BASF India Limited is a diversified chemical company with a portfolio spanning six key segments: Agricultural Solutions, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care, and Chemicals. The company serves a wide range of industries, providing innovative solutions that contribute to sustainable and efficient business practices across sectors.

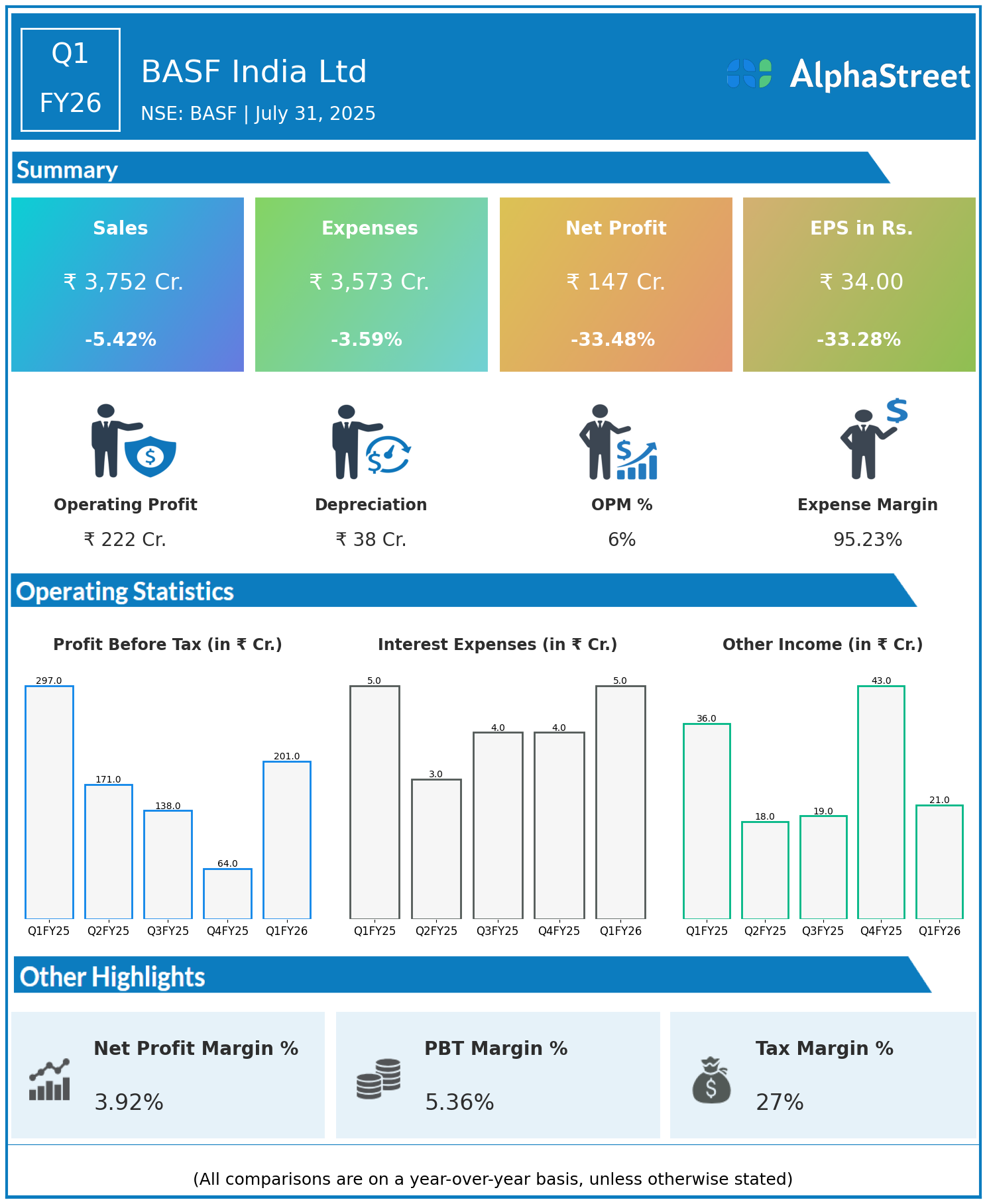

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹3,752 crore, down 5.42% year-on-year (YoY) from ₹3,967 crore in Q1 FY25.

- Total Expenses: ₹3,573 crore, down 3.59% YoY from ₹3,706 crore.

- Consolidated Net Profit (PAT): ₹147 crore, down 33.48% from ₹221 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹34.00, down 33.28% from ₹50.96 YoY.

Operational & Strategic Update

- Revenue Decline: The decrease in revenue was mainly due to softer demand and pricing pressures across some segments amidst global economic uncertainties and input cost volatility.

- Expense Reduction: Total expenses declined but at a slower rate than revenue, reflecting ongoing cost management efforts albeit with some fixed cost absorption challenges.

- Profitability Impact: Net profit and EPS fell sharply, indicating margin contraction driven by weaker sales volumes, pricing pressures, and inflationary costs in certain segments.

- Segment Performance: Agricultural Solutions and Surface Technologies faced headwinds, while Materials and Nutrition & Care segments maintained relatively stable performance.

- Innovation & Sustainability: BASF India continues to invest in product innovation, sustainable technologies, and localized solutions aimed at enhancing customer value and reducing environmental impact.

- Market Position: Despite current challenges, BASF remains a trusted partner to diverse industries through its broad applications portfolio and technical expertise.

Corporate Developments

Q1 FY26 posed profitability challenges for BASF India, reflecting both macroeconomic headwinds and sectoral softness. The company is focused on strengthening operational efficiencies, optimizing its portfolio, and driving growth in high-potential segments to regain momentum.

Looking Ahead

BASF India Ltd is positioned to navigate the evolving business environment by leveraging its innovation-driven approach, cost discipline, and strategic segment focus. Recovery in demand prospects, coupled with sustainability initiatives and advanced solutions, is expected to support improved financial performance in FY26 and beyond.