Executive Summary

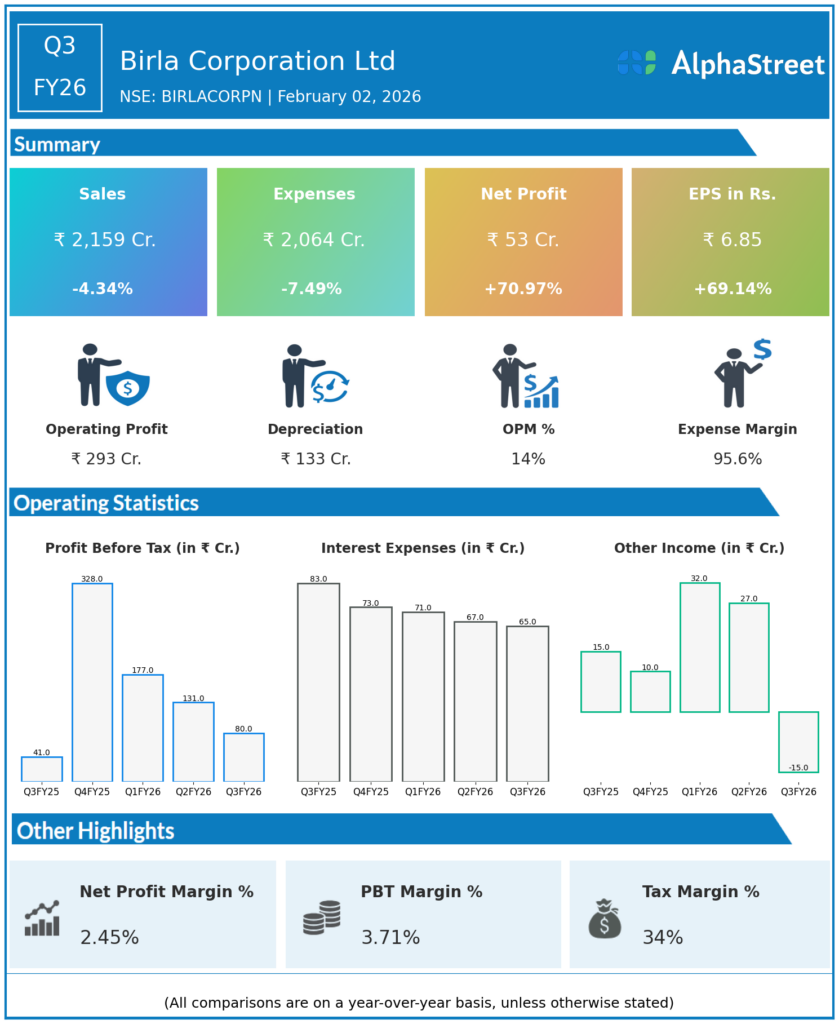

Birla Corporation Ltd reported Q3FY26 revenues of ₹2,159 crore, down 4.34% YoY, but consolidated net profit surged 70.97% to ₹53 crore through 7.49% expense cuts and cost optimization. Cement demand recovered in December led by B2B sales, boosting margins despite seasonal weakness.

Revenue & Growth

Revenues declined to ₹2,159.00 crore from ₹2,257.00 crore YoY, with cement segment down 6% to ₹2,027 crore due to October-November slowdown. Total expenses fell 7.49% YoY to ₹2,064.00 crore; jute revenue rose 31% to ₹133 crore on 33% domestic and 81% export growth.

Profitability & Margins

Consolidated net profit jumped 70.97% YoY to ₹53 crore from ₹31 crore, with EBITDA margin expanding 256 bps to 13.55%. Basic EPS rose 69.14% to ₹6.85 from ₹4.05; 9M FY26 net profit up 581% to ₹263 crore.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

PAT margin improved to 2.44%; EBITDA at ₹292 crore (up YoY). Interest expenses at ₹65 crore, depreciation ₹133 crore; new ₹34 crore labor code provision impacted results. 9M revenue up 6.6% YoY.