Blue Star Ltd (NSE: BLUESTARCO) reported moderate revenue growth and lower reported profit for the quarter ended December 31, 2025 (Q3 FY26), reflecting steady operating performance and the impact of a one-time exceptional charge related to new labor codes.

Quarterly Performance

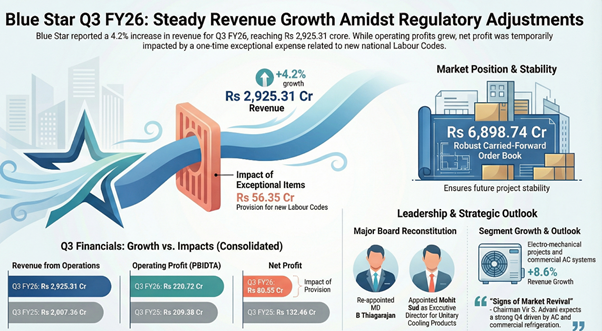

Consolidated revenue from operations rose 4.2% year-on-year to ₹2,925.31 crore, compared with ₹2,807.36 crore in Q3 FY25. Operating profit increased 5.4% year-on-year to ₹220.72 crore, with operating margin broadly stable at about 7.5%.

Profit after tax declined to ₹80.55 crore from ₹132.46 crore a year earlier. The decline was driven by a one-time exceptional expense of ₹56.35 crore recognized towards higher gratuity and leave encashment liabilities following notification of new labor codes. Excluding this item, operating performance remained stable. Earnings per share for the quarter stood at ₹3.92 versus ₹6.44 in Q3 FY25.

SWOT Analysis

Strengths:

- Diversified revenue base across projects, unitary products, and professional electronics.

- Order book of ₹6,898.74 crore providing revenue visibility.

- Moderate leverage with a debt-equity ratio of 0.27 and stable liquidity ratios.

Weaknesses:

- Net profit sensitivity to one-time regulatory and employee cost adjustments.

- Seasonal dependence of the unitary products segment.

- Lower profitability in professional electronics and industrial systems.

Opportunities:

- Recovery in commercial air conditioning and refrigeration demand.

- Execution of a large project pipeline in electro-mechanical services.

- Regulatory-driven replacement demand in room air conditioners.

Threats:

- Regulatory changes affecting employee costs and compliance.

- Input cost volatility impacting margins.

- Demand fluctuations linked to weather patterns and macro conditions.

Segment Snapshot

The electro-mechanical projects and commercial air conditioning segment reported revenue growth of 8.6% year-on-year to ₹1,696.21 crore, supported by project execution and services.

The unitary products segment, which includes room air conditioners and commercial refrigeration, recorded revenue of ₹1,154.22 crore, marginally lower than ₹1,164.36 crore in the year-ago quarter, reflecting seasonality and inventory adjustments ahead of revised energy labelling norms.

Professional electronics and industrial systems revenue declined 7.1% year-on-year to ₹74.88 crore.

Nine-Month & Full-Year Context

For the nine months ended December 31, 2025, consolidated revenue increased to ₹8,329.93 crore from ₹7,948.69 crore a year earlier. Profit after tax for the nine-month period declined to ₹300.15 crore from ₹397.28 crore, largely reflecting the exceptional labor-code-related charge and higher finance and depreciation costs.

As of March 31, 2025, the company had reported full-year revenue of ₹11,967.65 crore and profit after tax of ₹591.28 crore, providing a higher base for year-on-year comparison.

Balance Sheet & Cash Metrics

As of December 31, 2025, consolidated net worth stood at ₹3,195.34 crore. The debt-equity ratio was 0.27, and the current ratio was 1.27, indicating moderate leverage and stable liquidity. Operating margin for the nine-month period stood at 7.25%, while net profit margin was 3.59%.

Order Book & Market Context

The carried-forward order book stood at ₹6,898.74 crore as of December 31, 2025, compared with ₹6,810.00 crore a year earlier, providing near-term revenue visibility in the projects business.

The room air conditioner business saw modest growth, partly supported by channel inventory build-up ahead of mandatory energy label changes effective January 2026.

What Investors Are Watching

Investors are monitoring margin trends excluding exceptional items, execution of the project order book, recovery in unitary products volumes, and working capital efficiency. Progress on distribution expansion and capacity utilization remains a key focus.