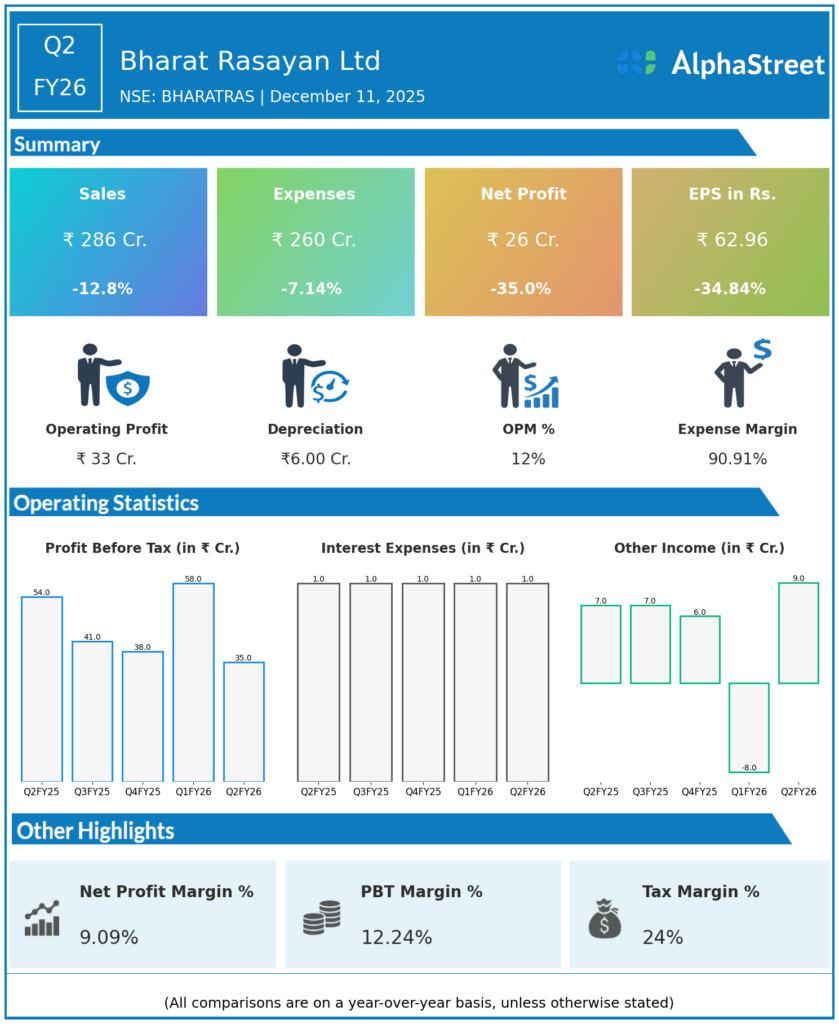

Bharat Rasayan Ltd, incorporated in 1989 and engaged in manufacturing technical grade pesticides and intermediates for the agro-chemical industry, reported weaker financial performance in Q2FY26.

Financial Highlights:

- Revenues declined 12.8% year-on-year to ₹286 crore from ₹328 crore.

- Total expenses fell 7.14% to ₹260 crore from ₹280 crore.

- Consolidated net profit dropped 35.0% to ₹26 crore from ₹40 crore.

- Earnings per share decreased 34.84% to ₹62.96 from ₹96.62.

Revenues contracted more sharply than costs, leading to margin compression and significant profit decline amid agro-chemical demand pressures.

Outlook:

Bharat Rasayan Ltd targets demand recovery, cost optimization, and new product development to restore profitability trajectory.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.