Bannari Amman Sugars Limited is one of India’s leading sugar manufacturers with operations including three sugar factories with cogeneration plants in Tamil Nadu, two sugar factories with cogeneration plants in Karnataka, two distillery units (one in each state), a granite processing unit in Tamil Nadu, and windmills located in southern Tamil Nadu. Presenting below are its Q1 FY26 Earnings Results.

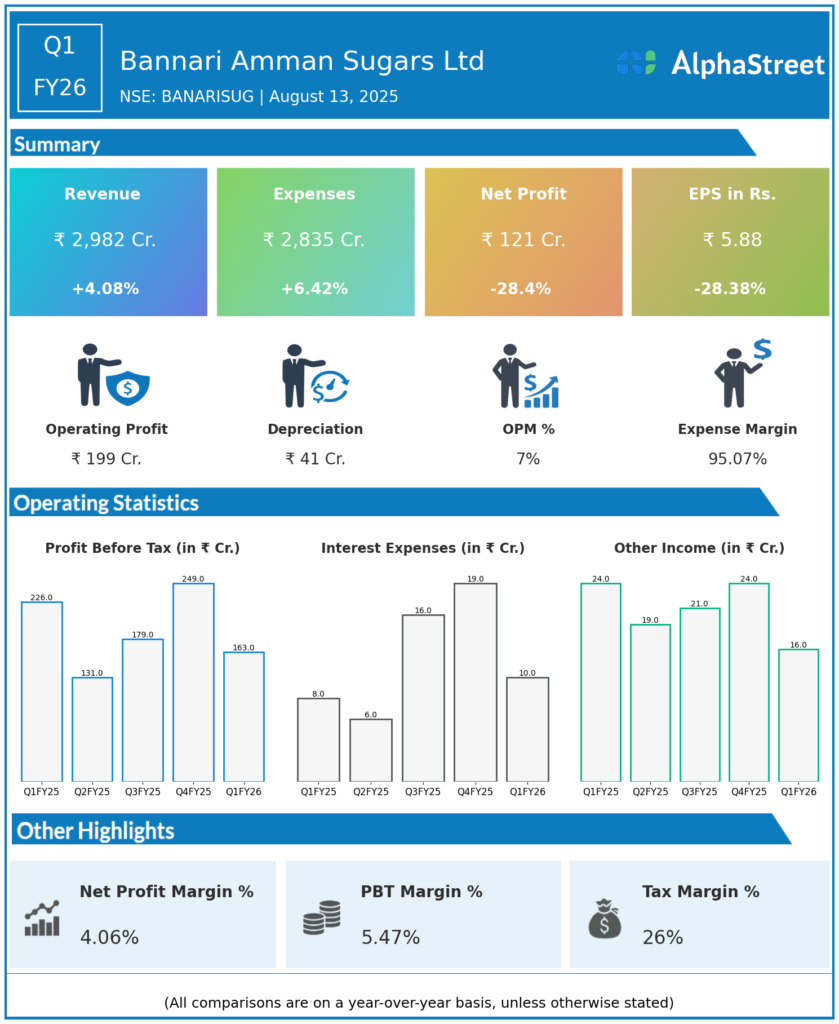

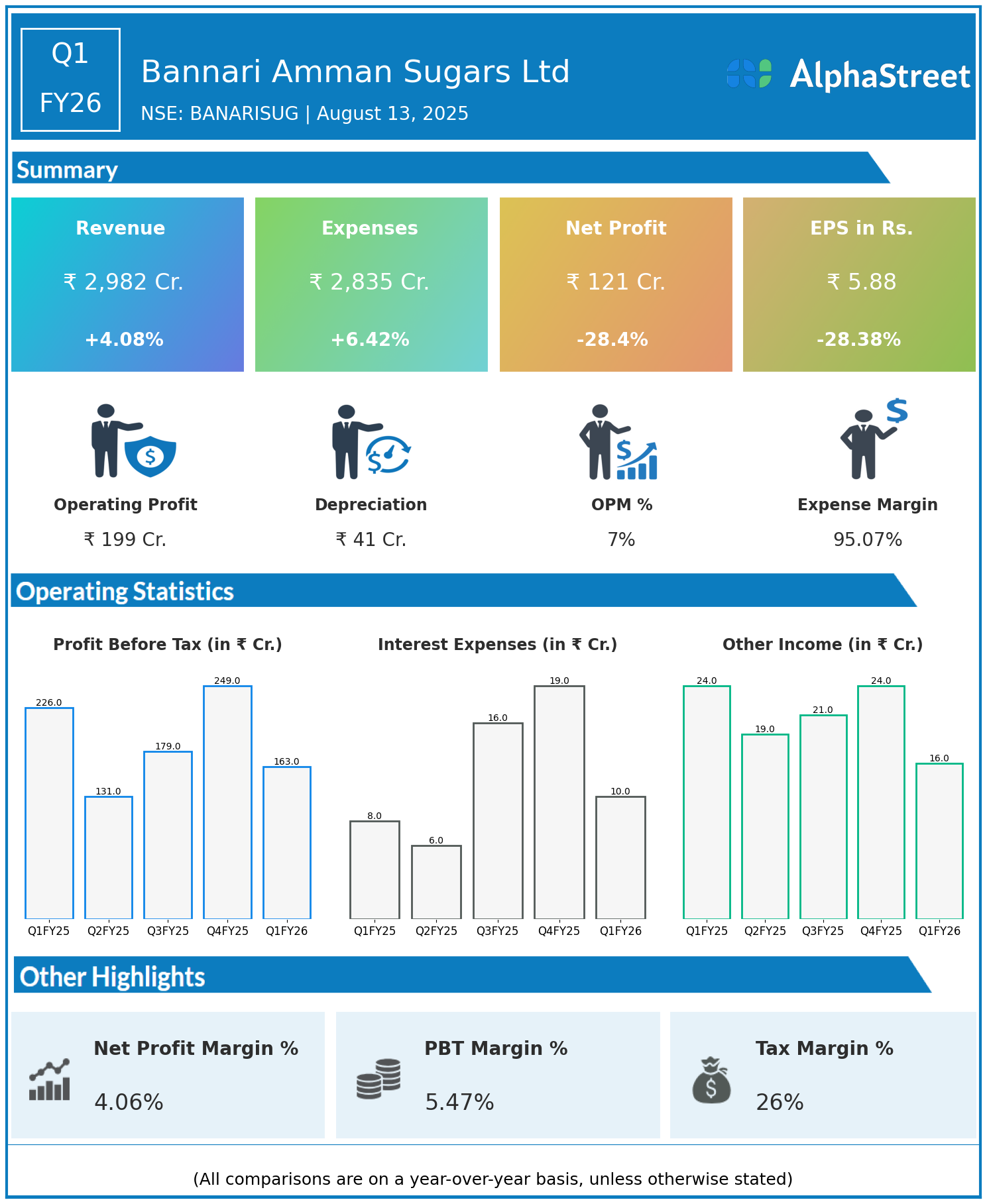

Q1 FY26 Earnings Results

- Revenue: ₹2,982 crore, up 4.08% year-on-year (YoY) from ₹2,865 crore in Q1 FY25.

- Total Expenses: ₹2,835 crore, up 6.42% YoY from ₹2,664 crore.

- Consolidated Net Profit (PAT): ₹121 crore, down 28.40% from ₹169 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹5.88, down 28.38% from ₹8.21 YoY.

Operational & Strategic Update

- Steady Revenue Growth: Revenues increased by 4.08%, supported by steady production and sales volumes across sugar and allied business segments.

- Rising Expenses: Expenses grew faster than revenue due to higher input costs, operational expenditures, and possible inflationary pressures, leading to margin compression.

- Profitability Decline: Net profit and EPS declined significantly by over 28%, reflecting margin pressure from rising costs despite stable topline growth.

- Diversified Operations: Bannari Amman Sugars leverages vertical integration with sugar production, cogeneration, distilleries, granite processing, and renewable wind power to diversify revenue streams.

- Strategic Focus: The company is focused on improving operational efficiencies, cost controls, and enhancing value-added product offerings to navigate challenging market conditions.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results signal a challenging quarter for Bannari Amman Sugars Limited with a notable profit decline despite revenue growth. The company’s integrated operations and sustainable energy initiatives provide resilience, but enhancing cost management and margin recovery remain priority areas.

Looking Ahead

Bannari Amman Sugars Ltd aims to drive improved profitability through cost optimization, capacity utilization, and leveraging its diversified business portfolio. Continued focus on innovation, efficiency enhancements, and renewable energy growth is expected to support comeback in earnings and shareholder value creation through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.