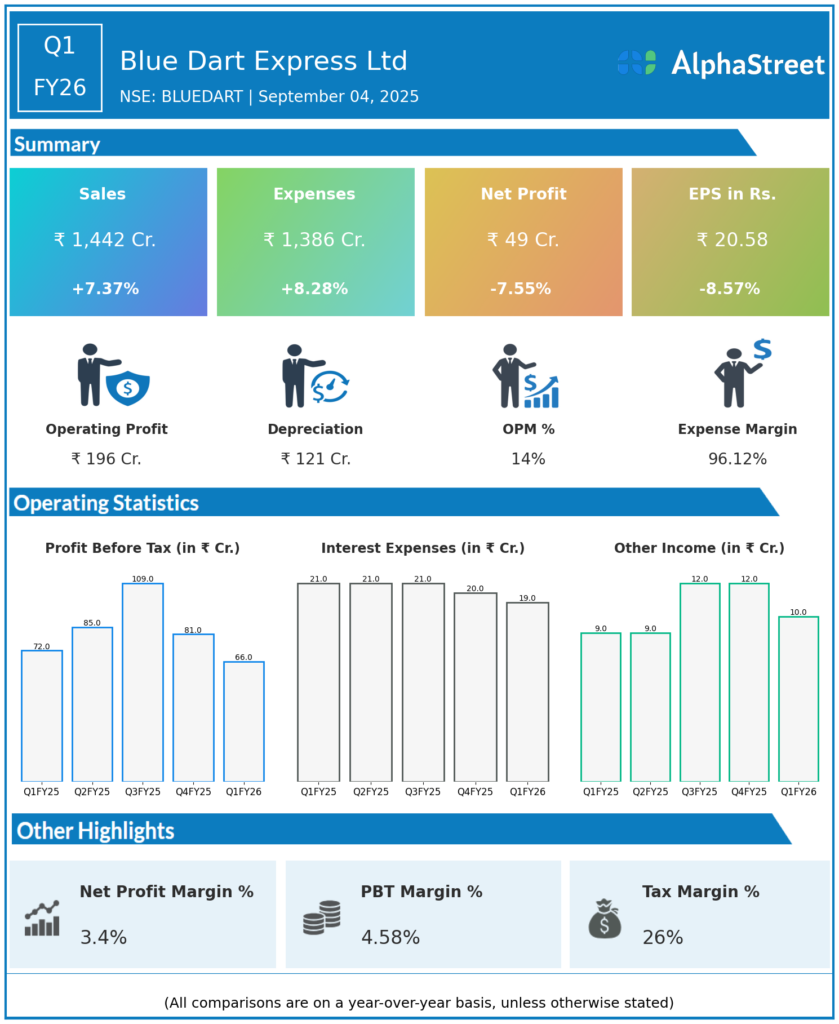

Blue Dart Express Ltd, incorporated in 1988, is a leader in transportation and door-to-door distribution of time-sensitive shipments across South Asia, operating via an integrated ground and air network. Presenting below its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

