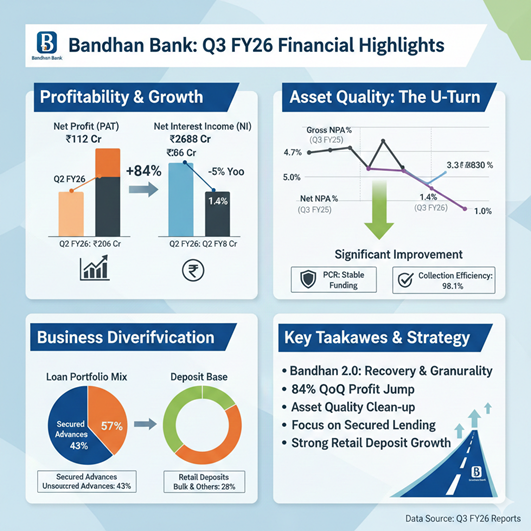

Bandhan Bank Ltd (BANDHANBK.NS), a mid-sized private-sector lender, delivered strategic progress in Q3 FY26, signaling a steady recovery despite sector-wide interest-rate pressures. Management reaffirmed the “Bandhan 2.0” agenda, producing a 84% sequential jump in Net Profit, which rose to ₹206 crore from ₹112 crore in the previous quarter.

Management Commentary & Strategic Direction

Senior leadership, led by MD & CEO Partha Pratim Sengupta, highlighted a continued shift toward secured lending and granular growth. “The third quarter performance reflects strengthening fundamentals and a steady turnaround,” Sengupta noted. The bank is prioritizing risk mitigation and funding optimization to navigate the competitive private banking environment.

Customer Metrics & Product Updates

The bank’s total customer base has expanded to 32.5 million, with a strong retail footprint across India. Strategic diversification is evident in the loan book: Secured loans now account for 57% of total advances, a deliberate move to reduce the historical reliance on unsecured microfinance (EEB).

Technologically, the bank is accelerating its “Digital Push.” In Q3, enhancements to the mBandhan mobile platform and new corporate cash management solutions (Payable and Next Gen Solutions) were rolled out. Currently, 92% of new savings accounts are opened digitally, significantly improving operational turnaround times.

Funding & Interest Rate Environment

Despite a competitive deposit landscape, Bandhan Bank reported a Net Interest Income (NII) of ₹2,688 crore, representing a 3.8% sequential growth. The Net Interest Margin (NIM) showed a modest improvement to 5.9% (up from 5.8% in Q2), aided by a better asset mix and a focus on low-cost retail deposits.

Asset Quality & Risk Metrics

Asset quality remained a focal point of the “Bandhan 2.0” consolidation.

- Gross NPA: 3.3%

- Net NPA: 1.0%

- Provision Coverage Ratio (PCR): 84.3% (including technical write-offs).

- Collection Efficiency: Improved to 98.1% overall, with the microfinance (EEB) segment climbing to 98.2%.

Geographical Expansion & Competitive Positioning

Bandhan operates over 6,350 banking outlets across 35 states and UTs. While it maintains a dominant “East and North-East” stronghold, the bank is expanding its “Non-East” footprint to diversify geographic risk. While larger peers like HDFC and ICICI Bank possess greater pricing power, Bandhan’s competitive edge remains its deep-rooted microfinance heritage and a growing retail-to-total deposit ratio, which reached 72.37% this quarter.

Key Q3 FY26 Performance Data

| Metric | Q3 FY26 Value | Quarter-on-Quarter (QoQ) |

| Net Profit (PAT) | ₹206 Cr | +84% |

| Net Interest Margin (NIM) | 5.9% | +10 bps |

| Secured Loan Share | 57% | Increasing |

| Retail Deposit Ratio | 72.37% | Increasing |

| Collection Efficiency | 98.1% | Stable/Improving |

Summary

Q3 FY26 highlights Bandhan Bank’s successful transition toward a diversified, secured-lending model. With loans and advances growing 10% YoY to ₹1.45 lakh crore and a significant recovery in profitability, the bank is effectively leveraging digital transformation and disciplined credit management to position itself for sustainable, inclusive growth.