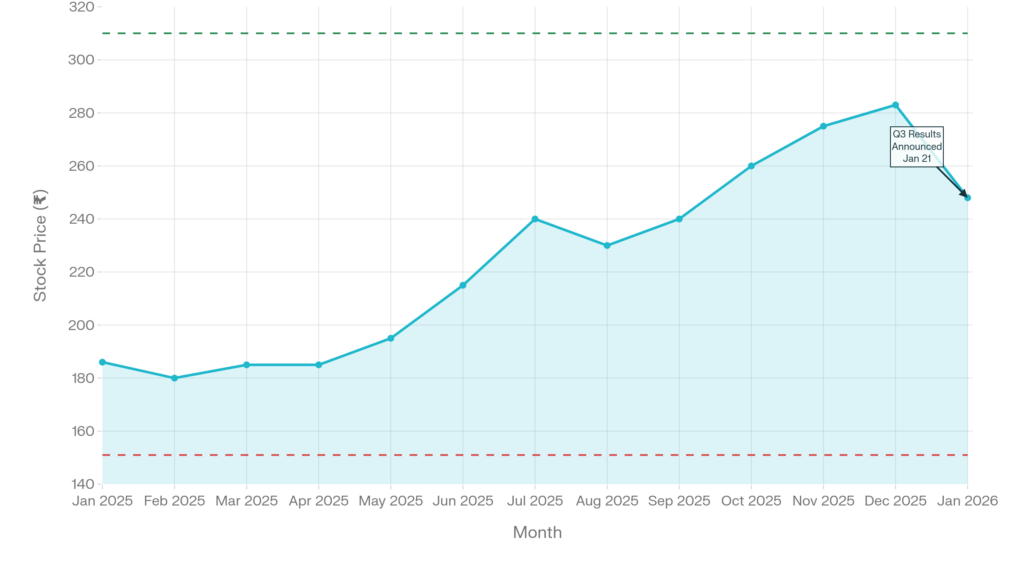

Bajaj Consumer Care Ltd (BAJAJCON), a leading Indian personal care manufacturer, announced consolidated Q3 FY2025-26 results with sharp profit acceleration, yet market sentiment shifted negative as the stock closed down 4.56% at ₹247.45.

Market Capitalization

Bajaj Consumer Care’s market capitalization declined to ₹3,232 crore following the 4.56% sell-off on results day, down from approximately ₹3,646 crore at the start of January 2026. The company’s market cap has fluctuated significantly over the past 12 months, ranging from ₹2,400 crore at the 52-week low to approximately ₹4,000 crore at peak valuations in December 2025.

Latest Quarterly Results

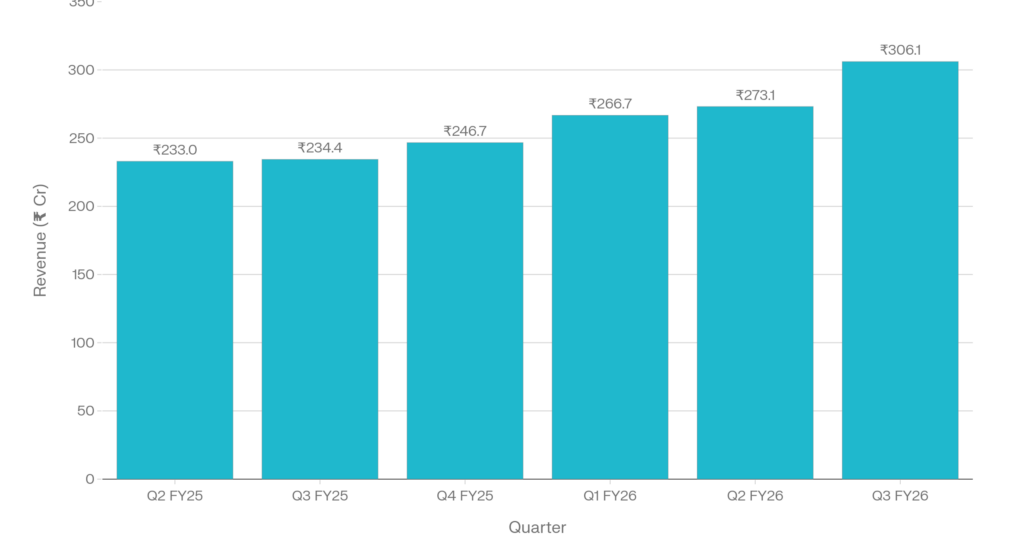

Q3 FY2025-26 delivered record topline performance with revenue from operations reaching ₹306.09 crore, marking the company’s highest quarterly sales ever recorded. The 30.6% year-on-year growth from ₹234.42 crore in Q3 FY25 accelerated significantly above the recent quarterly pace, while quarter-on-quarter growth of 15.1% from Q2’s ₹265.27 crore showed sustained momentum.

