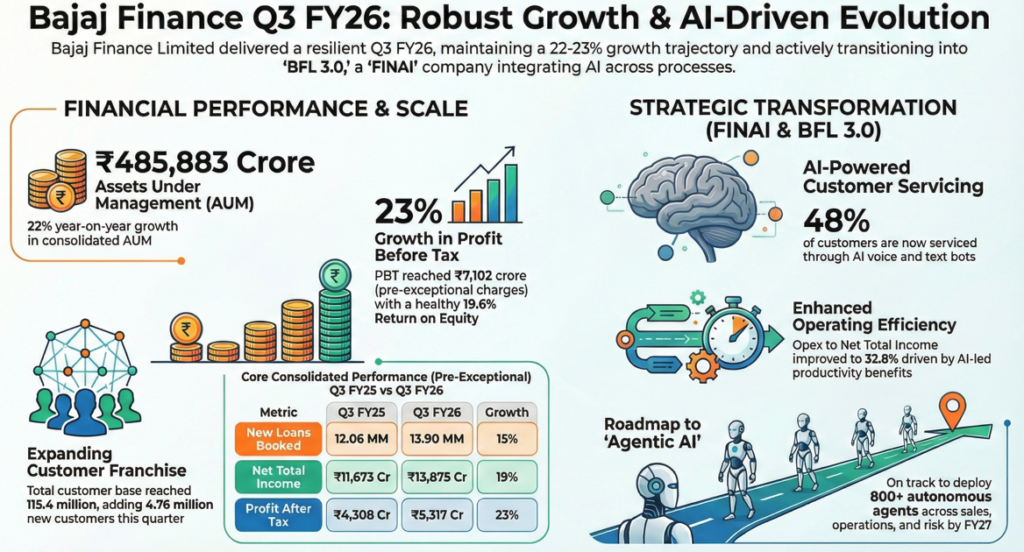

Bajaj Finance Limited (NSE:BAJAJFINSV), a leading Indian non-banking financial company (NBFC) with a deposit-taking license, focused on the mass and affluent customer segments, reported a 23% increase in consolidated core profit before tax to ₹7,102 crore for the third quarter ended December 31, 2025, driven by robust loan disbursements and a rapidly expanding customer franchise.

Key Financial Metrics: Q3 & 9M FY26

The company’s core performance remained strong across all lead indicators.

- Assets Under Management (AUM) grew by 22% to ₹485,883 crore.

- Quarterly Results (Normalized):

- Profit After Tax (PAT) rose 23% to ₹5,317 crore.

- Net Interest Income (NII) climbed 21% to ₹11,317 crore.

Nine-Month (9M) Performance

- Normalized PAT stood at ₹15,030 crore, representing 23% growth year-on-year.

- Adjustments: BFL took an accelerated ECL provision of ₹1,406 crore to enhance balance sheet resilience and a one-time ₹265 crore charge related to New Labour Codes.

Operational & Business Highlights

- BFL booked 13.90 million new loans in Q3, a 15% increase over the previous year.

- Customer franchise reached 115.40 million, with 4.76 million new customers added in the quarter alone.

- Company’s digital push, titled “FINAI,” saw significant traction, including 20.7 million voice-to-text conversions for customer interactions.

Industry Metrics & Asset Quality

- Maintained a strong Capital Adequacy Ratio of 21.45%.

- Asset quality remained stable with Gross NPA at 1.21% and Net NPA at 0.47%.

- Annualized cost of funds improved by 7 basis points over the previous quarter to 7.45%.

Management Commentary

Management described the core performance as “robust across volume, AUM, opex, credit cost, and profitability”. Regarding future credit costs, the leadership expressed optimism for FY27, citing significantly improved vintage credit performance.

Geographic Presence & Target Customers

BFL’s footprint extends to 4,052 locations with over 241,000 active distribution points across India. The company targets urban and rural B2C consumers, MSMEs, and mid-market corporates, leveraging a unique “hub and spoke” model in rural markets.

Major Achievements

- Secured the 5th largest market position in gold loans.

- Contribution to the national credit market includes a 232 basis point share of total credit and a 281 basis point share of retail credit.

- Profit ranking in India has reached 24th.

- Maintains superior creditworthiness, holding AAA/Stable ratings for long-term borrowings and A1+ ratings for short-term programs from major agencies including CRISIL, ICRA, CARE, and India Ratings.

- Within the payments industry, its FASTag franchise is ranked #2.

- Achieved a remarkable 18-year CAGR of 35% for Assets Under Management (AUM) and 48% for Profit After Tax (PAT).

- Distribution network is one of the most extensive in the industry, encompassing 4,052 locations and over 240,700 active distribution points.

- Strategic partnerships have yielded high engagement, such as the Airtel partnership which has over 7 lakh EMI cards in force.

- As of Q3 FY26, the company is on track to disburse 50 million loans annually and cross the ₹5 lakh crore AUM milestone.

Guidance

Under its new long-range strategy (LRS), BFL aims to become the “lowest risk company in India” while acting as a technology leader.

- AUM Growth: Guided corridor of 25%-27%.

- Profitability: Targeted sustainable ROA of 4.3%-4.7% and ROE of 19%-21%.

2030 Vision

The company targets a customer franchise of 200-220 million and 100 million annual loan disbursements by FY30.