Bharat Heavy Electricals Limited (BHEL) is an integrated power plant equipment manufacturer engaged in design, engineering, manufacture, erection, testing, commissioning, and servicing a wide array of products and services for sectors including Power, Transmission, Industry, Transportation, Renewable Energy, Oil & Gas, and Defence. It is the flagship engineering and manufacturing company of India, owned and controlled by the Government of India. Presenting below are its Q1 FY26 Earnings Results.

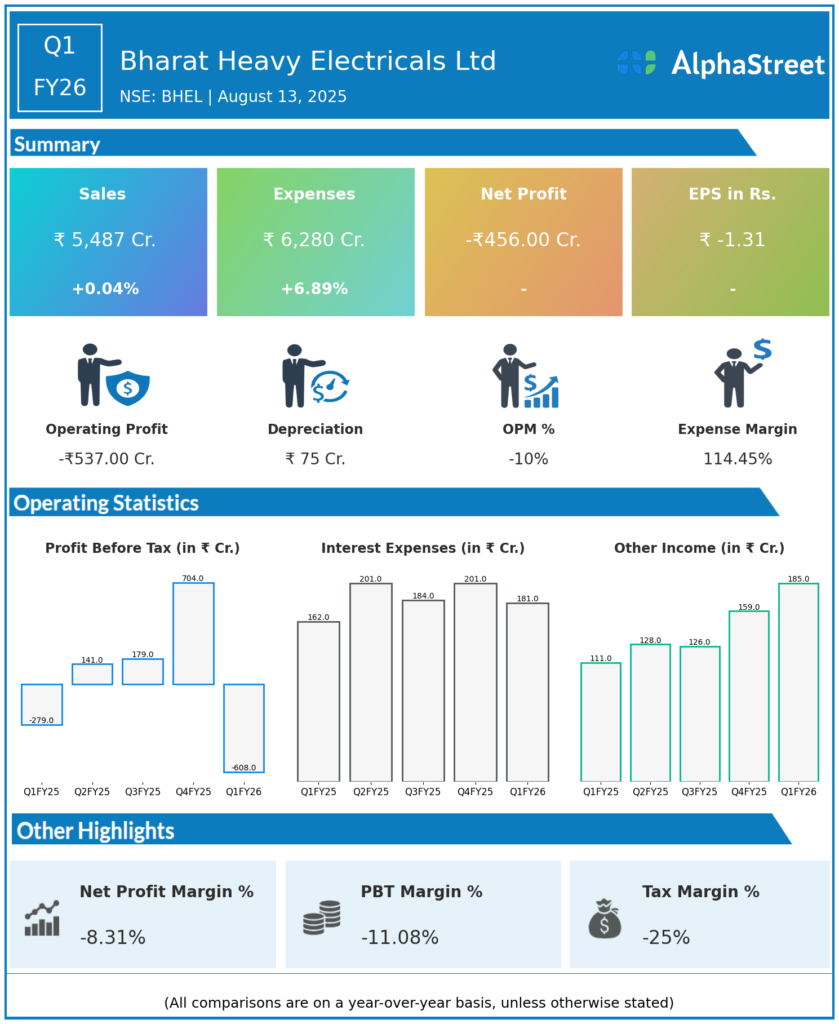

Q1 FY26 Earnings Results

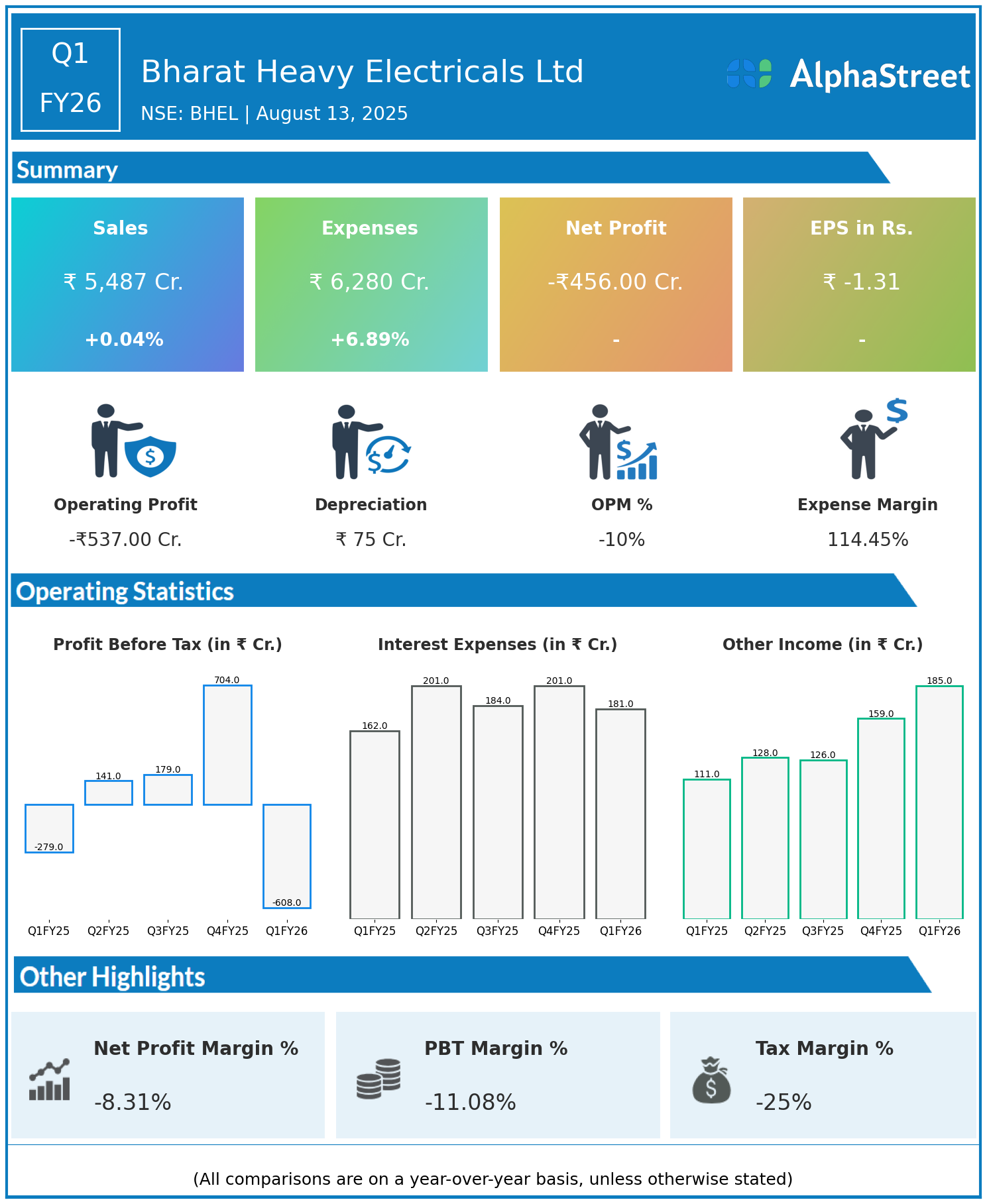

- Revenue: ₹5,487 crore, up 0.04% year-on-year (YoY) from ₹5,485 crore in Q1 FY25.

- Total Expenses: ₹6,280 crore, up 6.89% YoY from ₹5,875 crore.

- Consolidated Net Profit (PAT): -₹456 crore, compared with -₹211 crore in the same quarter last year.

- Earnings Per Share (EPS): -₹1.31, compared with -₹0.61 YoY.

Operational & Strategic Update

- Flat Revenue Performance: Revenue remained essentially flat versus last year, signaling subdued order execution and sales growth within the core power and engineering segments.

- Expense Escalation: Total expenses rose nearly 7%, outpacing revenue, driven by higher raw material costs, employee expenses, and other operational outlays.

- Widening Losses: The net loss more than doubled, indicating continued margin pressure and challenges from under-recovery of fixed costs, delayed project execution, or adverse sales mix.

- Segment Overview: BHEL’s broad sector exposure, including renewables, industry, and defence, offers growth potential, though current quarter performance highlights ongoing headwinds in its mainstay power equipment business.

- Strategic Initiatives: The company remains focused on technology upgrades, digital transformation, and diversification into non-power segments to mitigate volatility and support future growth.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results reflect the operational and financial challenges faced by Bharat Heavy Electricals Limited, with stagnant revenues and rising costs leading to deeper losses. The company’s efforts to drive efficiency and sectoral diversification are crucial for turnaround.

Looking Ahead

BHEL is expected to pursue cost rationalization, innovation in advanced manufacturing, and expansion in emerging sectors such as renewables and defence to stabilize and revive growth. Strategic project wins, operational efficiency, and government sector support will remain key to improving profitability and shareholder returns through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.