Executive Summary

Bharat Coking Coal Ltd swung to a Q3FY26 net loss of ₹22.88 crore from a ₹425 crore profit YoY, despite revenue holding near ₹2,853 crore. Coal production declined 10.7% to 8.90 MT amid operational challenges, marking stark contrast to prior strong performance.

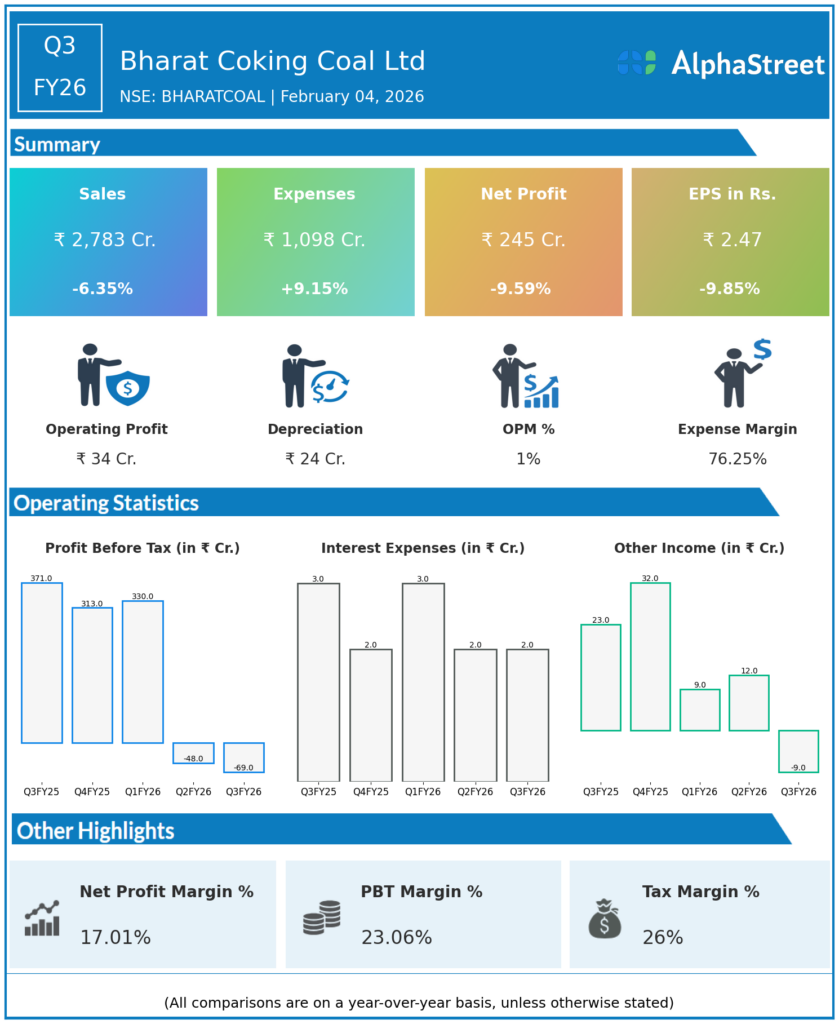

Revenue & Growth

Revenues from operations fell to ₹2,853 crore from ₹3,757 crore YoY, reflecting 24.1% contraction driven by 25.4% sales drop to ₹2,585 crore. Total expenses remained elevated while production and offtake declined 10.7% and 10% respectively to 8.90 MT and 8.78 MT.

Profitability & Margins

Consolidated net loss reached ₹22.88 crore versus ₹425 crore profit YoY, with pre-tax loss at ₹69.10 crore compared to ₹515 crore profit. Basic EPS turned negative at ₹0.05 from ₹0.91; 9M FY26 profit declined to ₹101 crore from ₹1,174 crore.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26. Recent listing of 46.57 crore shares (10% equity) completed January 19, 2026.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

9M revenue dropped to ₹9,165 crore from higher base; employee benefits expense at ₹1,533 crore and contractual costs at ₹1,024 crore pressured margins. Stripping activity adjustment provided ₹313 crore positive impact amid volume declines.