Bharat Forge Limited is engaged in the manufacturing and sale of forged and machined components for the automotive and industrial sectors.

(Source: 201903 Annual Report, Page No. 123)

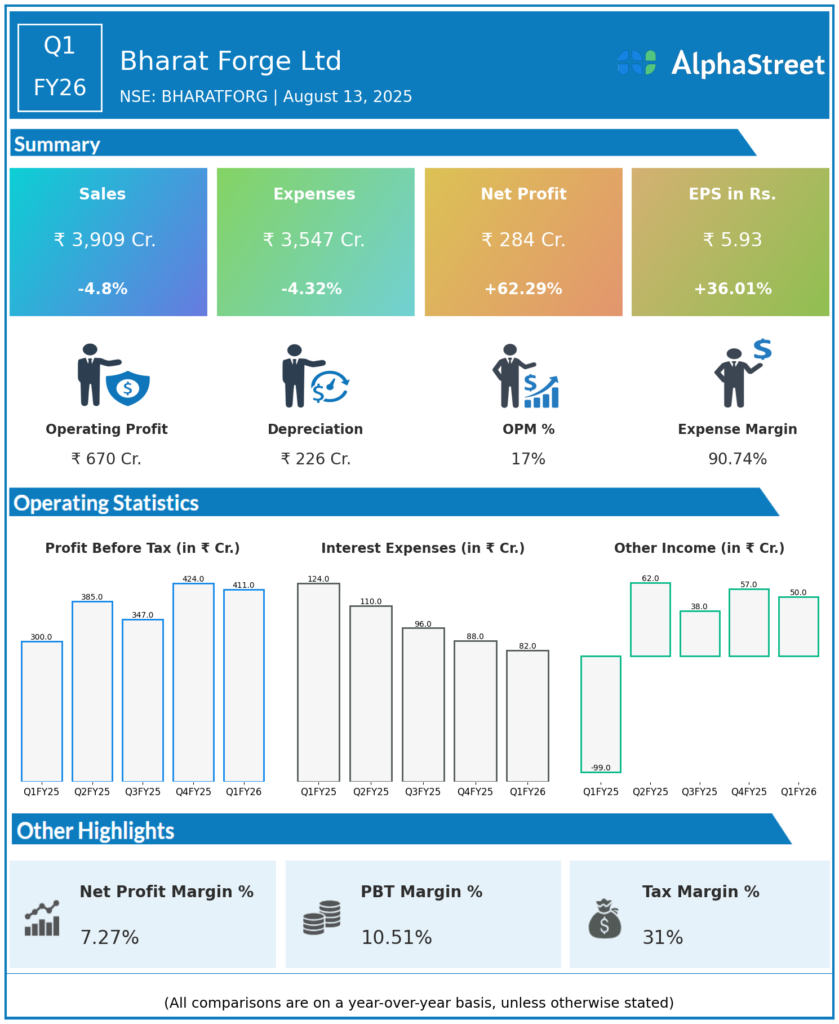

Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹3,909 crore, down 4.8% year-on-year (YoY) from ₹4,106 crore in Q1 FY25.

- Total Expenses: ₹3,547 crore, down 4.32% YoY from ₹3,707 crore.

- Consolidated Net Profit (PAT): ₹284 crore, up 62.29% from ₹175 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹5.93, up 36.01% from ₹4.36 YoY

Operational & Strategic Update

- Revenue Decline: The 4.8% drop in revenue is attributable to softer demand conditions in certain end-user industries and global market headwinds affecting order flows, particularly in export-driven segments.

- Cost Rationalisation: Expenses declined by 4.32%, broadly in line with revenue contraction, reflecting the company’s strong focus on cost control, operational efficiency, and supply chain optimisation.

- Sharp Profit Growth: Despite lower revenues, net profit surged by over 62%, supported by improved operating margins, a shift towards higher-value products, and better capacity utilisation in certain high-margin segments.

- Diversified Portfolio Impact: Bharat Forge’s presence across automotive (including EV components), railways, defence, aerospace, and industrial equipment helped cushion the revenue impact from cyclical downturns in specific markets.

- Strategic Focus: The company continues to invest in advanced manufacturing capabilities, lightweighting technologies, and strategic capacity expansions to strengthen its positioning in global high-performance component markets.

