Birlasoft Limited, part of The CK Birla Group and headquartered in Pune, provides software development and IT consulting services primarily to sectors such as Banking, Financial Services & Insurance, Life Sciences, Energy Resources & Utilities, and Manufacturing. The company employs over 10,000 professionals globally. Presenting below are its Q1 FY26 Earnings Results

Q1 FY26 Earnings Results

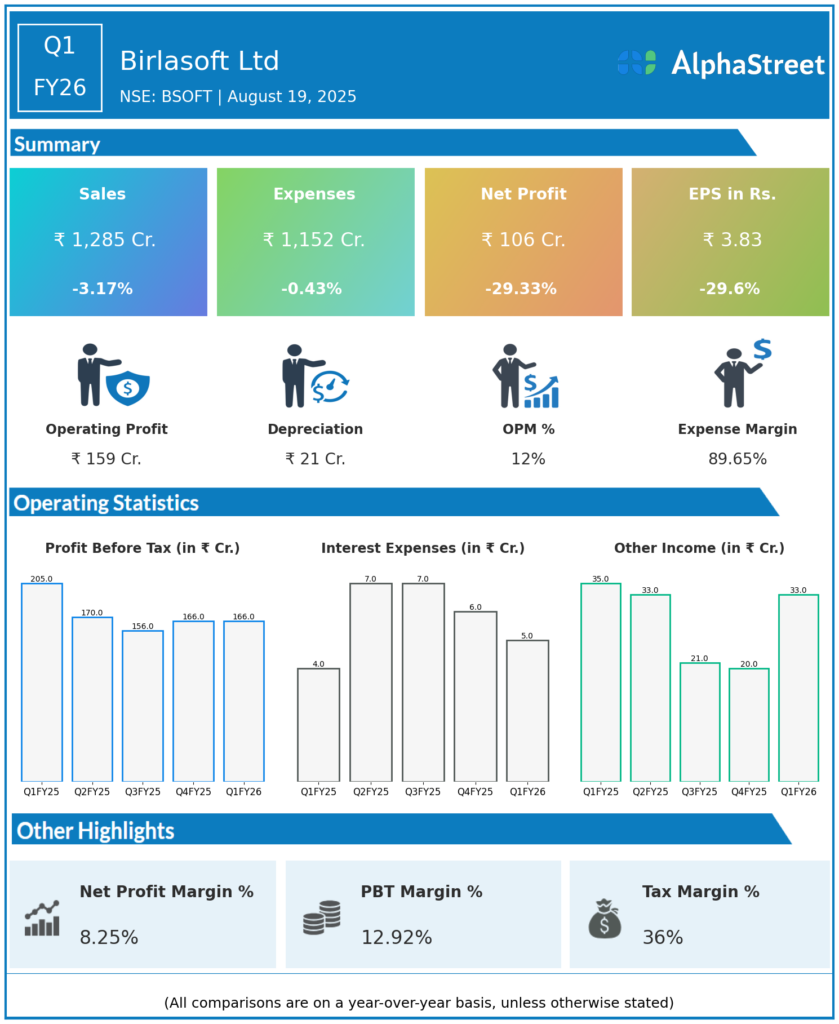

- Revenue: ₹1,285 crore, down 3.17% year-on-year (YoY) from ₹1,327 crore in Q1 FY25.

- Total Expenses: ₹1,152 crore, down 0.43% YoY from ₹1,157 crore.

