Stock Data:

| Ticker | NSE: BIOCON |

| Exchange | NSE |

| Industry | PHARMACEUTICALS |

Price Performance:

| Last 5 Days | +1.43% |

| YTD | -7.18% |

| Last 12 Months | -22.16% |

Company Description:

Biocon is India’s premier biotechnology company. It has evolved into a fully integrated biopharmaceutical player with API manufacturing facilities, strong capabilities in biologics, innovative drug development, and a branded generics business in India. With over 25 years of expertise in fermentation technology, the company has built a strong presence in high-growth segments such as statins, immuno-suppressants, and anti-diabetes drugs. Biocon is among the few companies globally to have received approvals for its biosimilars from developed countries such as the US, EU, Australia, and Japan. Biocon operates through three main business segments: generics, biosimilars, and research services.

Critical Success Factors:

1. Biosimilars Portfolio: Biocon has one of the largest global biosimilars portfolios, covering a wide range of products including recombinant human insulin, insulin analogs, monoclonal antibodies, and other biologics for diabetes, oncology, and immunology. The company is well-positioned to benefit from the growing acceptance of biosimilars and their potential to increase access to high-quality, affordable drugs.

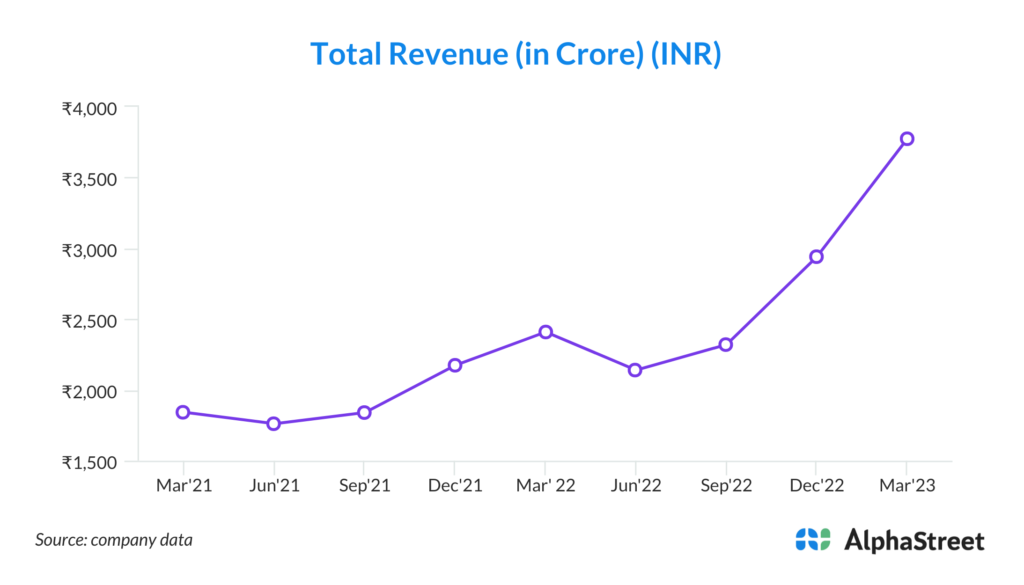

2. Growth Opportunities: Biocon is poised for significant growth in the coming years. Its three business units are at an inflection point, and investments in R&D and capex towards complex products such as peptides and oncology molecules are expected to yield positive results. The company anticipates mid-teen growth in its generics business and clear growth drivers in its biosimilars segment.

3. Global Presence: With approvals for biosimilars in developed markets, Biocon has established a global presence. It has the advantage of being one of the few companies to receive regulatory clearance from the US, EU, Australia, and Japan, giving it a competitive edge in these lucrative markets.

4. Strong Research Capabilities: Biocon’s strong expertise in developing and manufacturing complex biosimilars, coupled with its partnerships and commercialization strength, enhances its global presence. The company’s research services segment, represented by Syngene, further contributes to its strength in research and development.

