BLS International Services Ltd, part of the four-decades-old BLS Group, is a global leader in visa application outsourcing with a diversified range of services. The company provides tech-enabled, AI-powered end-to-end solutions for governments and citizens, including visa, passport, consular, citizen services, biometrics, attestation, and retail services. With operations in over 70 countries and more than 50,000 centers globally, BLS handles millions of applications annually, serving over 46 client governments. Presenting below its Q1 FY26 Earnings Results.

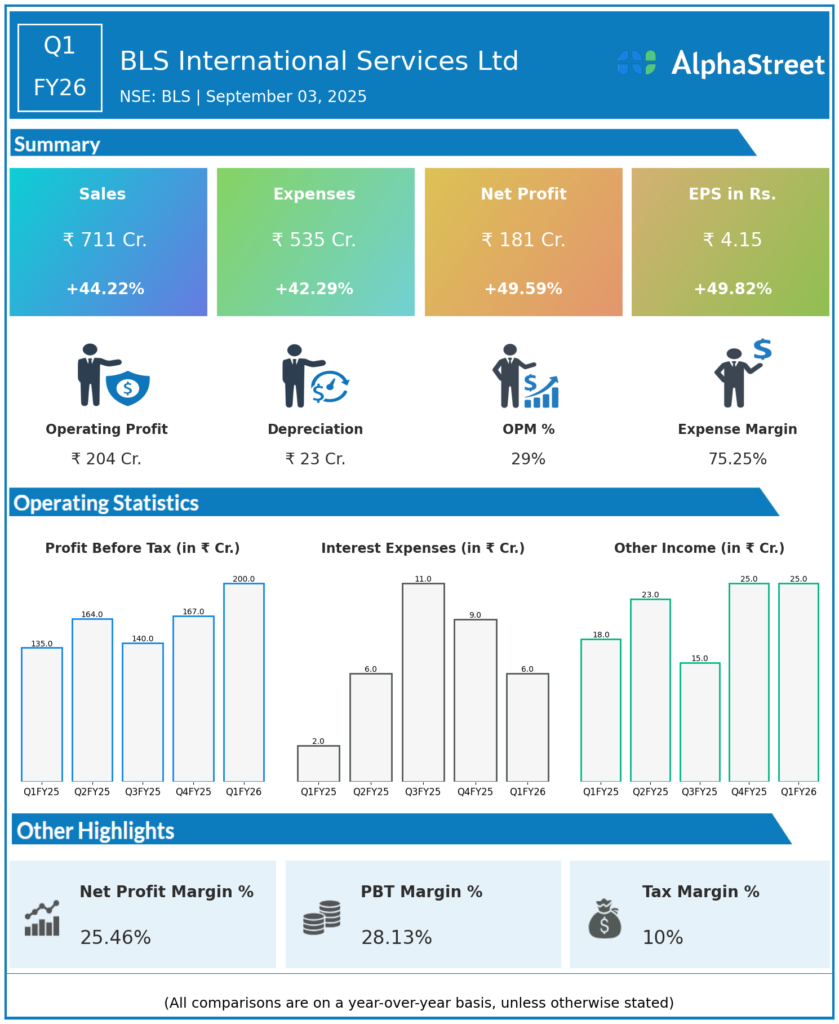

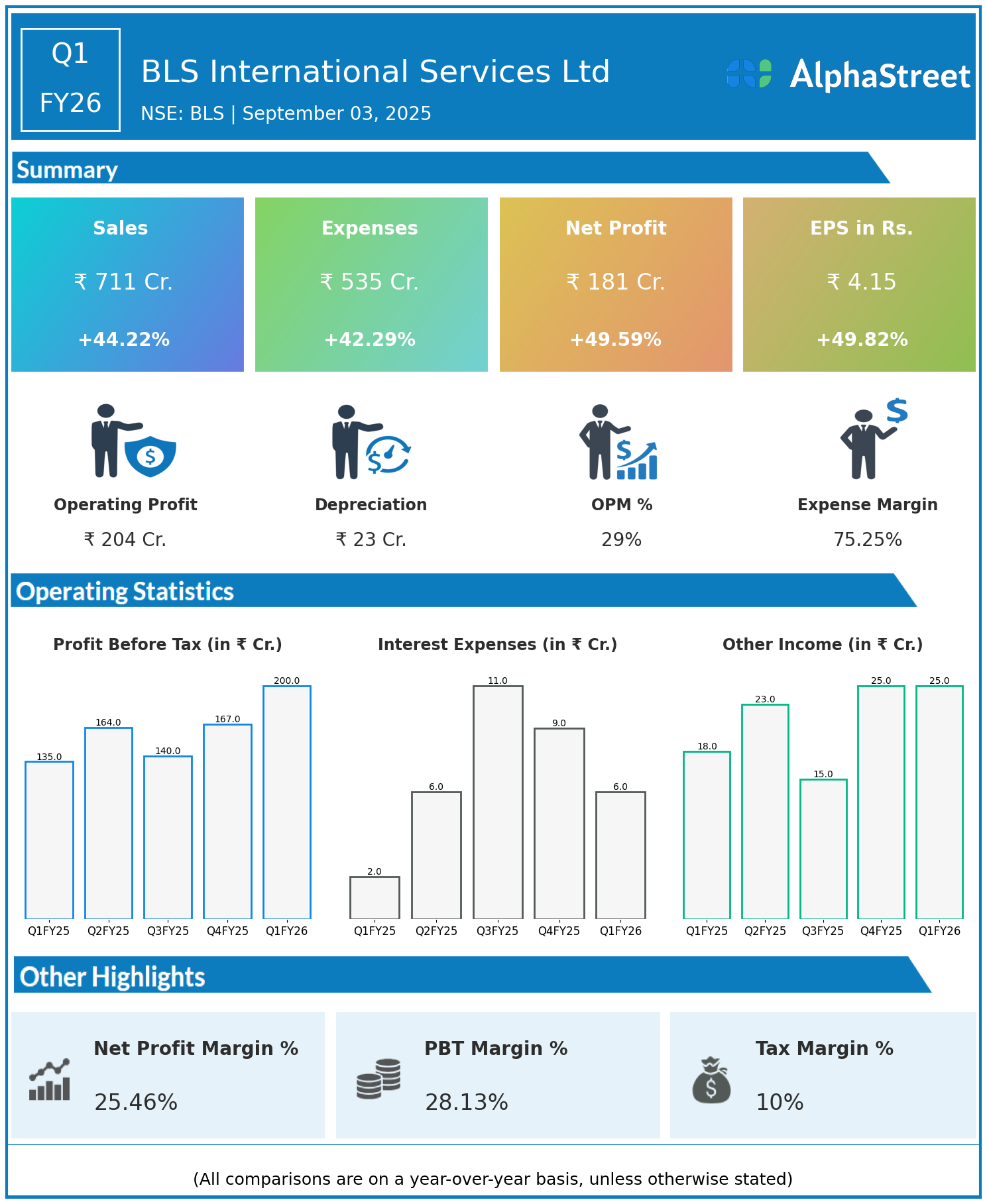

Q1 FY26 Earnings Results

- Revenue: ₹711 crore, up 44.22% year-on-year (YoY) from ₹493 crore in Q1 FY25.

- Total Expenses: ₹535 crore, up 42.29% YoY from ₹376 crore.

- Consolidated Net Profit (PAT): ₹181 crore, up 49.59% from ₹121 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹4.15, up 49.82% from ₹2.77 YoY.

Operational & Strategic Update

- Strong Revenue and Profit Growth: Revenues and profits surged by over 44% and 49% respectively, reflecting expanded global operations and service demand.

- Rising Expenses Managed: Expenses increased by 42%, closely tracking revenue growth, showing operational scalability.

- Market Leadership: BLS International is among the top two global players in visa outsourcing, known for quality, security, and technological innovation.

- Strategic Focus: Continued investment in technology, expansion of visa centers, and broadening service offerings underpin growth.

Corporate Developments in Q1 FY26 Earnings

BLS International’s Q1 FY26 results highlight robust demand for visa and consular services worldwide, supported by technological advancements and strong government partnerships.

Looking Ahead

BLS International aims to sustain leadership by enhancing service quality, expanding global footprint, and leveraging AI and digital tools to improve customer experience.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.