvement helped deliver an 89% profit surge. Its strategic positioning as India’s only domestic solar glass manufacturer continues to provide it with a structural edge in supporting the country’s solar capacity expansion.

Looking Ahead

The company remains focused on capacity expansion projects, scaling up solar glass production, and enhancing export competitiveness to restore topline momentum. Rising adoption of solar power under India’s clean energy mission and global renewable energy growth are expected to provide long-term demand visibility. Profitability improvements, coupled with ongoing capacity additions, are likely to support sustained growth for Borosil Renewables in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.