Borana Weaves Limited (NSE: BORANA), a Surat-based textile manufacturer specialising in synthetic greige fabrics, delivered a strong set of earnings for the third quarter of fiscal year 2026, underpinned by solid topline expansion and healthy margin improvement.

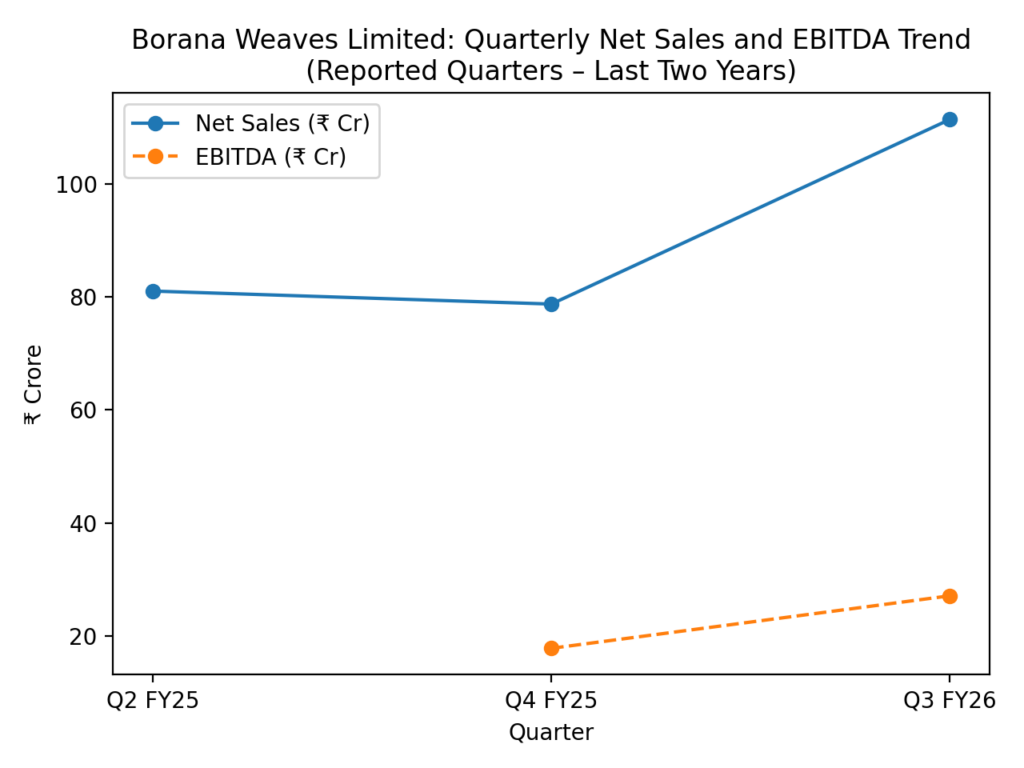

According to its unaudited standalone results for the quarter ended December 31, 2025, the company reported a net sales figure of ₹111.36 crore, marking a significant 41.7 % year-on-year rise compared with ₹78.58 crore recorded in the same quarter last fiscal. This performance highlights dependable demand for its core product lines despite broader volatility in the commodities and textile markets.

Driven by this sales momentum and a favourable cost structure, Borana Weaves’ quarterly net profit climbed sharply to ₹18.55 crore, up 62.7 % from ₹11.40 crore in Q3 of FY 2025. The company’s profitability was also reflected in its EBITDA, which expanded by 58 % year-on-year to ₹28.65 crore.

The operating results translated into a notable earnings per share increase, with EPS rising to ₹7.02 from ₹5.72 in the December 2024 quarter, underscoring both top- and bottom-line leverage.

Operational & Strategic Expansion Bolsters Growth

Borana Weaves’ Q3 results align with a broader capacity expansion strategy that has been underway throughout FY 2026. In late 2025, the company commissioned additional looms at its Unit 4 facility ahead of schedule, expanding total manufacturing capacity to approximately 346 million meters per annum. This capital deployment — funded partly by funds raised through its public listing — aims to support both scale and responsiveness to evolving customer mixes.

Further bolstering its industrial footprint, the company reported commissioning of 64 new water-jet looms in January 2026, with the balance to come online in phases, enhancing throughput and flexibility in production.

Beyond production capacity, Borana Weaves is also examining renewable energy initiatives via planned contracts totaling over 23 MW and working capital enhancements aligned with operational growth.

Market Context & Competitive Landscape

The textile sector’s third-quarter results across India have been mixed in early earnings reports, with several companies in related industries reporting varying degrees of revenue expansion or margin pressure. Within this broader context, Borana Weaves’ double-digit growth in both sales and earnings underscores a comparatively resilient performance in its niche segment.

Analysts note that demand for synthetic greige fabrics, buoyed by applications in apparel and industrial textiles, along with efficiency gains from recent capacity additions, contributed materially to the company’s quarterly outcome. While standalone quarterly summaries do not always capture the full long-term strategic picture, Borana Weaves’ Q3 results reflect improving operational leverage and momentum as it moves through FY 2026. The company’s focus on scaling production and exploring ancillary energy projects demonstrates a proactive approach to balancing growth and cost efficiency. With continued execution, this positions Borana Weaves to potentially capitalize on demand trends in India’s large and dynamic textile market.