Corporate Developments in Q1 FY26 Earnings

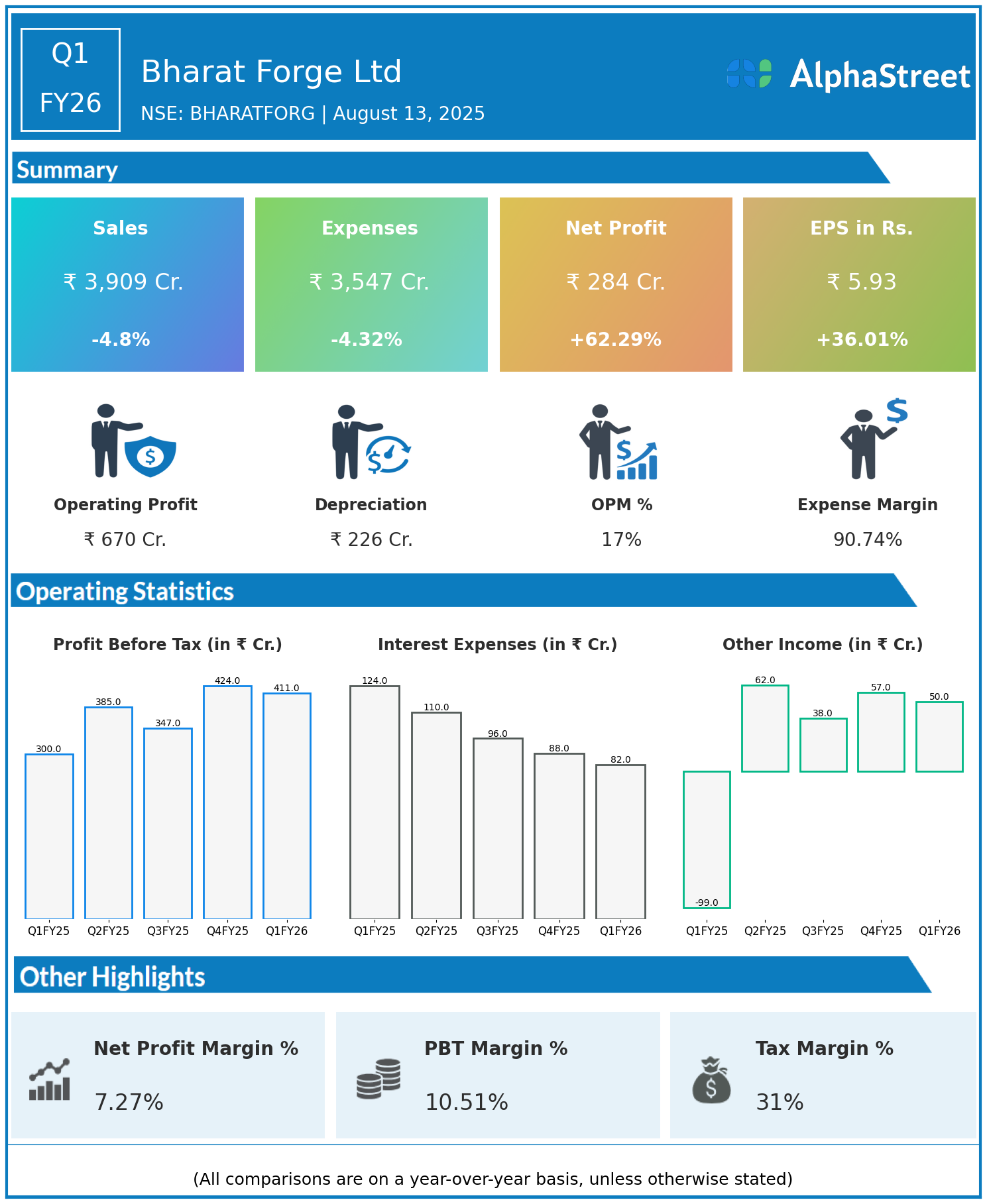

Q1 FY26 results highlight Bharat Forge Ltd’s ability to deliver robust profitability growth even in a subdued revenue environment. Focused execution, product mix optimisation, and continued diversification into defence and aerospace have significantly enhanced the bottom line performance.

Looking Ahead

Bharat Forge Ltd is expected to benefit from the recovery in global automotive demand, rising defence sector opportunities, and the transition to new-age mobility solutions. Continued innovation, market diversification, and efficiency enhancements are likely to sustain profit momentum and create long-term shareholder value through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.