Bajaj Electricals Ltd. (BAJAJELEC.NS) reported a decline in revenue and a consolidated net loss for the third quarter ended December 31, 2025, according to unaudited financial results released on Feb 9, 2026.

Financial Highlights

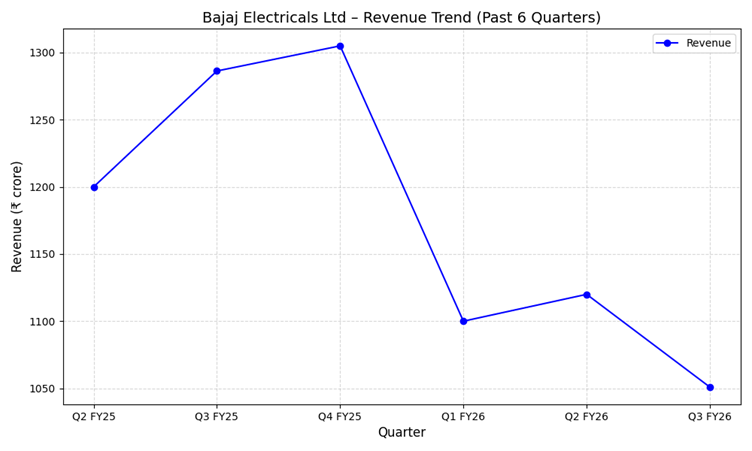

- Revenue from operations: ₹1,050.9 crore, down 18.5% from ₹1,286.3 crore in Q3 FY2025.

- Gross profit: ₹319 crore, a 20.5% decline year-on-year.

- EBIT (Earnings Before Interest and Tax): Loss of ₹8 crore, compared with a profit of ₹64 crore in Q3 FY2025.

- Profit before tax: Loss of ₹25.17 crore versus a profit of ₹45.42 crore in Q3 FY2025.

- Net profit: Loss of ₹34.10 crore, including exceptional items related to labor code implementation and joint venture losses.

- Cash from operations: ₹211 crore.

- Cash and investments on hand: ₹620 crore.

The results reflect contraction in both top-line and operating profitability due to lower sales volumes and increased one-time charges. Staff costs decreased to ₹91 crore from ₹99 crore a year earlier. Finance costs were ₹13 crore, covering interest on vendor financing and lease liabilities.

Segment Performance

- Consumer Products (CP): Revenue declined 25.2% year-on-year. Lower demand and trade channel inventory normalization contributed to the decline. Core products, including fans, lighting appliances, and small electrical goods, recorded weaker sales.

- Lighting Solutions (LS): Revenue increased 9.1% year-on-year. Growth came from premium lighting products and export markets. The segment provided partial offset to losses in the CP division.

- Channels and Exports: General trade sales declined 18%, alternate channels were down 27%, while export revenues recorded double-digit growth.

The company noted that gross margins contracted due to volume decline in high-margin product categories, despite cost optimization measures. Exceptional items totaling ₹34 crore, primarily due to labor code impact and joint venture losses, contributed to the net loss.

Corporate Actions and Balance Sheet

Bajaj Electricals approved the sale of select office properties in Mumbai for ₹26.53 crore as part of non-core asset optimization. The board also approved minimum director remuneration for FY2025‑26 in case of inadequate profits and appointed an additional independent director for a five-year term.

Operating cash flow remained positive, supporting liquidity for ongoing operations. The company continues to focus on cost management and premium product segments to navigate the current demand environment.

Quarterly Trend and Industry Context

The Q3 FY2026 performance follows a trend of earnings pressure observed in earlier quarters, including Q2 FY2026, when consolidated net profit declined due to margin pressures. The results reflect broader demand challenges in the consumer electrical products market and trade channel adjustments. Lighting Solutions continued to show resilience amid softer consumer product sales.