Net profit surged 83% to ₹46.37 crore from ₹25.31 crore year-ago, reflecting not only volume gains but substantial margin expansion. Profit before tax reached ₹56.43 crore, up significantly from ₹35.80 crore in Q3 FY25. Basic earnings per share doubled to ₹3.44 from ₹1.98 in the prior-year quarter.

EBITDA performance was particularly striking, nearly doubling to ₹56 crore from ₹28.7 crore year-ago, with EBITDA margin expanding 610 basis points to 18.3% from 12.2%. This margin recovery reflects improved cost structure, pricing discipline, and favourable product mix. Cost of goods sold improved to 40.7% of revenue from 47.0% in Q3 FY25, while advertising and sales promotion increased 36.6% in absolute terms but remained contained at approximately 15.3% of revenue.

Full-Year Results Context

Bajaj Consumer Care’s FY2025 (year ended March 31, 2025) presented a contrasting profile to current momentum. Full-year consolidated revenue declined 1.88% to ₹949.75 crore from ₹967.98 crore in FY2024, marking the first annual contraction in recent years. Net profit fell more sharply, declining 19.41% to ₹125.26 crore from ₹155.43 crore, reflecting both volume pressure and margin compression during the year.

Q4 FY25 revenue of ₹246.73 crore posted modest 5.34% growth, while net profit declined 12.93% to ₹30.98 crore in that quarter. The contrast between FY25’s challenges and FY26’s emerging strength underscores the impact of operational initiatives rolled out through the fiscal year, particularly distribution expansion via Project Aarohan and pricing actions in flagship products.

Financial Trends

Operating performance has accelerated in FY26, with Q3 delivering record revenue of ₹306 crore and margin of 18.3%, reflecting improved volume, pricing, and operational efficiency

Operating performance has accelerated markedly in FY2025-26, with consecutive quarterly improvements demonstrating sustained momentum. Revenue progression from ₹233 crore in Q2 FY25 to ₹306 crore in Q3 FY26 reflects broad-based demand recovery, while EBITDA margin expansion from 12-13% range to 18.3% indicates substantial operational leverage. The company has transitioned from the margin-pressured environment of late FY25 to a period of profitable growth supported by improved pricing realization, mix benefits, and cost discipline.

Stock Price Trend

Business & Operations Update

Bajaj Consumer Care’s operational landscape evolved substantially through FY26 with two key initiatives. Project Aarohan, the company’s distribution expansion program, extended coverage into multiple new states during the year, enhancing rural and semi-urban penetration particularly for the core Almond Drops Hair Oil (ADHO) brand. General Trade channel registered recovery post-monsoon with strong wholesale momentum in urban markets, though rural demand remained subdued through Q1 and early Q2 before improving.

The GST rate reduction announced in September 2025 benefited consumer affordability, and the company passed through benefits to customers, creating tailwinds for Q3 and anticipated Q4 demand. International business faced headwinds from tariffs and geopolitical challenges in GCC and Africa markets, though Nepal and Bangladesh markets grew strongly in mid-teens.

M&A and Strategic Moves

Bajaj Consumer Care completed the full acquisition of Vishal Personal Care Pvt Ltd (parent of the Banjara’s skincare brand) in May 2025, making it a wholly owned subsidiary. The deal, valued at ₹120 crore with an enterprise value of ₹108.3 crore, was executed in two tranches: Tranche 1 (49% stake) closed March 10, 2025 for ₹59.5 crore, while Tranche 2 (51% stake) completed May 16, 2025 for ₹62.1 crore. Vishal Personal Care contributed to Q1 FY26 consolidated revenue with high-single-digit standalone growth in the quarter.

Guidance and Outlook

The company did not issue formal full-year FY26 guidance in its Q3 results announcement. However, management commentary in Q2 FY26 indicated confidence in volume recovery and margin expansion, citing Project Aarohan penetration gains and GST rate benefits supporting H2 demand.

Performance Summary

Operating performance has accelerated in FY26, with Q3 delivering record revenue of ₹306 crore and margin of 18.3%, reflecting improved volume, pricing, and operational efficiency.

Bajaj Consumer Care delivered a defining quarter in Q3 FY26 with record revenue and near-doubling of profit, yet the market’s 4.56% sell-off reflects valuation hesitation after a 56% year-to-date rally. The 83% profit surge and 610 basis point margin expansion demonstrate successful execution of cost management and pricing initiatives, while Project Aarohan and new category traction provide multi-year growth drivers.