“We look forward to embarking on a journey with newer challenges, delivering the best services through reach and best in class transit time. With a focus on Bharat we are expanding our presence in Tier II & III markets. We have about 700 retail stores(with DHL) across India, offering customers a quick turnaround time and an enhanced direct reach to pin-codes in the country. Additonally, we plan to set up about 100 new stores in the near future to aggressively expand our channel footprint.”

-Balfour Manuel, Managing Director

Business Basics

Blue Dart Limited is a leading logistics services provider in India. The company was established in 1983 and has its headquarters in Mumbai, India. Blue Dart is a subsidiary of DHL, which is a global logistics company. The company provides a wide range of logistics services such as air and ground express delivery, freight forwarding, supply chain management, and logistics solutions.

Blue Dart operates through a network of over 35,000 locations across India and has a workforce of more than 9,000 employees. The company has a fleet of over 12,000 vehicles, including 747 freighters, to provide efficient and timely delivery of goods and packages to its customers. Blue Dart also operates international services to over 220 countries worldwide, through its strategic partnership with DHL. The company has a strong focus on technology and innovation and has developed a range of digital solutions to enhance its logistics services. These solutions include an advanced shipment tracking system, mobile applications for customers and employees, and e-commerce solutions for businesses.

Q3 FY23 Financial Performance

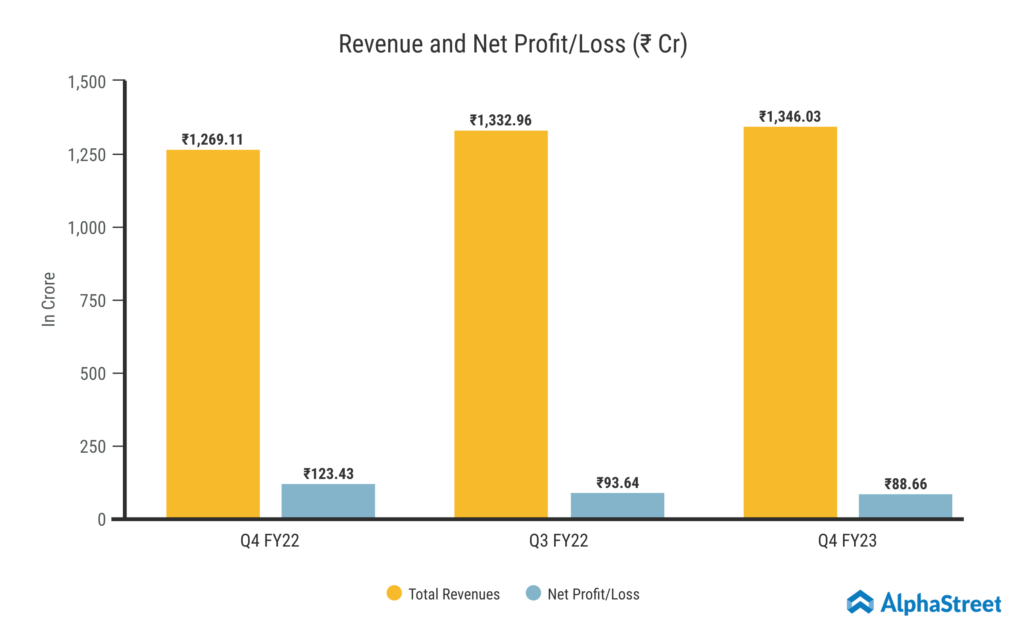

Blue Dart Limited reported Total Income for Q4 FY23 of ₹1,346.03 Crore up from ₹1,269.11 Crore year on year, a growth of 6%. The consolidated Net Profit of ₹88.66 Crore, down 28.1% from ₹123.43 Crore in the same quarter of the previous year. The Earnings per Share is ₹37.36 for this quarter.

Blue Dart’s Partnership With what3words

To improve its delivery process in India, Blue Dart has partnered with what3words. It’s a startup in the mapping industry that develops a unique geocoding system for logistics companies. The company has created a grid of 3 m x 3 m squares, each with a distinct address created from three words. Using this technology, Blue Dart couriers can make precise deliveries to any 3m x 3m square. This partnership has enabled retailers to add a what3words field for customers to use at checkout. Customers can specify exactly where they want their deliveries to go, whether that’s a front door, a particular apartment complex entrance or a hidden side passage, by adding their what3words address in the address section of the “My Blue Dart” App, Blue Dart website and On the Move (OTM) platform.

As per the management, “Given the customer centricity values that Blue Dart carries, we partnered with what3words to stand true to our brand commitment of Customer Convenience and Delight. The three-word addressing will not only provide a seamless last mile delivery but will also increase delivery efficacy by reaching the precise location (within 3m of space) as specified by the customer. We believe that as the use of what3words grows, it will provide a unique way for us to deliver to specific locations, particularly in areas with informal addresses.”

Analysis Of Logistics Industry In India

The logistics industry in India has witnessed significant growth in recent years, driven by increasing demand from various sectors such as e-commerce, retail, manufacturing, and pharmaceuticals. The industry is expected to continue to grow at a rapid pace, fueled by favorable government policies and infrastructure investments. This industry is a $215-billion market in India. Only 10-15% of the market is controlled by organized players, and the market is highly fragmented with many unorganized players. Among the BRICS nations, the average cost of logistics was 11% of GDP, but India’s cost share was 14% of GDP. An increase in exports and imports was one of the factors contributing to the 10.50% YoY growth in the goods and logistics market in India in 2022.

The Indian logistics industry faces a number of challenges, including high logistics costs that are more than a third higher than the global average. Inadequate infrastructure is another significant challenge confronting the Indian logistics industry. The movement of goods is heavily regulated in the Indian logistics sector, and numerous agencies are involved. Logistics companies in India also face difficulties with warehousing, taxation, and the port and transportation sectors.

Another factor contributing to the growth of the logistics industry in India is the country’s geographic location, which makes it a strategic gateway for trade between Asia and the Middle East. Additionally, the Indian government has undertaken several initiatives to improve infrastructure, such as the development of dedicated freight corridors and the expansion of ports and airports.