Bluestone Jewellery and Lifestyle Ltd (BLUESTONE.NS) is India’s second-largest digital-first, omnichannel jewelry retailer. Unlike traditional chains focused on heavy wedding gold, Bluestone sells design-led, lightweight jewelry targeting consumers aged 25–45.

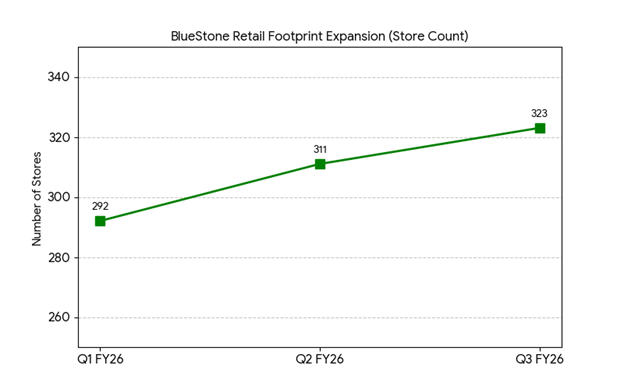

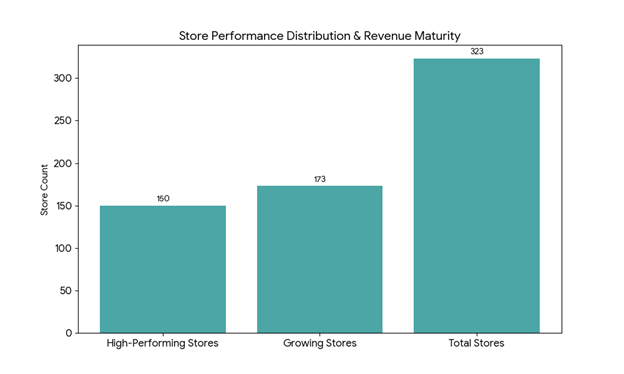

The company operates a vertically integrated model, managing design, manufacturing, and retail. As of December 31, 2025, Bluestone had 323 stores with a total footprint of 747,000 square feet across more than 127 cities.

Market Reaction

Shares of Bluestone rose 3.2% to ₹1,145 in early trading on Thursday after the company reported its first quarterly profit. The stock has gained 8% over the past three months. The market capitalization is approximately ₹10,200 crore.

Q3 FY26 Financial Results

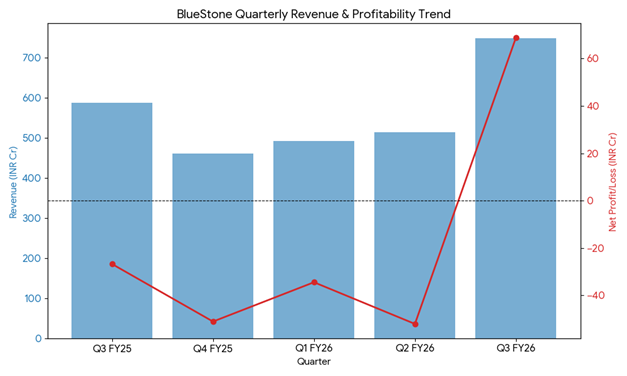

- Revenue: ₹747.9 crore, up 27.4% from ₹587.1 crore in Q3FY25.

- Profit after tax: ₹68.8 crore, compared with a loss of ₹26.8 crore a year earlier.

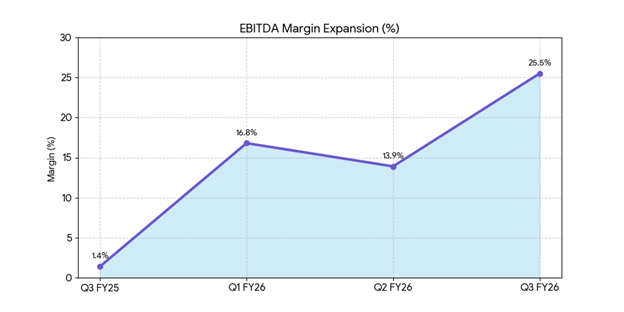

- Adjusted EBITDA: ₹190.8 crore, up 169.7%; margin increased to 25.5% from 12.1%.

- Standalone cash PAT: ₹122.5 crore, up 720.9% year-on-year.

Nine-month performance: Revenue rose 34% to ₹1,753.6 crore. Reported PAT narrowed to a loss of ₹10.4 crore from ₹170.6 crore last year.

