Company Overview

Bigbloc Construction Ltd (BIGBLOC.NS) is a leading Indian manufacturer of autoclaved aerated concrete (AAC) blocks, wall panels, and related construction materials. Operating multiple plants across Gujarat and Maharashtra, the company serves residential, commercial, and infrastructure projects. Recent initiatives include expansion into construction chemicals and wall panel products to diversify revenue streams.

Management Summary

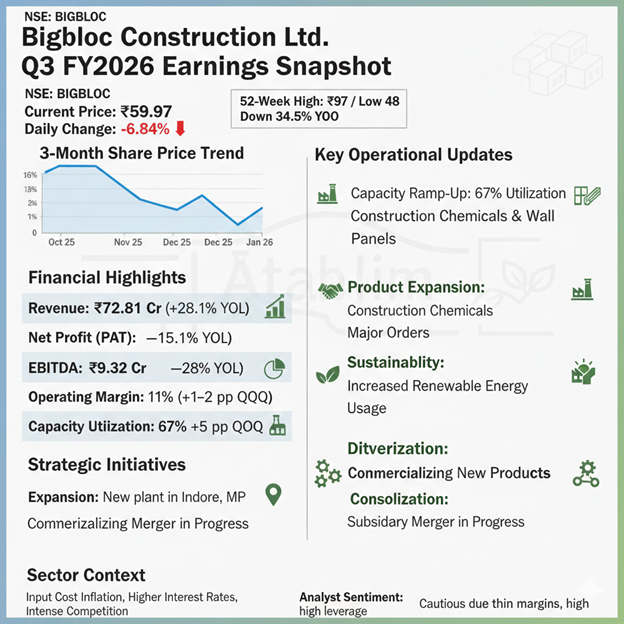

In Q3 FY2026, Bigbloc reported consolidated revenue of ₹72.81 crore, up 28.1% year-on-year, driven by higher sales volumes of AAC blocks and incremental wall panel volumes. EBITDA increased 28% to ₹9.32 crore, reflecting operational leverage as fixed costs were absorbed more efficiently. Operating margins improved slightly to around 11%, but profitability remained constrained by rising raw material costs and interest expenses.

Net profit declined 15.1% to ₹1.85 crore, highlighting the impact of input cost inflation and financing charges. Management emphasized disciplined capital allocation, phased plant ramp-ups, and cost control as levers to improve profitability while sustaining revenue growth.

Analysts’ Questions and Management Responses

Product Launches: Analysts inquired about the construction chemicals facility. Management confirmed commercial production is underway, producing block jointing mortar, plaster, and tile adhesives. AAC wall panels were also highlighted as incremental revenue drivers with growing utilization.

Capacity Expansion: Questions on plant efficiency were addressed with updates on phased ramp-ups and ongoing utilization improvements. Land acquisitions in central India were confirmed to reduce logistics costs and access new markets.

M&A and Partnerships: Management stated strategic alliances and corporate consolidations are aimed at operational efficiency and market access without significant capital outlay.

Financial Priorities: Funding for growth is expected through a mix of internal accruals and project-specific financing, with a strong focus on controlling costs and improving operating leverage.

Product Update and New Launches

- Construction Chemicals Facility: Producing block jointing mortar, plaster, and tile adhesives to diversify revenue streams.

- AAC Wall Panels: Gaining traction in commercial orders, contributing to incremental revenue.

- Continued product innovation is expected to strengthen the overall portfolio.

Geographic Expansion

Bigbloc is planning new plants in central India to reduce logistics costs and expand market presence. Phased ramp-ups of existing plants are improving capacity utilization and operational efficiency.

Mergers & Acquisitions

The company is exploring strategic alliances and joint ventures to accelerate market access and technology adoption. Corporate consolidation aims to achieve scale advantages and operational efficiency.

Competitive Analysis

Bigbloc faces competition from both specialized AAC manufacturers and diversified building material firms. Its smaller scale limits pricing power compared to national players, but its regional focus and listed status provide a differentiated position. Operational efficiency, product diversification, and timely capacity expansion remain key competitive advantages.

Credit Ratings

Bigbloc’s credit profile reflects moderate risk. While some units have been rated investment grade by credit agencies, limited scale and working capital pressures contribute to a moderate credit rating. Management continues to focus on operational efficiency and financial discipline to improve credit standing.

Summary

Bigbloc Construction’s Q3 FY2026 performance demonstrates strong revenue growth supported by higher volumes and utilization gains. Profitability remains under pressure due to cost inflation and financing expenses. Strategic initiatives—including product diversification, geographic expansion, and M&A activity—position the company for incremental growth, while disciplined financial management and operational efficiency are central to sustaining long-term performance.