Bharat Heavy Electricals Limited (NSE: BHEL) is an Indian multinational power generation and electrical equipment manufacturing company based in New Delhi, India. It was established in 1964 and is owned by the Indian government. BHEL is India’s largest engineering and manufacturing company of its kind, and it provides products and services to the energy, transportation, and infrastructure sectors. The company’s portfolio includes power plants, power transmission and distribution systems, boilers, turbines, generators, transformers, electric vehicles, and other electrical systems. BHEL has 20 manufacturing divisions across India and also has international operations in several countries.

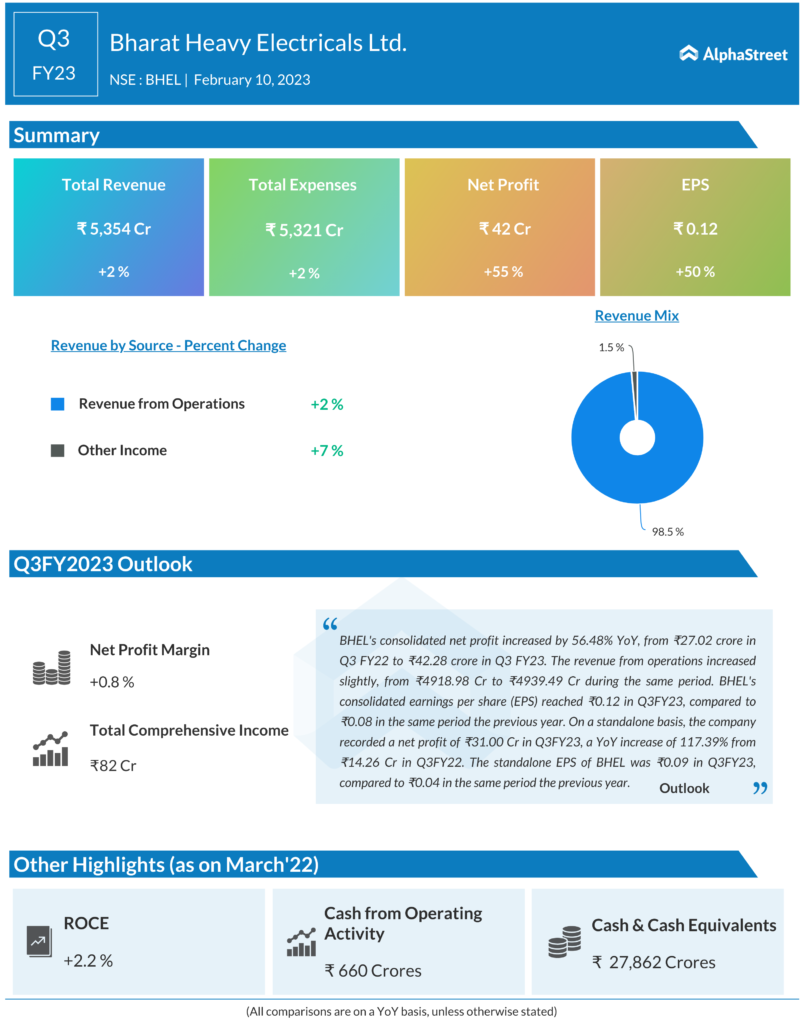

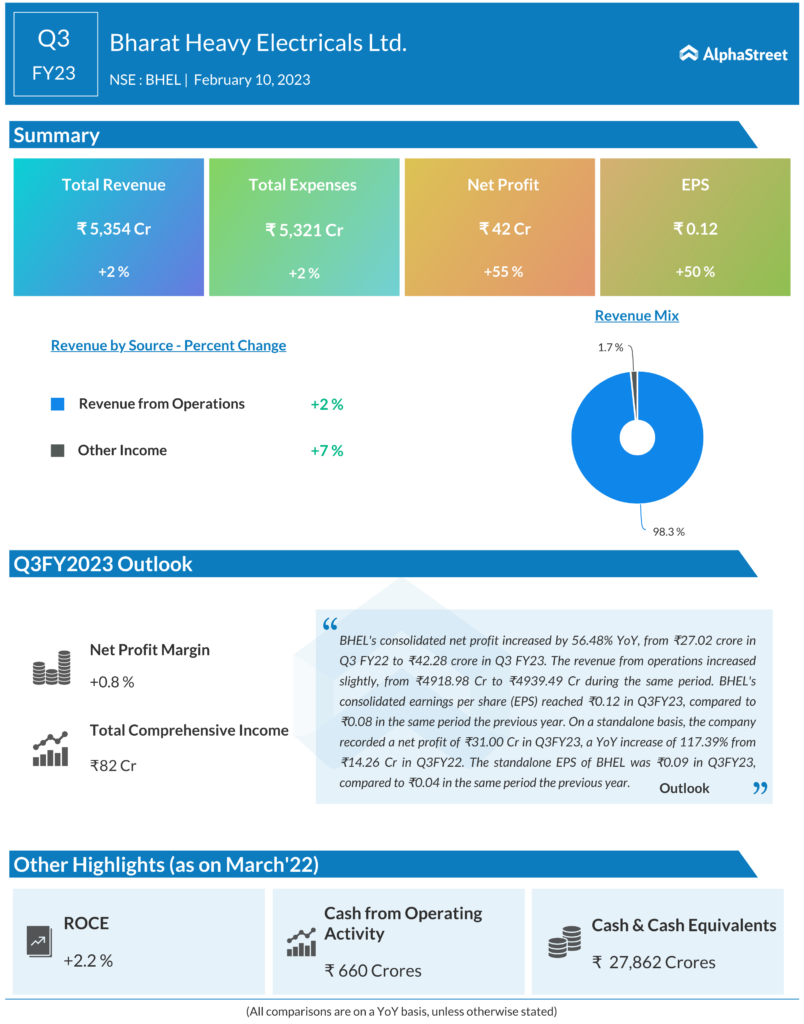

The company recently released its Q3 earnings report for the fiscal year 2023, and the results are positive. BHEL’s consolidated net profit increased by 56.48% YoY, from ₹27.02 crore in Q3 FY22 to ₹42.28 crore in Q3 FY23. The revenue from operations increased slightly, from ₹4918.98 Cr to ₹4939.49 Cr during the same period.

The profit before tax was ₹52.71 crore in Q3FY23, a YoY increase of 59.73% from ₹33 crore in Q3 FY22. The company’s revenue from the power sector reached ₹3,992.12 crore in Q3FY23, a YoY increase of 7.21% from ₹3723.49 Cr in Q3FY22. However, BHEL’s revenue from the industry sector reached ₹947.37 crore in Q3FY23, a YoY decrease of 20.75% from ₹1195.49 Cr in Q3FY22.

BHEL’s consolidated earnings per share (EPS) reached ₹0.12 in Q3FY23, compared to ₹0.08 in the same period the previous year. On a standalone basis, the company recorded a net profit of ₹31.00 Cr in Q3FY23, a YoY increase of 117.39% from ₹14.26 Cr in Q3FY22. The standalone EPS of BHEL was ₹0.09 in Q3FY23, compared to ₹0.04 in the same period the previous year.

In conclusion, BHEL’s Q3 earnings report shows a positive performance, with an increase in consolidated net profit, revenue from operations, and profit before tax. The company’s performance in the power sector was particularly strong, with a YoY increase in revenue, while the performance in the industry sector was weak, with a YoY decrease in revenue. Overall, the results indicate that BHEL is performing well and is on a positive trajectory.