Borosil Limited is one of India’s leading suppliers of laboratory glassware, microwaveable kitchenware, and opal ware products. With more than 15,000 retail outlets across the country and three modern manufacturing facilities, Borosil caters to both institutional and consumer markets. The company operates through two business segments Scientific & Industrial Products (SIP) and Consumer Products. Presenting below its Q1 FY26 Earnings Results.

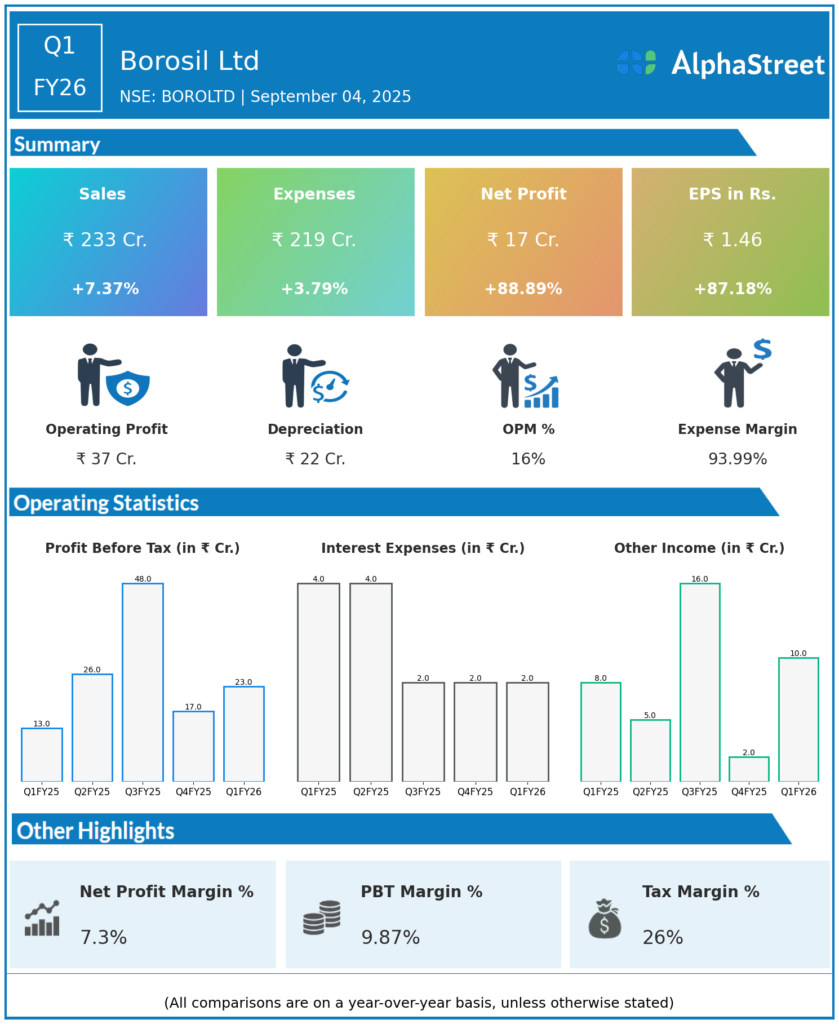

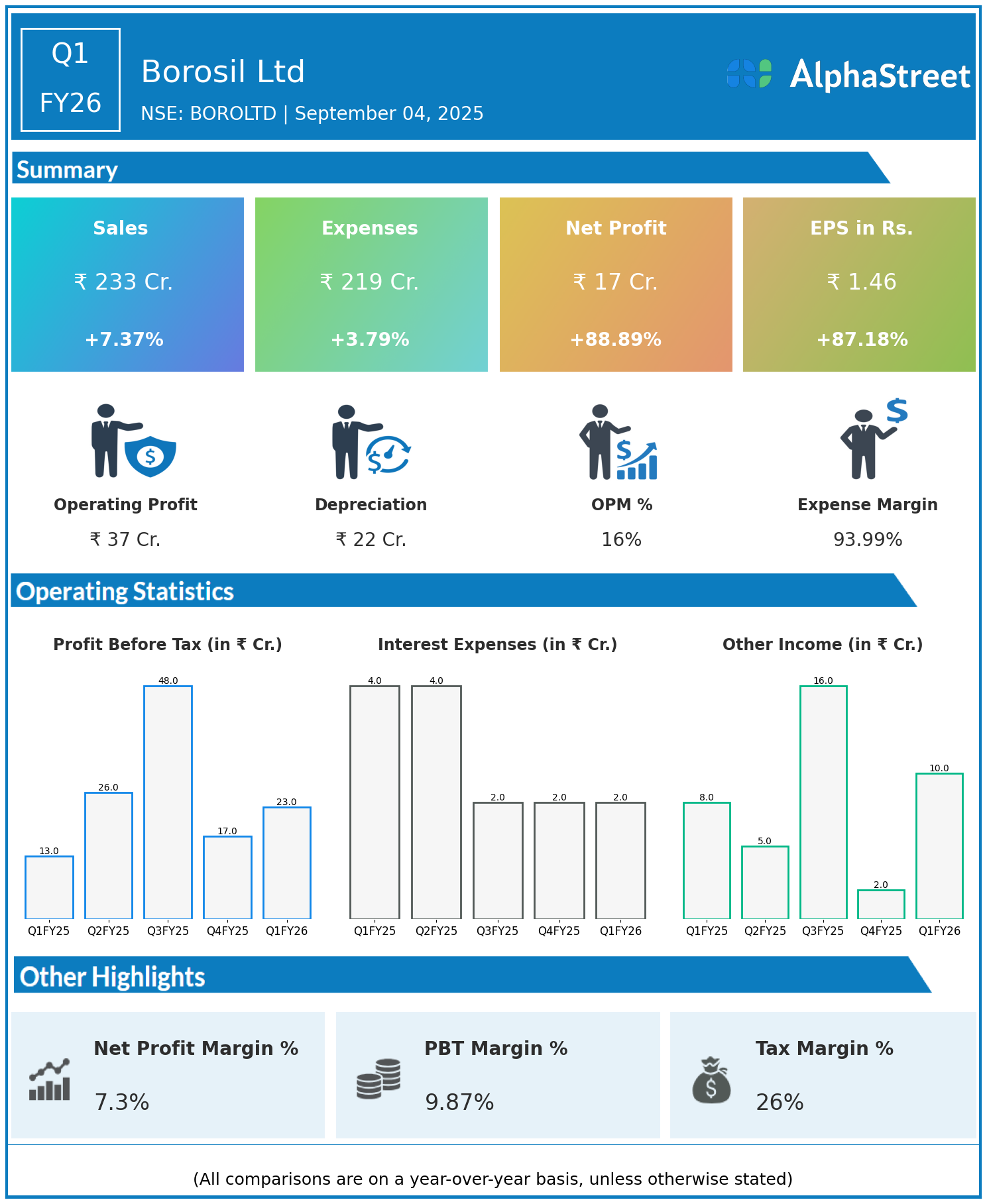

Q1 FY26 Earnings Summary

- Revenue: ₹233 crore, up 7.37% year-on-year (YoY) from ₹217 crore in Q1 FY25.

- Total Expenses: ₹219 crore, up 3.79% YoY from ₹211 crore.

- Consolidated Net Profit (PAT): ₹17 crore, up 88.89% YoY from ₹9 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹1.46, up 87.18% from ₹0.78 YoY.

Operational & Strategic Update

- Revenue Growth: Revenue growth was supported by strong demand in the consumer products segment, with borosilicate and opalware kitchenware continuing to gain wider acceptance in domestic and export markets.

- Cost Efficiency: While expenses rose moderately due to input costs and marketing spends, revenue growth outpaced costs, contributing to enhanced profitability.

- Profitability Surge: Net profit nearly doubled, reflecting operational leverage, better product mix in consumer products, and stronger contribution from premium offerings.

- Business Segments:

- Scientific & Industrial Products (SIP): Stable demand from pharmaceutical, R&D, and educational institutions provided steady growth.

- Consumer Products: Driving topline expansion with new product launches, deeper retail penetration, and premiumization in kitchenware.

- Strategic Investments: Continued focus on expanding e-commerce presence, modernizing manufacturing capacity, and enhancing brand recall across urban and semi-urban markets.

- Innovation & Product Development: Ongoing innovation in glassware and flameproof cookware supports Borosil’s positioning as a household and institutional brand.

Corporate Developments

The Q1 FY26 results highlight Borosil’s resilient demand environment and ability to scale profitably across both its institutional and consumer business lines. Strong brand visibility, expanding distribution reach, and growing consumer preference for premium and sustainable kitchenware positioned the company favorably despite cost pressures.

Looking Ahead

Borosil plans to maintain growth momentum through innovation-driven product rollouts, stronger omni-channel distribution, and capacity enhancement at its manufacturing facilities. Scaling exports in both consumer and laboratory glassware segments, alongside improving operational efficiency, remains central to its growth strategy for FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.