Bharti Hexacom Ltd delivered impressive Q3 FY26 results with profit growth far outpacing modest revenue gains in Rajasthan and Northeast circles. Expense control drove exceptional bottom-line expansion.

Executive Summary

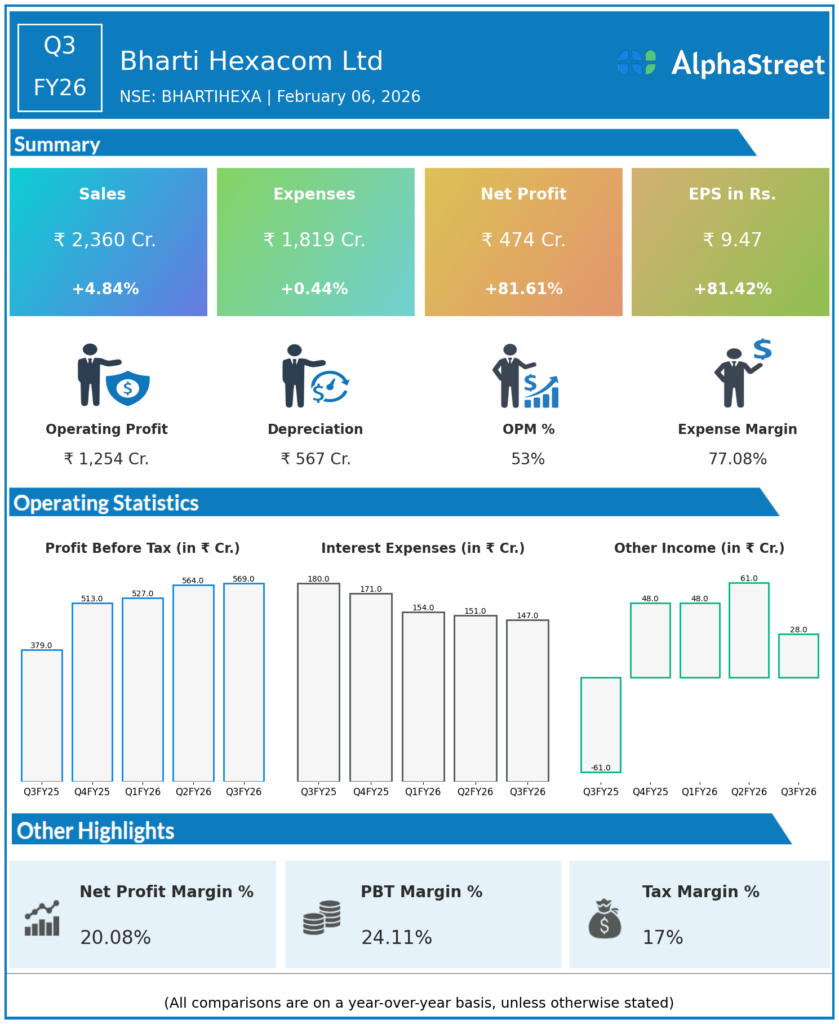

Bharti Hexacom Ltd reported consolidated revenues of ₹2,360 crore for Q3 FY26, up 4.84% YoY from ₹2,251 crore. Net profit jumped 81.61% YoY to ₹474 crore from ₹261 crore, with EPS rising 81.42% YoY to ₹9.47 from ₹5.22. Minimal expense growth supported margin leverage.

Revenue & Growth

Revenues increased 4.84% YoY to ₹2,360 crore from ₹2,251 crore, reflecting steady demand for mobile, fixed-line, and broadband services. Total expenses edged up 0.44% YoY to ₹1,819 crore from ₹1,811 crore. QoQ figures unavailable from dataset.

Profitability & Margins

Consolidated net profit surged 81.61% YoY to ₹474 crore. EPS advanced 81.42% YoY to ₹9.47. PAT margin expanded to 20.08% from 11.59% YoY; EBITDA and gross margin data not provided.

Balance-sheet Highlights

Balance sheet metrics such as net debt, current assets, or liabilities absent from input data. Operations focused on regional telecom services maintain asset-light model. Net debt/EBITDA and current ratio unavailable.

Cash Flow / Liquidity

Cash flow details including operating cash flow and free cash flow not reported in dataset. Liquidity supports network investments in specified circles. Current ratio unavailable.