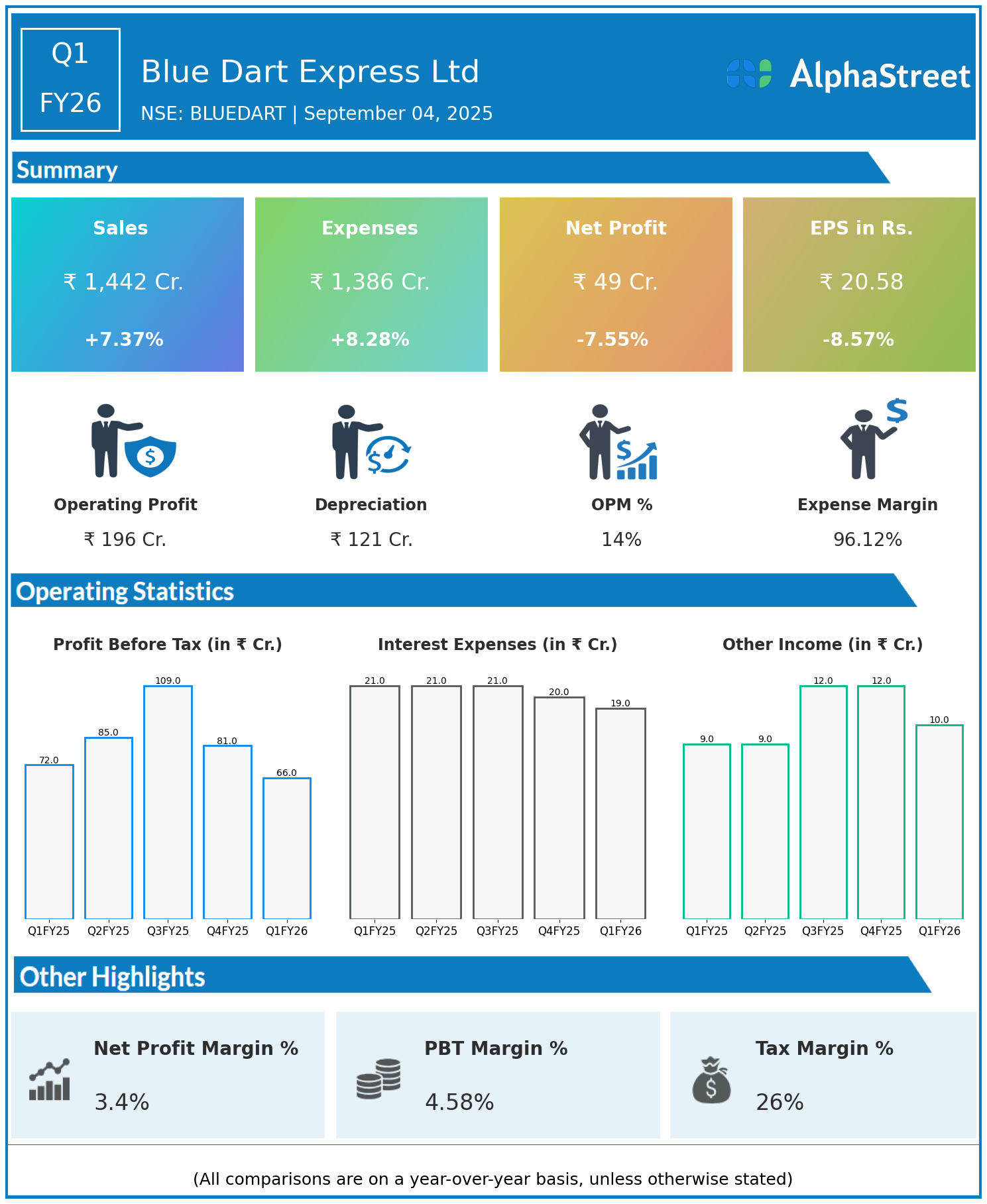

- Revenue: ₹1,442 crore, up 7.37% year-on-year (YoY) from ₹1,343 crore in Q1 FY25.

- Total Expenses: ₹1,386 crore, up 8.28% YoY from ₹1,280 crore.

- Consolidated Net Profit (PAT): ₹49 crore, down 7.55% from ₹53 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹20.58, down 8.57% from ₹22.51 YoY

Operational & Strategic Update

- Revenue Growth: Blue Dart achieved a 7% increase in revenue, driven by continued strength in B2B and B2C express delivery demand and expansion into high-growth areas.

- Rising Costs Impacting Margins: Expenses grew faster than revenue at 8.3%, reducing profit margins due to increased investment in logistics infrastructure, automation, and higher operational costs.

- Profit Decline: Net profit and EPS declined by about 8%, despite revenue gains, largely due to increased cost base and investments for future growth.

- Market Position: Blue Dart remains South Asia’s premier integrated air express and distribution company and continues investing in network expansion and digital capabilities.

- Strategic Moves: New hubs and operational upgrades were initiated to strengthen efficiency and service reliability.

Corporate Developments in Q1 FY26 Earnings

The company in Q1 FY26 continues to focus on operational resilience, customer engagement, and scaling infrastructure to meet changing trade dynamics and volume demands.

Looking Ahead

Blue Dart’s strategic investments in logistics and digitalization are aimed at long-term market leadership, though near-term profit margins may remain under pressure due to ongoing expense growth.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.