Stock Data:

| Ticker | NSE: BALKRISIND |

| Exchange | NSE |

| Industry | TYRE |

Price Performance:

| Last 5 Days | +1.19% |

| YTD | +12.69% |

| Last 12 Months | +12.47% |

Company Description:

Balkrishna Industries Ltd is one of the leading manufacturers of over-the-highway (OTR) tires. The company specializes in producing tires for various applications, including agricultural, construction, and industrial vehicles, as well as earthmoving, port, mining, ATV, and gardening equipment. With a global presence in Europe, the United States, and India, BKT has established itself as a key player in the industry. The company’s extensive distribution network enables it to sell its products in 160 countries. BKT operates three manufacturing plants in India, located in Aurangabad, Bhuj, Bhiwadi, and Chopanki, with an additional molding plant near Mumbai.

Critical Success Factors:

- Strong Global Presence: BKT’s global footprint and widespread distribution network contribute to its market dominance. With approximately 50% of its sales coming from European markets, and 18% and 21% from the US and India, respectively, BKT has established a strong foothold in these regions. This diversification helps the company mitigate risks associated with regional economic fluctuations.

- Diversified Product Portfolio: The company offers a wide range of tires catering to diverse applications. The company’s product portfolio covers agriculture, construction, industrial, and specialty vehicles. This diversification helps BKT capture opportunities in multiple sectors and reduces its reliance on a single market segment.

- Cost Efficiency and Competitive Advantage: BKT maintains a low-cost production model, giving it a competitive edge in the market. By optimizing its manufacturing processes and raw material sourcing, the company achieves favorable margins compared to its domestic counterparts. This cost efficiency enhances BKT’s profitability and allows it to offer competitive pricing to customers.

- Resilient Business Model: The company has built a resilient business model that positions it as a strong global player. The company aims to expand its market share from the current 5% to 10% globally in the next 4-5 years. BKT plans to achieve this through new product launches, expansion into new geographies, and further investment in production capacity. Its self-reliance in carbon black and strategic sourcing arrangements for other raw materials contribute to its operational stability and margin sustainability.

Key Challenges:

- European Market De-stocking: BKT is currently facing near-term concerns in the European market due to de-stocking and higher channel inventory. The company expects this de-stocking to continue until June-July 2023. While the management anticipates a recovery in the European market in the second half of FY24, prolonged de-stocking can impact BKT’s sales and profitability.

- Macroeconomic and Forex Risks: BKT’s export-oriented business model exposes it to macroeconomic risks in overseas markets. Any adverse movements in the macro environment, such as economic downturns or changes in trade policies, can impact the company’s financial performance. Additionally, currency fluctuations, particularly forex risks, can affect BKT’s revenues and profitability.

- Competition and Pricing Pressure: Although BKT has successfully reduced the pricing gap between its products and key players in overseas markets, it continues to face competition from other international tire manufacturers. Intensified competition or pricing pressures could impact BKT’s market share and pricing power. Continuous efforts to innovate and offer differentiated products will be crucial to maintain a competitive edge.

Financial Performance:

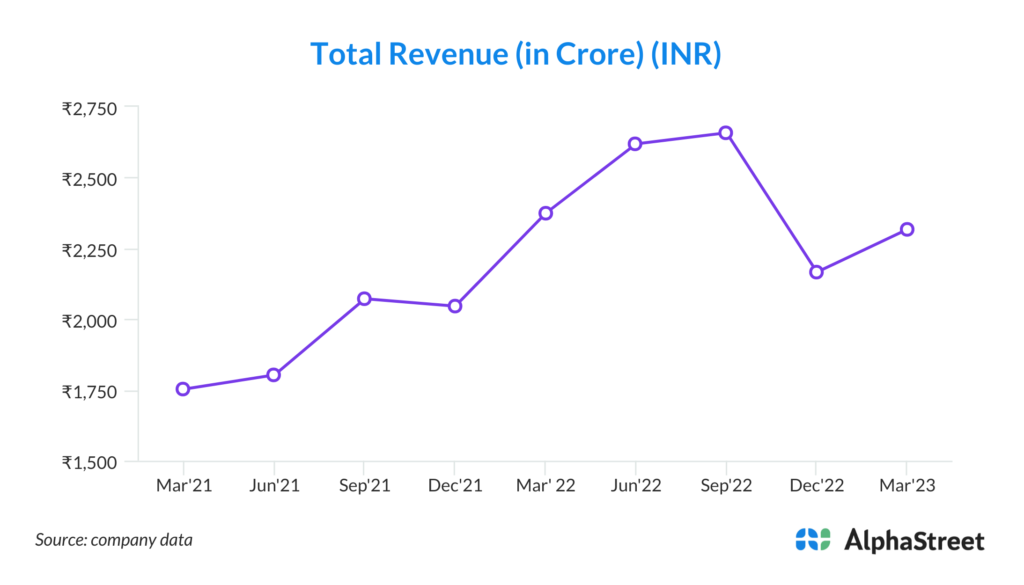

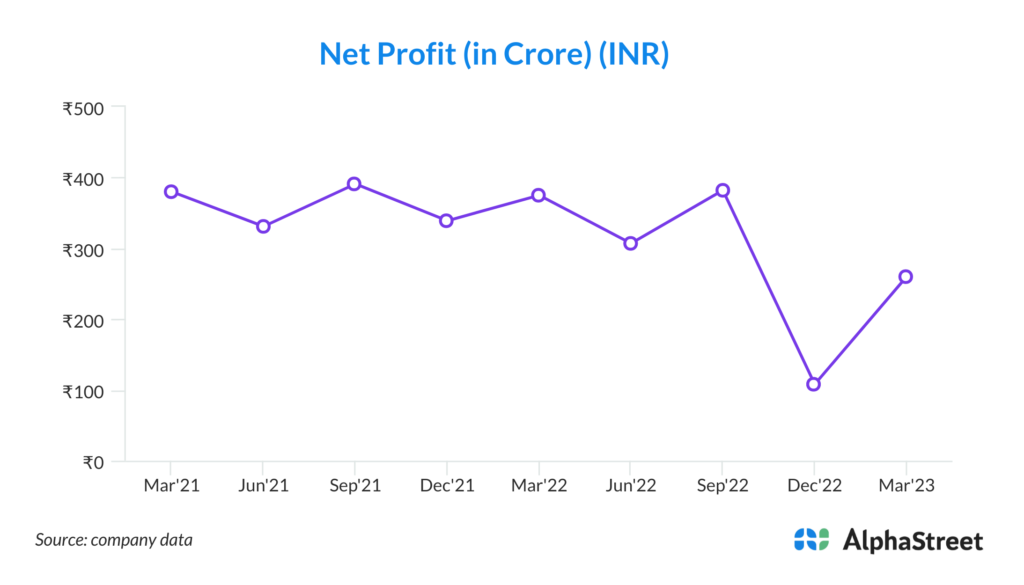

In Q4FY23, BKT reported strong financial results, surpassing estimates. Revenues increased by 8.2% quarter-on-quarter to Rs. 2318 crore, driven by a 9.3% q-o-q increase in volumes. The company’s EBITDA margins expanded significantly to 20.3%, exceeding expectations. This margin expansion was primarily due to the correction in raw material costs and a contraction in freight rates. BKT recorded a forex gain of Rs. 27 crore in the quarter, further strengthening its financial position. As of the end of FY23, BKT had cash reserves of Rs. 2000 crore and net debt of Rs. 1200 crore.

Conclusion:

Balkrishna Industries Ltd has a strong global presence and a diversified product portfolio. BKT’s cost efficiency, competitive advantage, and resilient business model position it well for future growth. However, the company faces risks related to European market de-stocking, macroeconomic and forex risks, as well as competition and pricing pressure. Investors should closely monitor the recovery of the European market, as it plays a significant role in BKT’s overall performance. BKT’s strong financial position, with healthy cash reserves and manageable debt levels, provides a solid foundation for future investment and growth opportunities.