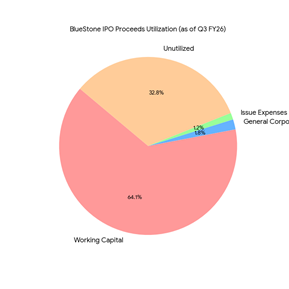

IPO Proceeds Utilization

Bluestone raised ₹820 crore in its August 2025 IPO. Of this, ₹550.65 crore has been deployed for working capital and inventory. About ₹269 crore remains for expansion and strategic initiatives.

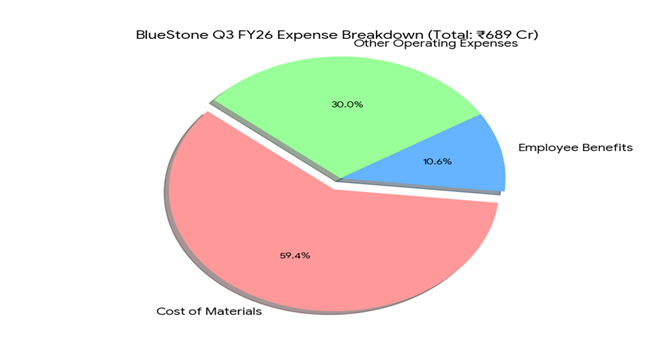

Expense Breakdown

- Cost of goods sold: 63% of revenue, slightly lower than the prior-year ratio.

- Selling and distribution expenses: 8.4% of revenue.

- General and administrative costs: 3.2% of revenue.

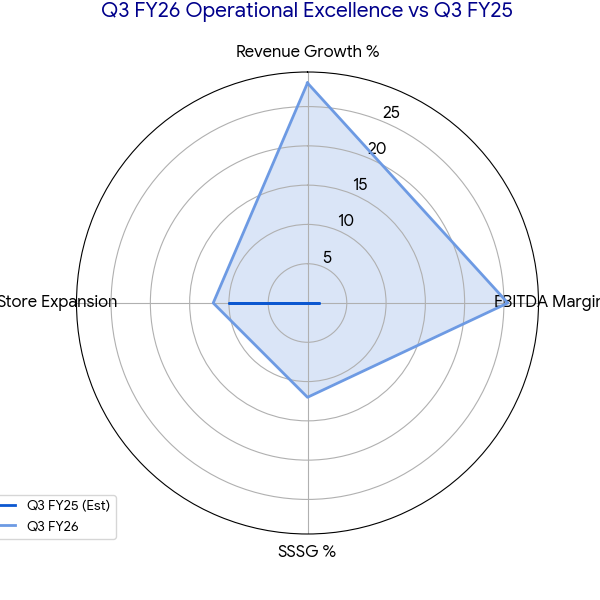

Operational Excellence

- Added 12 stores in the quarter, bringing total FY26 additions to 48.

- Over 150 stores are approaching an annualized revenue run-rate of ₹10 crore per store.

- Operating leverage contributed to margin expansion, with adjusted EBITDA increasing nearly threefold year-on-year.

Store Performance Distribution and Revenue Maturity

- Around 47% of stores now generate over ₹8–10 crore in annualized revenue.

- Newly opened stores are stabilizing and contributing to overall growth.

- Expansion is balanced with operational efficiency to sustain high-margin performance.

Sector and Competitive Context

The Indian jewelry sector faces rising input costs, with spot gold near $4,700 per ounce, and cautious discretionary spending.

Bluestone’s digital-first model contrasts with traditional retailers such as Titan Company Ltd and Kalyan Jewellers, which focus on heavy wedding gold and store expansion.

| Feature | Bluestone | Traditional Retailers (Titan, Kalyan) |

| Primary focus | Daily / occasion wear | Heavy wedding jewelry |

| Core material | High diamond ratio | Predominantly 22KT gold |

| Growth driver | Digital discovery + omnichannel | Store expansion + brand heritage |

| Q3 margin trend | Expansion (operating leverage) | Tightening (high inventory costs) |

Top digital competitors include CaratLane (Titan-backed), GIVA, and Melorra. The stock has outperformed the NSE Nifty FMCG index by 12% over the past year.

Guidance

Bluestone did not provide numeric financial guidance. Management highlighted priorities for the upcoming quarters:

- Continued store expansion toward a 500+ store network.

- Sustaining profitability through operating leverage and digital-first efficiencies.

- Strategic deployment of remaining IPO proceeds to support growth and working capital.

- Balancing expansion with high-margin revenue streams from design-led jewelry.

Bottom Line

Bluestone posted its first profitable quarter, driven by revenue growth, margin expansion, and operational efficiency. Effective deployment of IPO proceeds and high-performing stores contributed to the turnaround. The company remains positioned to expand its store network while maintaining profitability in its digital-first, omnichannel model.