Bombay Dyeing & Manufacturing Company Limited (BDMC), part of the Wadia Group, is one of India’s oldest conglomerates with operations in Real Estate Development, Polyester Staple Fibre (PSF), and Retail (Textiles). The company continues to play a strategic role in India’s real estate and textile sectors, while leveraging its legacy brand in home furnishings and retail.

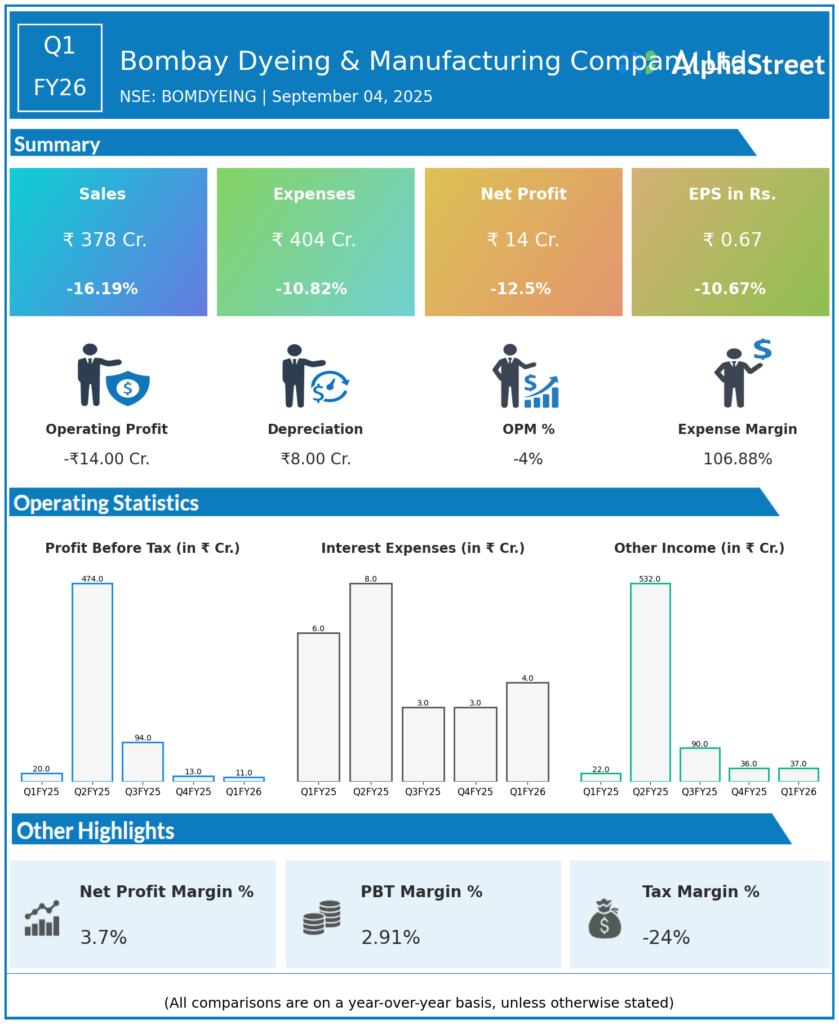

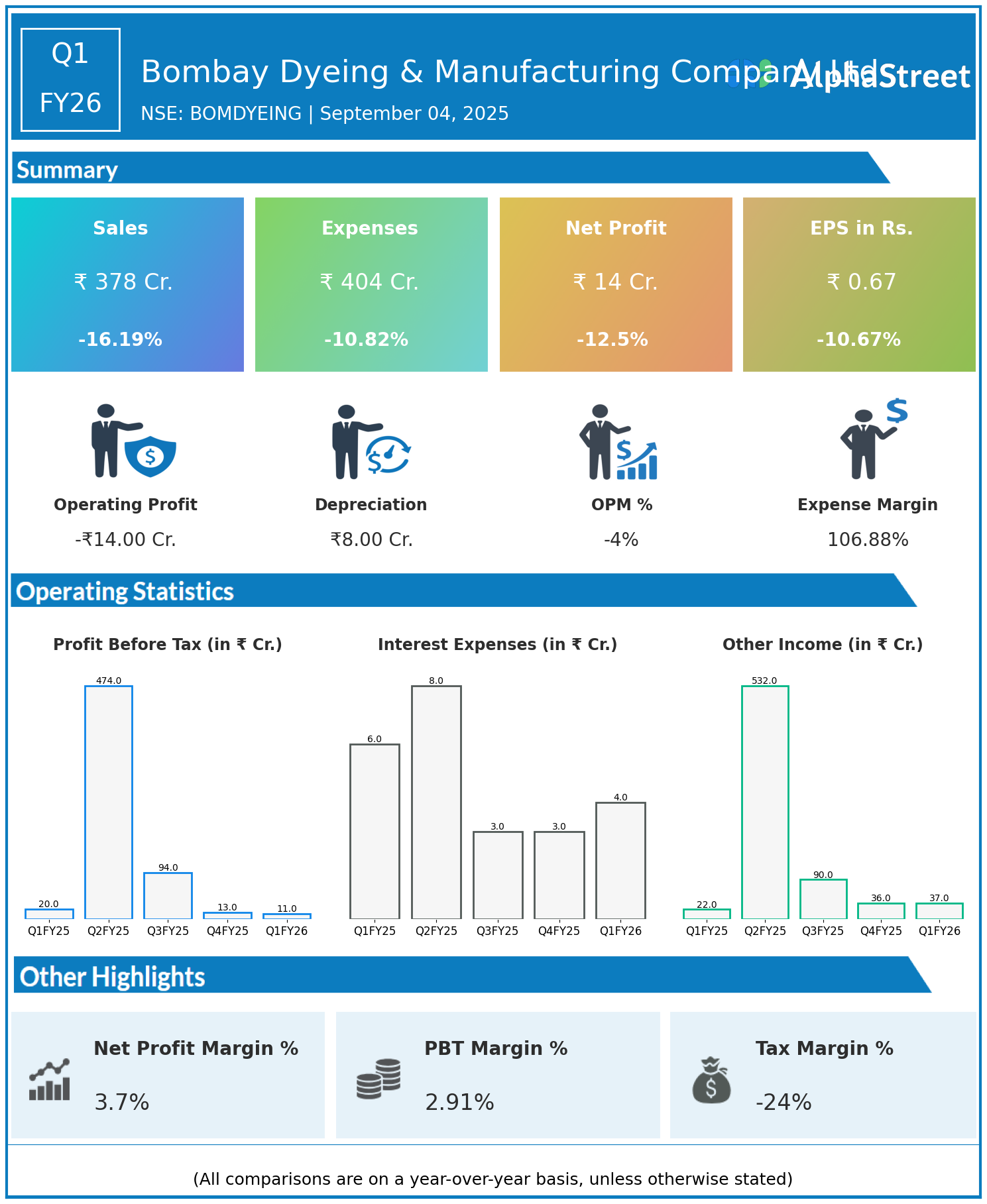

Q1 FY26 Earnings Summary

- Revenue: ₹378 crore, down 16.19% year-on-year (YoY) from ₹451 crore in Q1 FY25.

- Total Expenses: ₹404 crore, down 10.82% YoY from ₹453 crore.

- Consolidated Net Profit (PAT): ₹14 crore, down 12.5% YoY from ₹16 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹0.67, down 10.67% from ₹0.75 YoY.

Operational & Strategic Update

- Revenue Performance: The decline in revenues was primarily due to lower textile and polyester sales, coupled with a cautious demand environment in the core business segments.

- Cost Management: Total expenses moderated compared to last year, reflecting the company’s efforts in cost optimization and operational rationalization.

- Profitability Decline: Despite cost control measures, the fall in revenue weighed on profitability, leading to a 12.5% YoY decline in net profit.

- Segment View:

- Real Estate: Continued focus on monetization of key projects in Mumbai metropolitan region; stable progress on project pipelines.

- Polyester Staple Fibre: Faced margin pressures from volatile raw material prices and subdued demand.

- Retail (Textiles): Consumer discretionary weakness and competitive pressures impacted sales, though Bombay Dyeing continues to leverage its heritage brand positioning.

- Strategic Initiatives: Ongoing efforts to scale the real estate vertical as the primary growth driver while rationalizing non-core operations.

Corporate Developments

Bombay Dyeing’s Q1 FY26 results highlight a challenging macro environment for both textile and polyester segments, impacting top-line performance. However, the continued focus on real estate development, cost discipline, and capital efficiency provides the company with opportunities to pivot towards higher-margin growth.

Looking Ahead

The company aims to accelerate its real estate development projects to drive revenue growth, while also streamlining its polyester and textile segments to improve profitability. Strategic monetization of assets, reduction of debt, and maintaining a sharper focus on the real estate business are expected to be the key growth enablers in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.