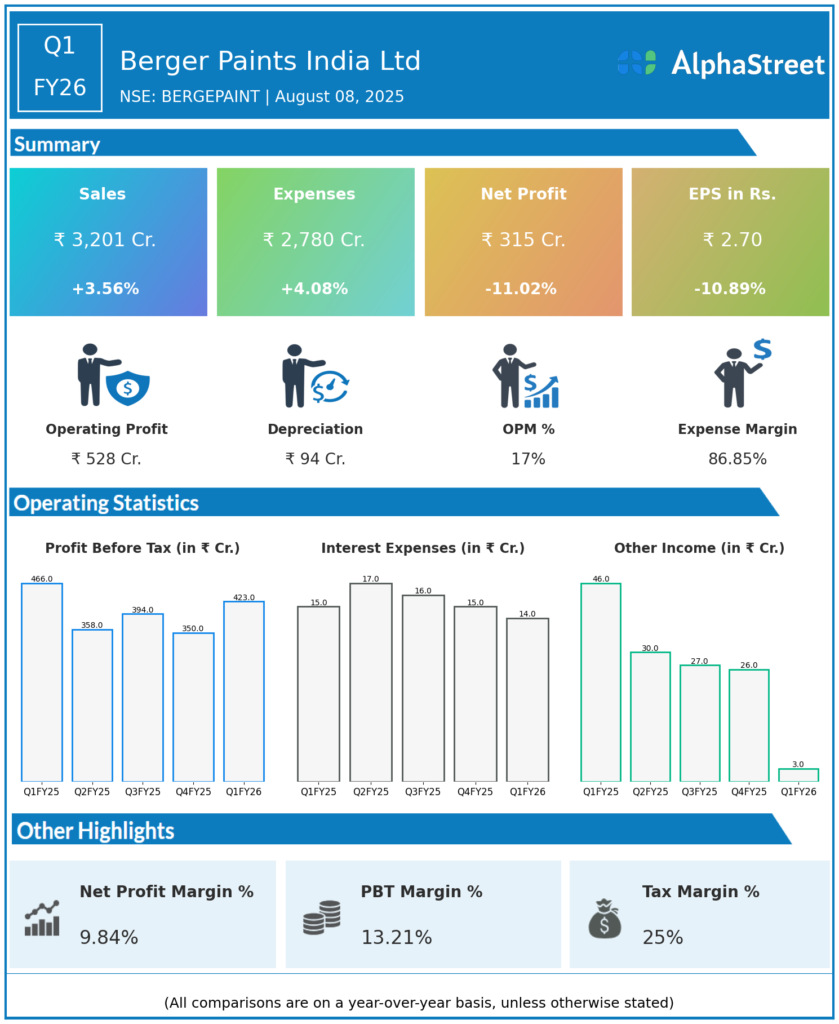

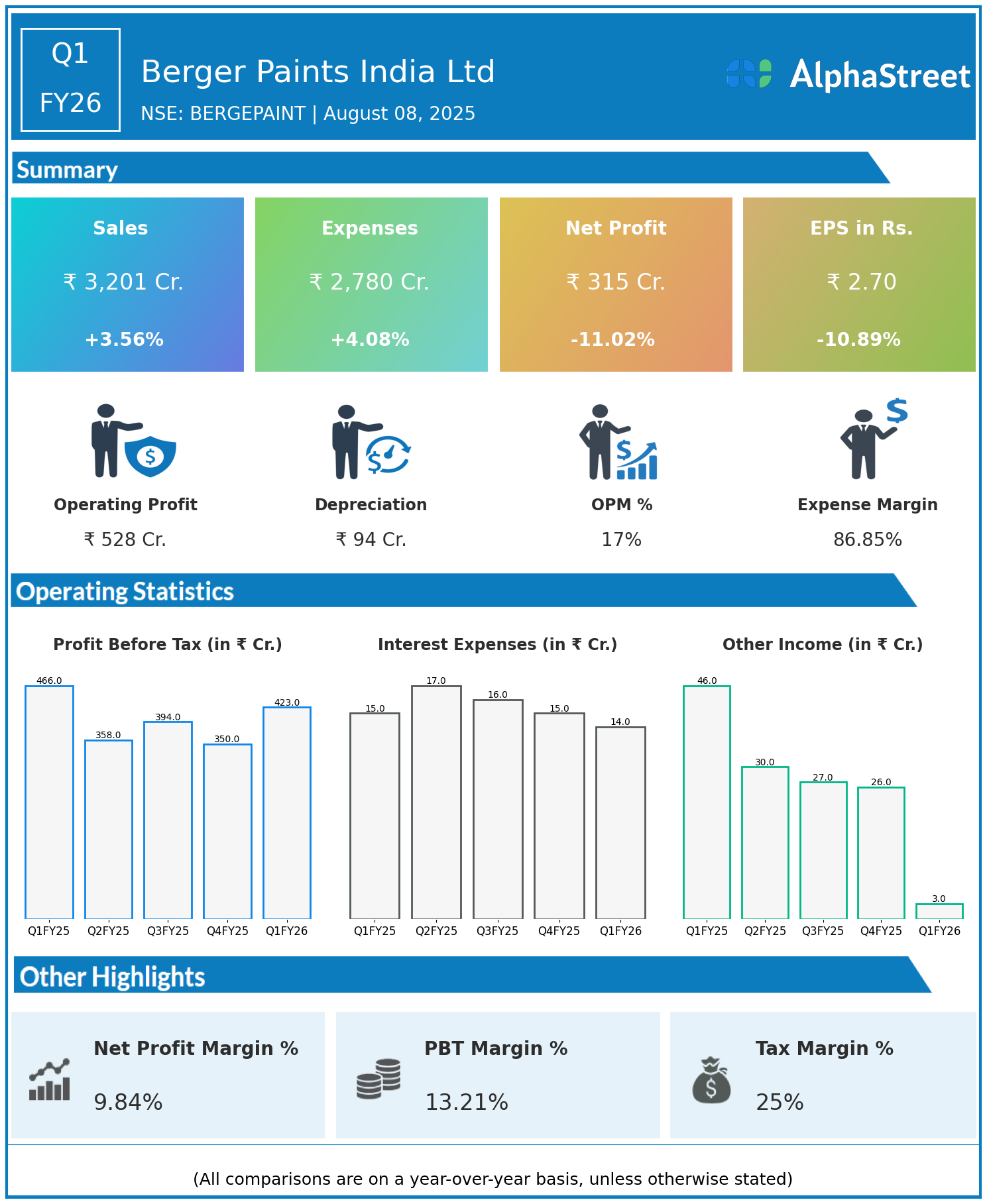

Berger Paints India Limited is a leading company engaged in the manufacturing and selling of paints, serving various sectors with a comprehensive portfolio of decorative and industrial coatings. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹3,201 crore, up 3.56% year-on-year (YoY) from ₹3,091 crore in Q1 FY25.

- Total Expenses: ₹2,780 crore, up 4.08% YoY from ₹2,671 crore.

- Consolidated Net Profit (PAT): ₹315 crore, down 11.02% from ₹354 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹2.70, down 10.89% from ₹3.03 YoY.

Operational & Strategic Update

- Moderate Revenue Growth: Revenue showed a modest increase, reflecting steady demand across its paint segments, supported by ongoing consumer and industrial demand in a competitive market environment.

- Rising Expenses: Total expenses increased at a slightly higher rate than revenues, driven by inflationary pressures on raw materials, supply chain costs, and operational expenditures.

- Profitability Decline: The 11% drop in net profit and EPS highlights margin pressure resulting from cost increases outpacing revenue growth, affecting overall profitability.

- Market & Product Focus: Berger Paints continues to focus on premiumizing its product portfolio, expanding distribution, and enhancing brand engagement to capture market share in both decorative and industrial coatings.

- Strategic Initiatives: The company is working on improving operational efficiencies, optimizing raw material sourcing, and driving innovation to mitigate cost pressures and strengthen margins.

- Industry Environment: The paints sector continues to face raw material cost volatility and competitive pricing dynamics, requiring companies to balance growth with margin management.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 presented a challenging quarter for Berger Paints India Ltd, marked by stable topline growth but declining profitability amid cost pressures. The company’s strategic focus on product innovation, premiumization, and distribution expansion remain crucial to sustain growth.

Looking Ahead

Berger Paints India aims to navigate the cost environment through operational improvements and strategic product mix enhancements. Continued investments in premium products, technological innovation, and market expansion should support margin recovery and long-term value creation through FY26 and beyond.

To view Berger Paints India ‘s previous results: Click Here