Bandhan Bank Ltd (BANDHANBK.NS) is a mid-sized Indian private lender with a retail-focused balance sheet and significant exposure to microfinance and unsecured lending, primarily in Eastern India.

Market Reaction

Shares of Bandhan Bank Ltd rose about 3.4% to ₹142.65 on Thursday after the bank reported its December-quarter results. The stock remains well below its 52-week high near ₹192 and above its 52-week low around ₹128. Over the past 12 months, the shares have trended lower, underperforming the broader private banking index amid recurring earnings pressure.

Bandhan Bank’s market capitalization stands at roughly ₹230 billion, reflecting discounted valuations relative to larger private-sector peers.

Financial Performance

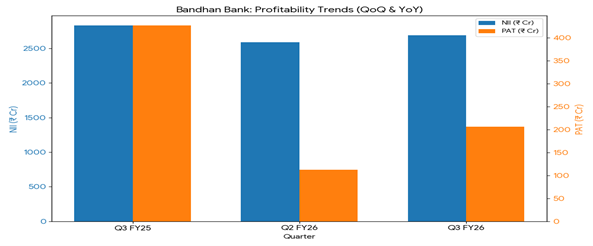

For the quarter ended Dec. 31, 2025, Bandhan Bank reported net profit of ₹2.06 billion, down 51.7% year over year, as lower income and elevated credit costs weighed on results. Total revenue declined about 13.9% year over year to ₹33.8 billion, while net interest income fell roughly 4.5% to ₹26.9 billion. Operating profit fell 28.5% year over year to ₹14.5 billion.

On a sequential basis, profit rose sharply from the September quarter, supported by lower provisioning and modest improvement in core operations. The contrast between sequential recovery and weak annual comparisons underscored the uneven earnings profile through FY2026.