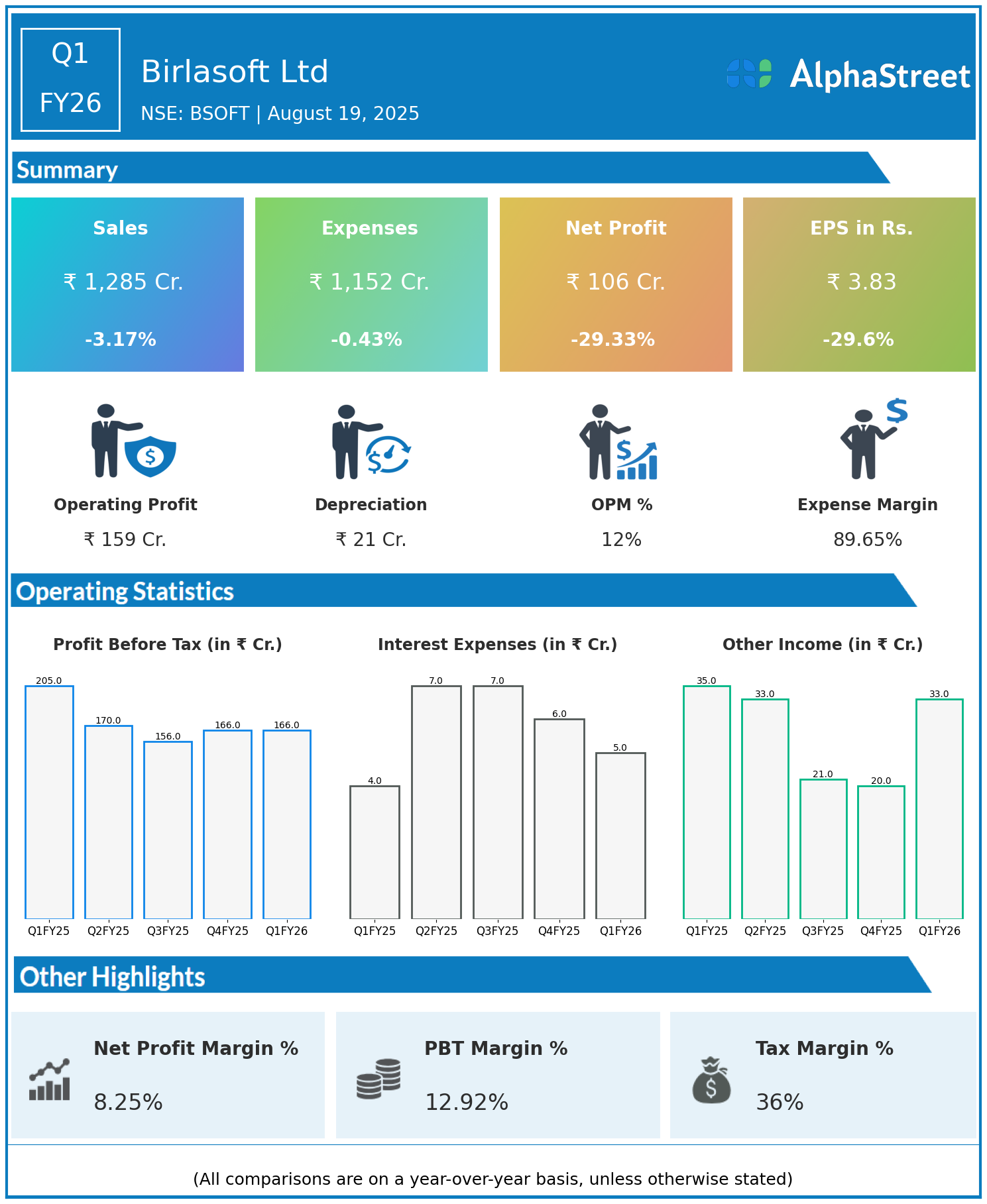

- Consolidated Net Profit (PAT): ₹106 crore, down 29.33% from ₹150 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹3.83, down 29.60% from ₹5.44 YoY.

Operational & Strategic Update

- Revenue Decline: Revenues dropped modestly due to cautious client spending and project slowdowns in some verticals.

- Stable Expense Base: Total expenses remained largely flat, reflecting cost control measures amid revenue pressure.

- Profitability Contraction: Net profit and EPS declined nearly 30%, pressured by revenue softness and margin compression.

- Market Focus: Birlasoft continues to concentrate on high-growth sectors such as BFSI, Life Sciences, and Energy Resources, leveraging its domain expertise and global delivery model.

- Strategic Initiatives: The company is ramping up investments in digital transformation, cloud adoption, and automation services to drive future growth.

Corporate Developments in Q1 FY26 Earnings

The quarter highlighted profitability pressures for Birlasoft Ltd amid top-line challenges. However, ongoing strategic investments in high-value services and technology capabilities are expected to support medium-term growth.

Looking Ahead

Birlasoft Ltd aims to bolster growth by expanding its digital and consulting services, broadening client engagements, and enhancing operational efficiency. The focus remains on leveraging emerging technologies and sectoral expertise to regain momentum and improve profitability through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.