Bharti Airtel is one of the world’s leading telecommunications service providers, with operations spanning 18 countries including India, Sri Lanka, and 14 African nations. The company offers a broad portfolio of telecom services covering mobile, broadband, fixed line, and digital TV, serving millions of customers globally. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

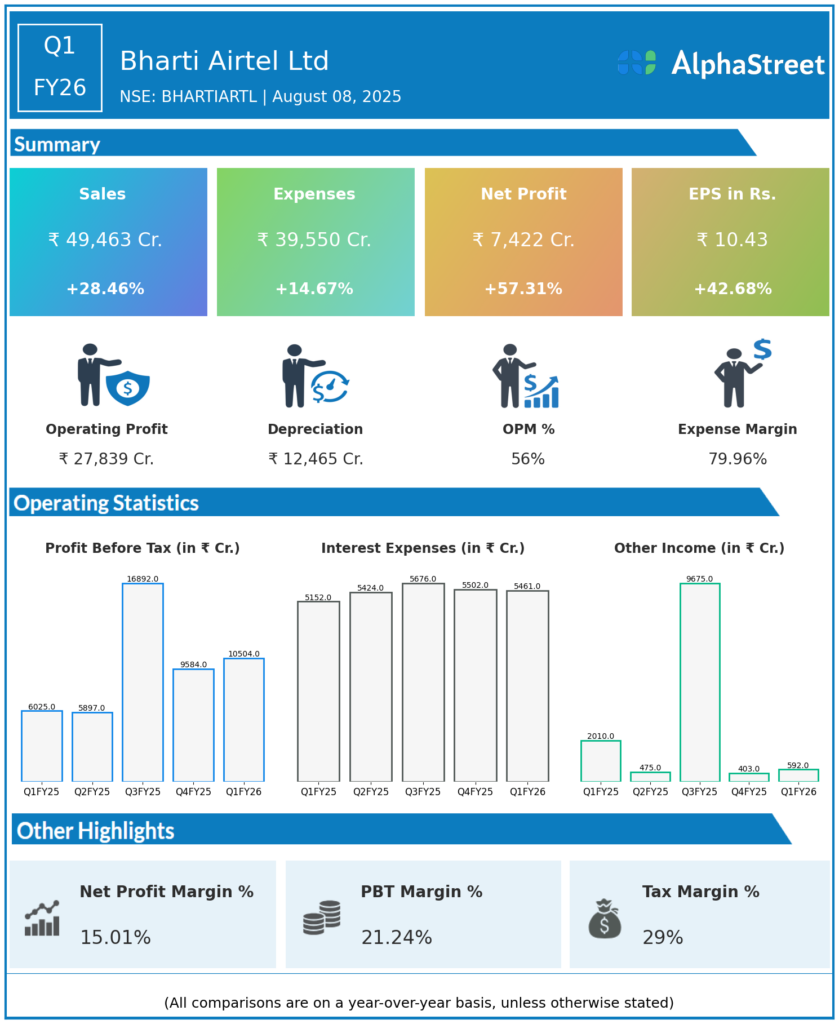

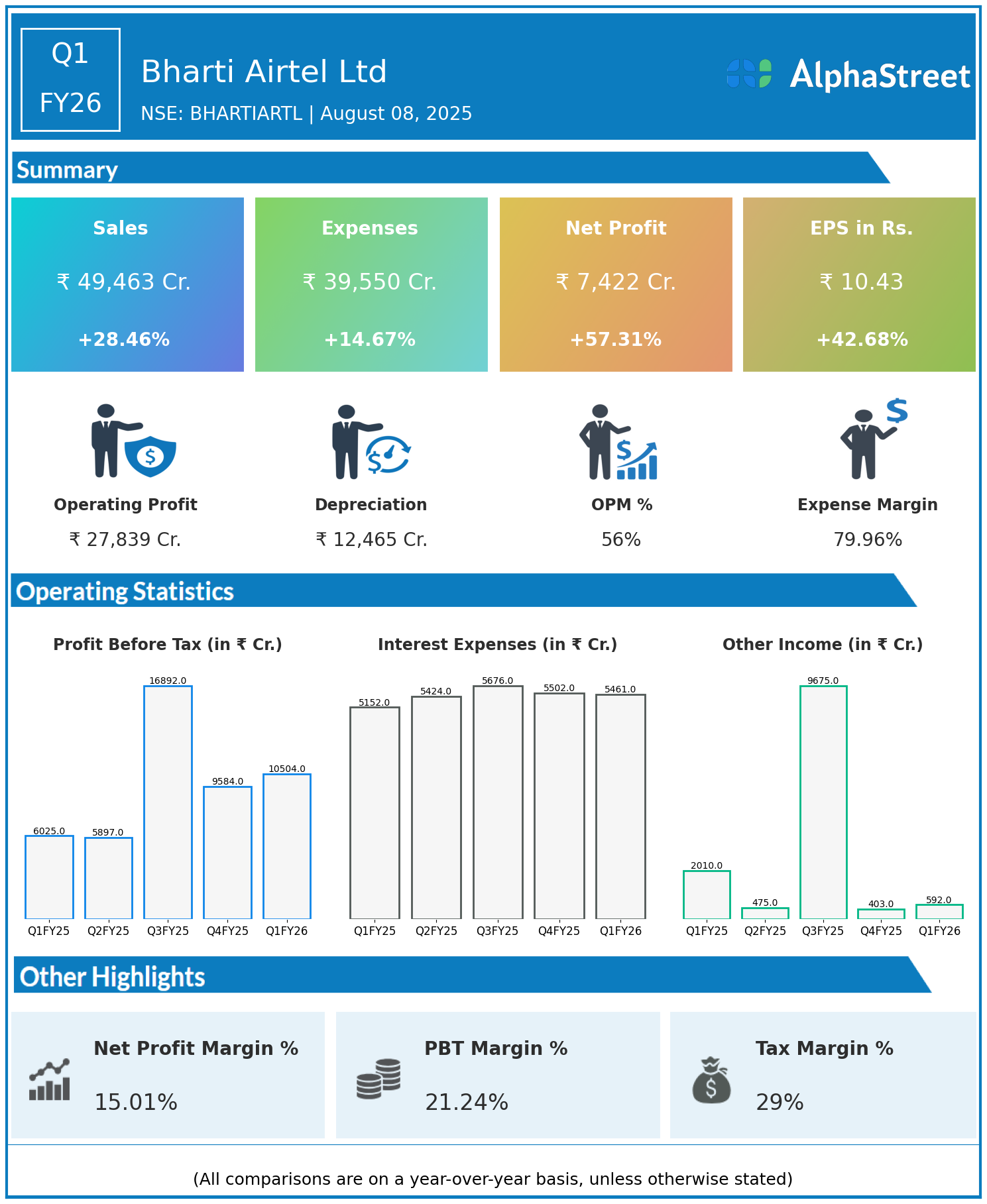

- Revenue: ₹49,463 crore, up 28.46% year-on-year (YoY) from ₹38,506 crore in Q1 FY25.

- Total Expenses: ₹39,550 crore, up 14.67% YoY from ₹34,491 crore.

- Consolidated Net Profit (PAT): ₹7,422 crore, up 57.31% from ₹4,718 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹10.43, up 42.68% from ₹7.31 YoY.

Operational & Strategic Update

- Robust Revenue Growth: Bharti Airtel delivered strong top-line growth driven by increased subscriber base, higher data consumption across markets, tariff hikes, and expanding digital service offerings. Growth in India and African operations contributed substantially.

- Controlled Expense Growth: Total expenses rose moderately at 14.67%, significantly lower than revenue growth, highlighting disciplined cost management, scale benefits, and operational efficiencies.

- Strong Profitability Expansion: The 57% surge in net profit and 43% rise in EPS reflect strong margin expansion fueled by efficient cost controls, higher ARPU (Average Revenue Per User), and strong cash flow generation.

- Market Leadership: Airtel maintains a leadership position in the Indian telecom market and is expanding in Africa through network enhancements, service innovations, and digital ecosystem development.

- Technology & Network Investments: Continued investments in 4G/5G network infrastructure, fiber rollout, and digital platforms are supporting customer experience and future growth trajectories.

- Strategic Focus: The company leverages a diversified revenue base spanning consumer, enterprise, and digital businesses to mitigate risks and drive sustainable profits.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results underscore Bharti Airtel’s strong operational execution and market resilience despite competitive pressures. The company continues to benefit from scale, network quality, and digital transformation initiatives.

Looking Ahead

Bharti Airtel is well-positioned to sustain growth momentum through expanding 5G adoption, increasing data monetization, and leveraging its pan-India and international footprint. Emphasis on innovation, cost management, and customer-centric offerings is expected to support continued margin improvement and robust shareholder value creation through FY26 and beyond.

To view Bharti Airtel’s previous results: Click Here