Bharat Electronics Limited (BEL), incorporated in 1954, is a premier manufacturer and supplier of advanced electronic equipment and systems mainly serving the defence sector. The company also maintains a niche presence in the civilian electronics market, contributing to India’s strategic and technological capabilities.

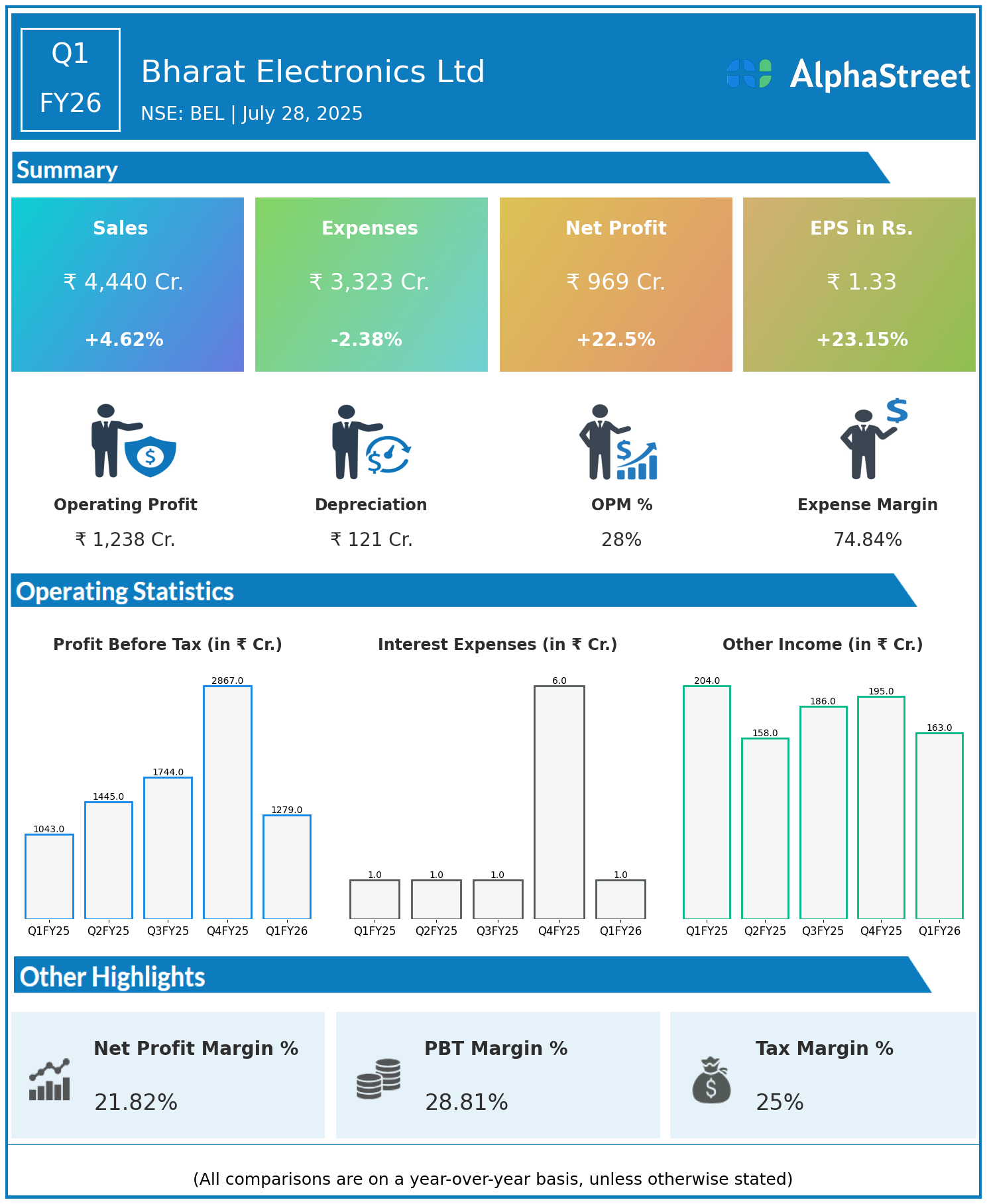

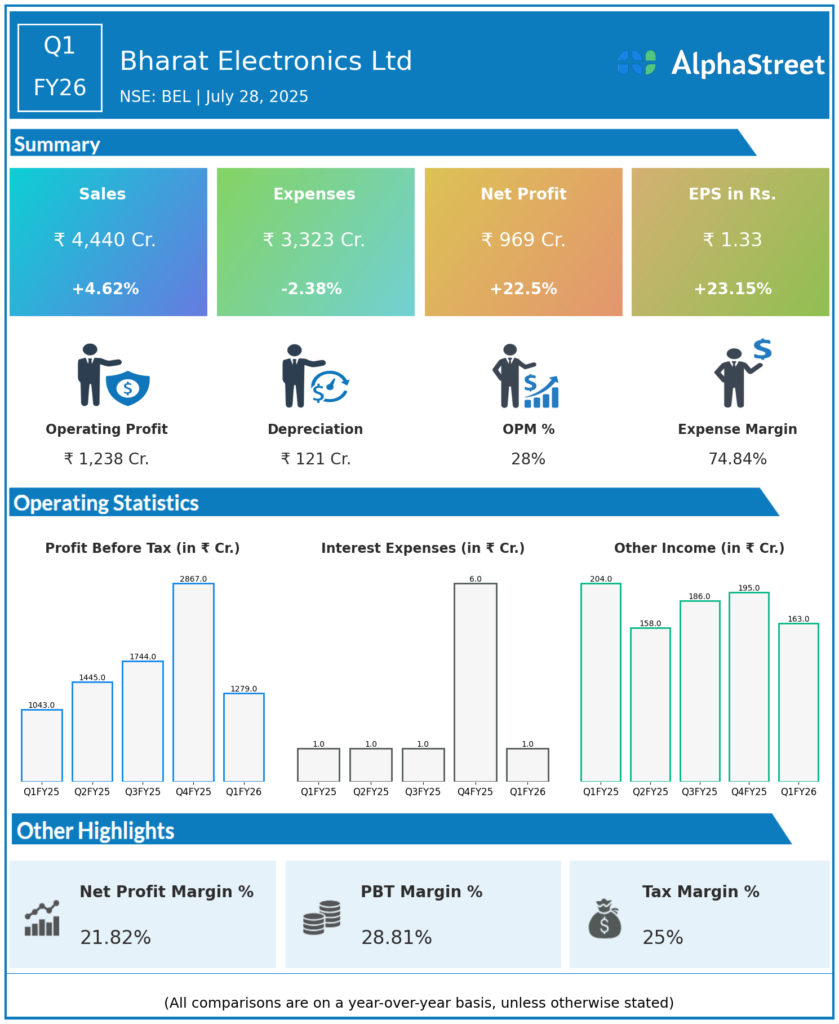

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue: ₹4,440 crore, up 4.62% year-on-year (YoY) from ₹4,244 crore in Q1 FY25.

-

Total Expenses: ₹3,323 crore, down 2.38% YoY from ₹3,404 crore.

-

Consolidated Net Profit (PAT): ₹969 crore, up 22.5% from ₹791 crore last year.

-

Earnings Per Share (EPS): ₹1.33, up 23.15% from ₹1.08 YoY.

Operational & Strategic Update

-

Revenue Growth: Robust order inflows from defence projects have driven revenue growth, underscoring BEL’s trusted vendor status in the defence electronics space.

-

Cost Efficiency: A reduction in expenses reflects enhanced operational efficiency, cost containment, and strategic sourcing benefits.

-

Profitability Surge: Substantial growth in net profit and EPS highlights improved margins and operational leverage.

-

Product & Market Focus: BEL continues to expand its portfolio in radar systems, communication equipment, electronic warfare, and other critical defence technologies, while also growing select civilian market initiatives.

-

Strategic Initiatives: Investments in R&D, collaborations with defence research organizations, and a focus on indigenization reinforce BEL’s role in bolstering India’s self-reliance in defence tech.

-

Sustainability & Innovation: The company emphasizes modern manufacturing and sustainable practices, aligning with environmental and social responsibility goals.

Corporate Developments

The Q1 FY26 results reflect BEL’s resilient financial health and operational performance amidst evolving defence sector demands. Disciplined cost management and revenue growth from key defence contracts position BEL strongly for ongoing expansion.

Looking Ahead

BEL is poised to leverage rising government focus on defence modernization and indigenous manufacturing. Continued innovation, product diversification, and operational improvements are expected to fuel long-term value creation through FY26 and beyond.