5. Sustainable Practices: Biocon’s commitment to sustainability is evident from its improved score in the Dow Jones Sustainability Index. It has been recognized in the S&P DJSI’s prestigious annual sustainability yearbook, showcasing its focus on environmental, social, and governance (ESG) practices.

Key Challenges:

1. Regulatory Challenges: Regulatory concerns and inspections by agencies such as the USFDA pose risks to Biocon’s operations. While recent inspections have not raised any critical observations, ongoing regulatory scrutiny can impact the company’s manufacturing facilities and product approvals.

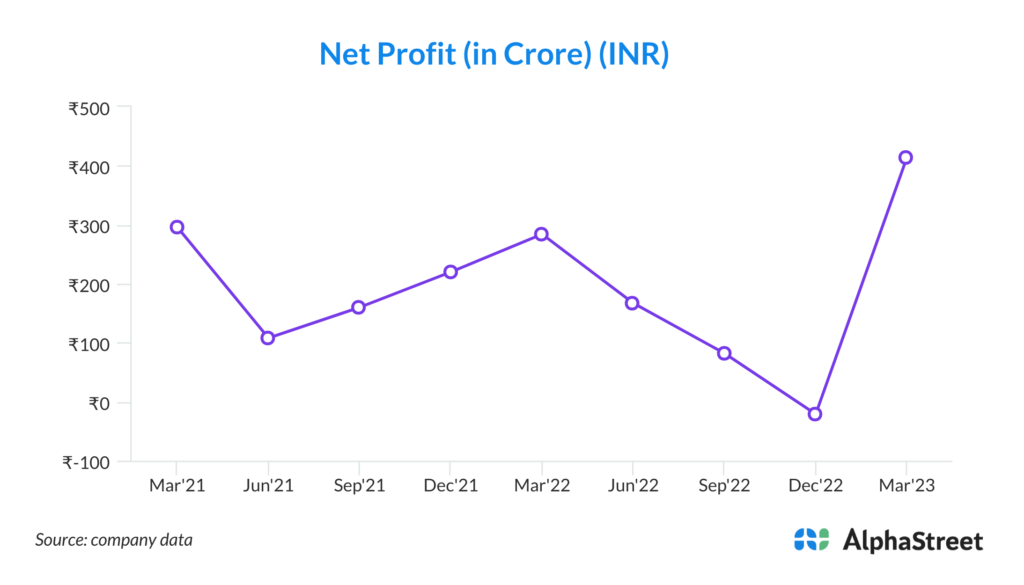

2. Price Erosion: Price erosion in the biosimilars segment is a concern for Biocon. Although currently lower than in other segments, continued pricing pressure may impact the company’s margins and profitability in the future.

3. Competitive Landscape: The biopharmaceutical industry is highly competitive, with numerous players vying for market share. Biocon faces competition from both domestic and international companies, and the success of its products depends on factors such as efficacy, safety, pricing, and regulatory approvals.

4. Patent Expiry: While Biocon has received approvals for its biosimilars, it is important to monitor the patent expiry of reference products. Loss of exclusivity for key global brands can increase competition and potentially impact Biocon’s market share and revenue growth.

5. Debt Reduction: Biocon’s net debt reduction efforts are commendable, but the company still carries a significant level of debt. Continued focus on debt reduction and maintaining a strong balance sheet should be a priority to mitigate financial risks.

Conclusion:

Biocon is well-positioned to benefit from the increasing demand for affordable biologics. The company’s focus on research and development, along with its sustainable practices, adds to its competitive advantage. However, risks such as regulatory challenges, price erosion, and intense competition need to be monitored. Additionally, the management’s efforts to reduce debt and maintain a strong financial position will be crucial for long-term sustainability. Investors interested in Biocon should closely track the company’s financial performance, pipeline of products, regulatory updates, and industry trends. Conducting a thorough valuation analysis, considering factors such as revenue growth, profitability, and market dynamics, will help determine the investment attractiveness of Biocon’s stock.