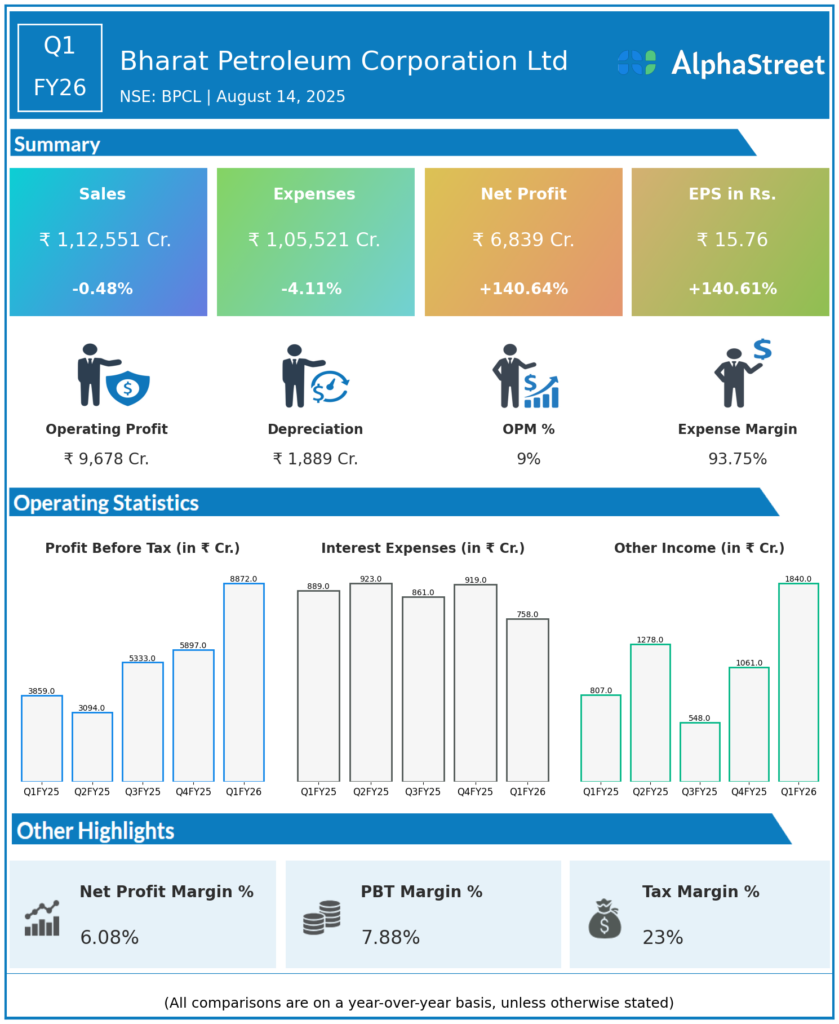

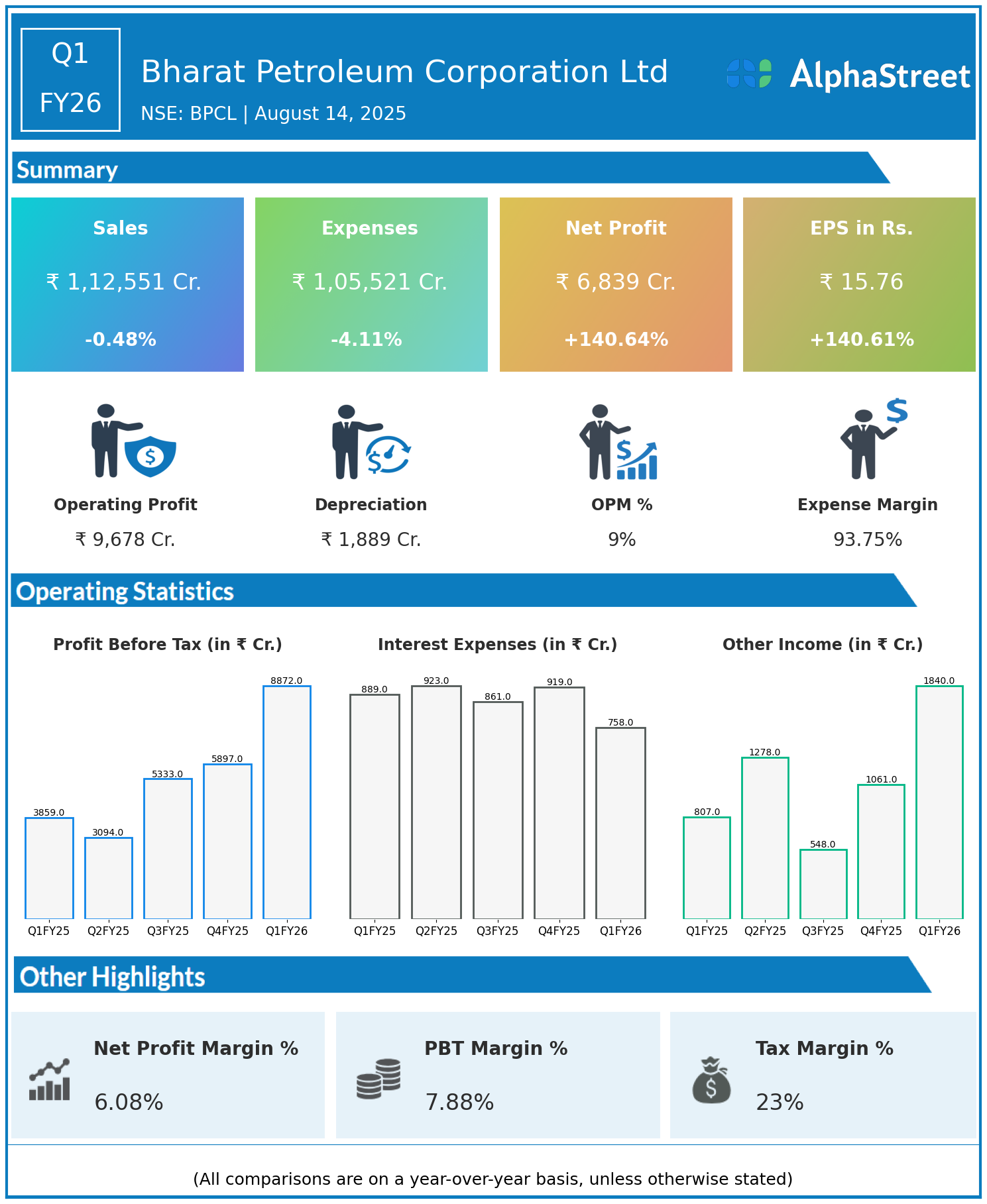

Bharat Petroleum Corporation Limited (BPCL), a public sector enterprise engaged in the refining of crude oil and marketing of petroleum products, has announced its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹1,12,551 crore, down 0.48% year-on-year (YoY) from ₹1,13,095 crore in Q1 FY25.

- Total Expenses: ₹1,05,521 crore, down 4.11% YoY from ₹1,10,043 crore.

- Consolidated Net Profit (PAT): ₹6,839 crore, up 140.64% from ₹2,842 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹15.76, up 140.61% from ₹6.55 YoY.

Operational & Strategic Update

- Flat Revenue Performance: Revenue remained broadly stable, with marginal YoY decline due to muted crude price movements and product sales realisations.

- Expense Reduction: Total expenses fell over 4%, aided by lower crude procurement costs, operational efficiencies, and optimised refining margins.

- Sharp Profit Growth: Net profit more than doubled, supported by higher refining margins, lower input costs, and improved marketing performance in both retail and industrial segments.

- Segment Performance: The refining segment benefited from favourable crack spreads and efficient throughput, while the marketing segment saw stable demand in transport fuels and lubricants.

- Strategic Focus: BPCL continues to invest in refinery upgrades, alternative fuel infrastructure, and expansion of its retail footprint, alongside its ongoing push into renewable energy and EV charging networks.

Corporate Developments in Q1 FY26 Earnings

The Q1 FY26 results highlight BPCL’s ability to deliver exceptional bottom-line growth despite muted revenue trends, driven by cost efficiency, advantageous market conditions in refining, and disciplined operations in marketing.

Looking Ahead

Bharat Petroleum Corporation Ltd plans to strengthen its refining capabilities, scale up renewable energy investments, and expand alternative fuel infrastructure. The company aims to leverage technology, supply chain efficiency, and a diversified energy portfolio to maintain profitability and enhance shareholder value through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.