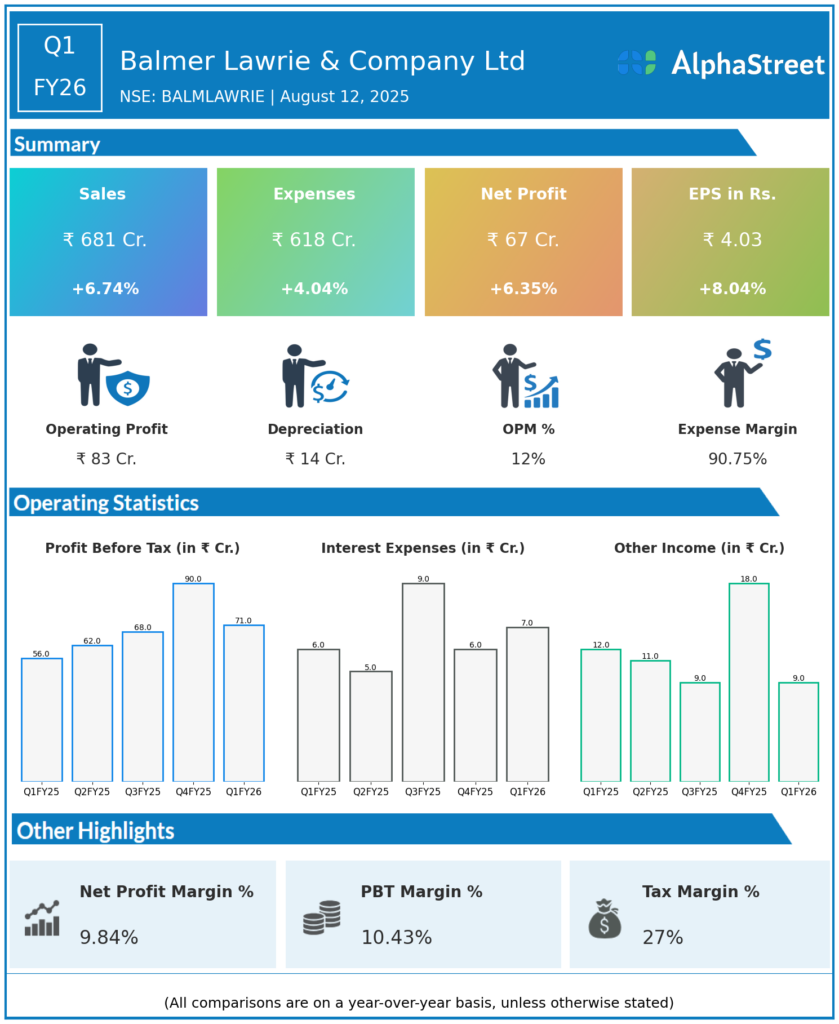

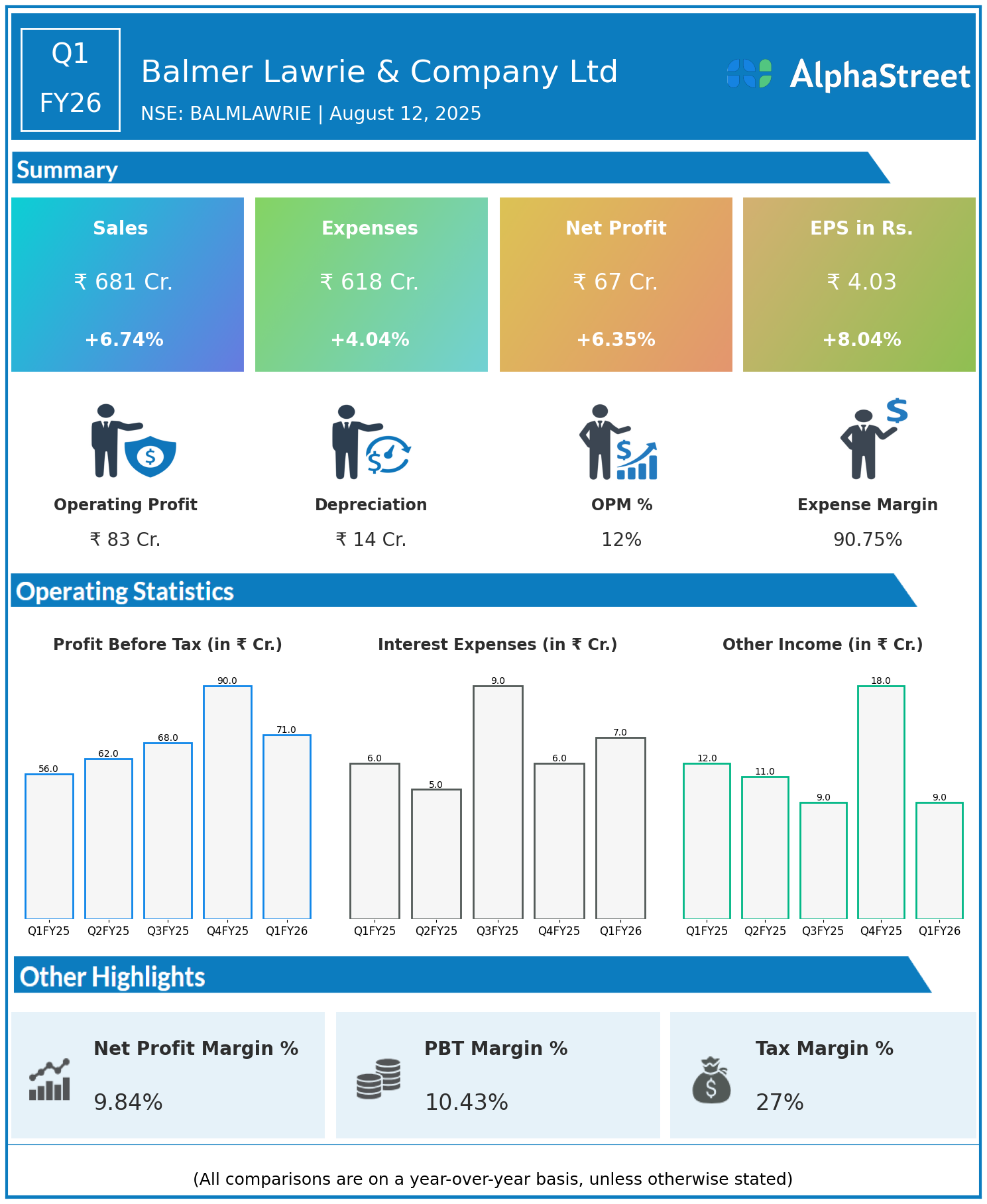

Balmer Lawrie & Company Limited is engaged in the business of industrial packaging, greases and lubricants, leather chemicals, logistics services and infrastructure, refinery and oil field services, and travel and vacation services in India. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹681 crore, up 6.74% year-on-year (YoY) from ₹638 crore in Q1 FY25.

- Total Expenses: ₹618 crore, up 4.04% YoY from ₹594 crore.

- Consolidated Net Profit (PAT): ₹67 crore, up 6.35% from ₹63 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹4.03, up 8.04% from ₹3.73 YoY.

Operational & Strategic Update

- Consistent Revenue Growth: The 7% increase in revenue reflects steady demand across its core segments, including industrial packaging, logistics, and travel services, supported by a diversified portfolio and strong customer relationships.

- Disciplined Cost Management: Total expenses rose at a slower pace than revenue, enabled by operational efficiencies and prudent cost control, which contributed to improved margins.

- Profitability Expansion: Net profit and EPS posted a healthy 6% and 8% increase, respectively, supported by stable operations and effective expense management even amidst market challenges.

- Market & Segment Focus: Balmer Lawrie continues to leverage its legacy in the industrial and logistics segments while expanding its footprint in travel and vacation services, aligning with evolving market demands.

- Strategic Initiatives: Investments in infrastructure, technology upgrades, and expansion of service offerings remain central to the company’s growth strategy, driving both scale and margin resilience.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 reflects stable performance for Balmer Lawrie & Company Limited, with solid topline growth and resilient profitability. The company’s ability to manage costs effectively and capitalize on its diverse business verticals has reinforced its market position and sustained shareholder value.

Looking Ahead

Balmer Lawrie & Company Ltd is optimistic about future growth opportunities in industrial and logistics solutions, chemicals, and travel services. The company’s focus on innovation, operational excellence, and strategic expansion is expected to support continued profitability and drive value creation through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.