Balance Sheet, Loan Portfolio, & Deposits

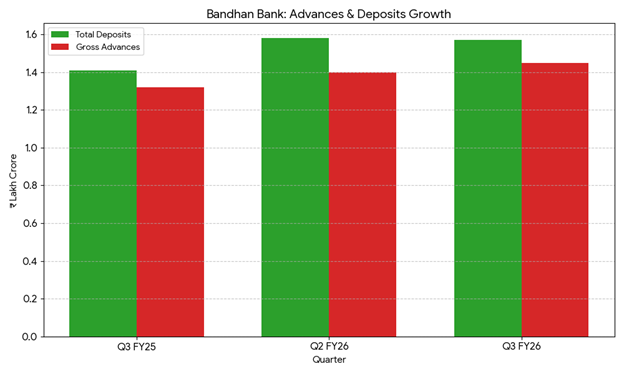

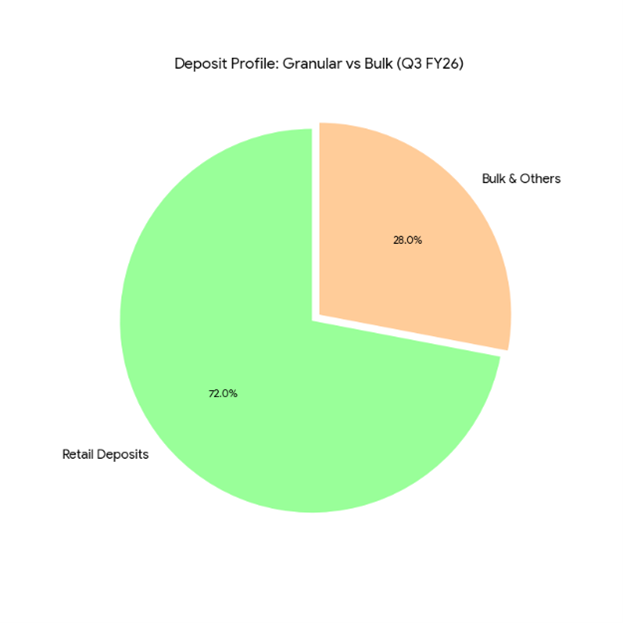

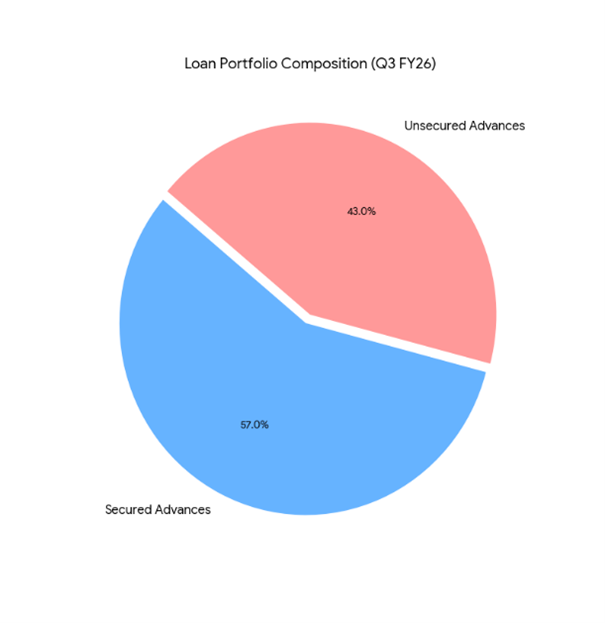

Gross advances rose to ₹1,452.2 billion, up 10% year over year and 3.7% quarter over quarter. The secured loan portion accounted for 56.7% of total advances, providing stability and risk mitigation. The non-EEB book stood at ₹951.5 billion, growing 25.4% year over year. Total deposits reached ₹1,567.2 billion, up 11.2% year over year, with retail deposits at ₹1,134.2 billion, representing 72% of total deposits. The CASA ratio declined slightly to 27.3%, reflecting persistent funding pressure.

Bandhan Bank’s loan portfolio is diversified across segments, with EEB (Emerging Entrepreneurs & Business) loans totaling ₹500.8 billion, representing 34.5% of the total book. Housing and retail loans accounted for ₹475.1 billion (32.7%), while wholesale banking contributed ₹456.3 billion (31.4%).

Asset Quality & Credit Costs

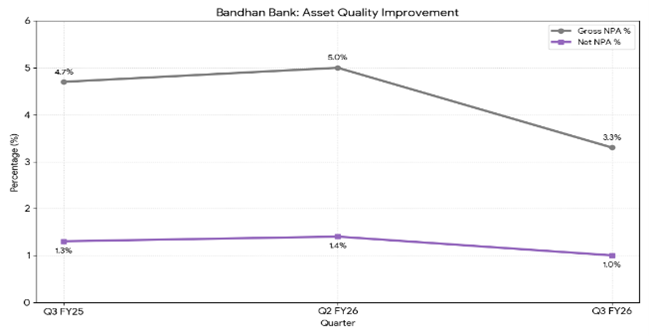

Gross NPA ratio improved to 3.3%, down 136 basis points year over year, while net NPA fell to 1.0%, easing 29 basis points YoY. Provision coverage ratio (PCR) stood at 70.8%, including standard and SR provisions, providing a substantial buffer against stressed assets. Credit costs declined to 3.3%, improving 85 basis points YoY. Sequential improvements in asset quality were observed across microfinance and retail portfolios.

Strategic Metrics

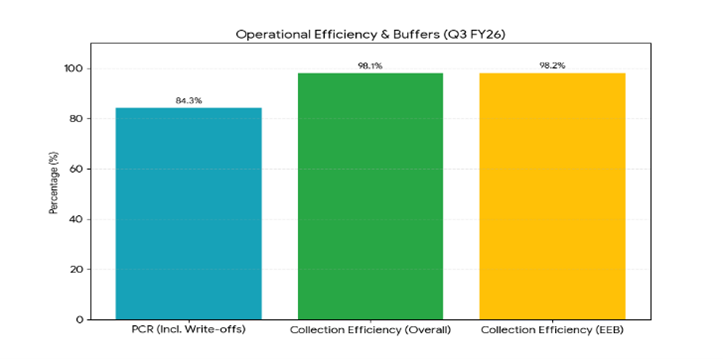

Bandhan Bank’s strategic metrics reinforce disciplined risk management:

- Secured loans: 57% – indicating lower-risk, more stable lending

- Retail deposits: 72% – reflecting a strong, granular funding base

- Provision coverage ratio (PCR): 84.3% – providing a high buffer against bad loans

- Collection efficiency: 98.1% – showing strong credit discipline

Year-to-date Context

For the first nine months of FY2026, the bank reported low double-digit growth in loans and deposits, while profitability declined sharply year over year due to elevated provisioning earlier in the fiscal year. Return ratios remained subdued, despite signs of stabilization in the December quarter. Net interest margin stood at 5.9%, slightly higher sequentially but down year over year.

Sector & Competitive Backdrop

India’s banking sector continues to face margin pressure from intense deposit competition, alongside cautious credit demand and elevated operating costs. Compared with larger private lenders such as HDFC Bank and ICICI Bank, Bandhan Bank continues to lag on profitability and funding strength. Its higher exposure to microfinance lending provides yield support but also increases earnings volatility.

Bottom Line

The December-quarter results showed sequential stabilization but weak year-over-year performance. Asset quality trends improved, strategic metrics point to disciplined risk management, and the loan portfolio mix remains diversified, but margins and funding remain constraints amid sector-wide pressure on spreads and credit costs.