Bajaj Auto Limited, the flagship company of the Bajaj Group, is a leading manufacturer of two-wheelers and three-wheelers with exports to 79 countries across Latin America, Southeast Asia, and other key international markets. Headquartered in Pune, India, the company also holds a 48% stake in KTM, a premium sports and super-sports motorcycle manufacturer, up from the initial 14% acquired in 2007. Presenting below are its Q1 FY26 Earnings Results.

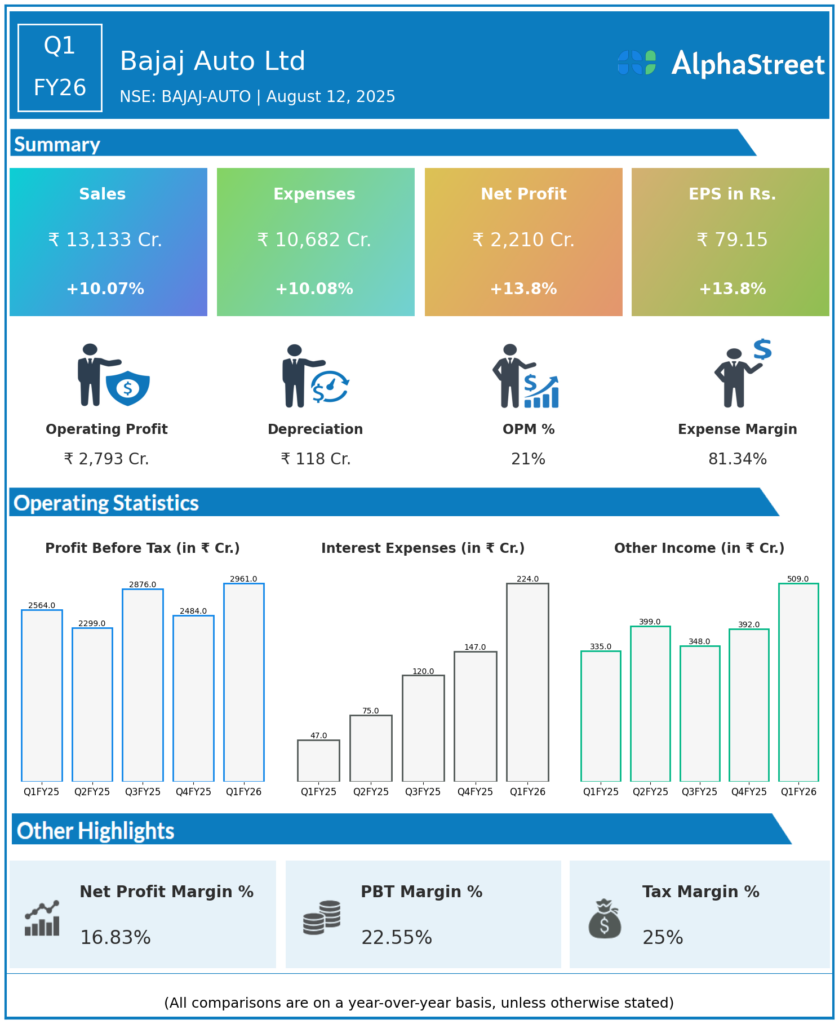

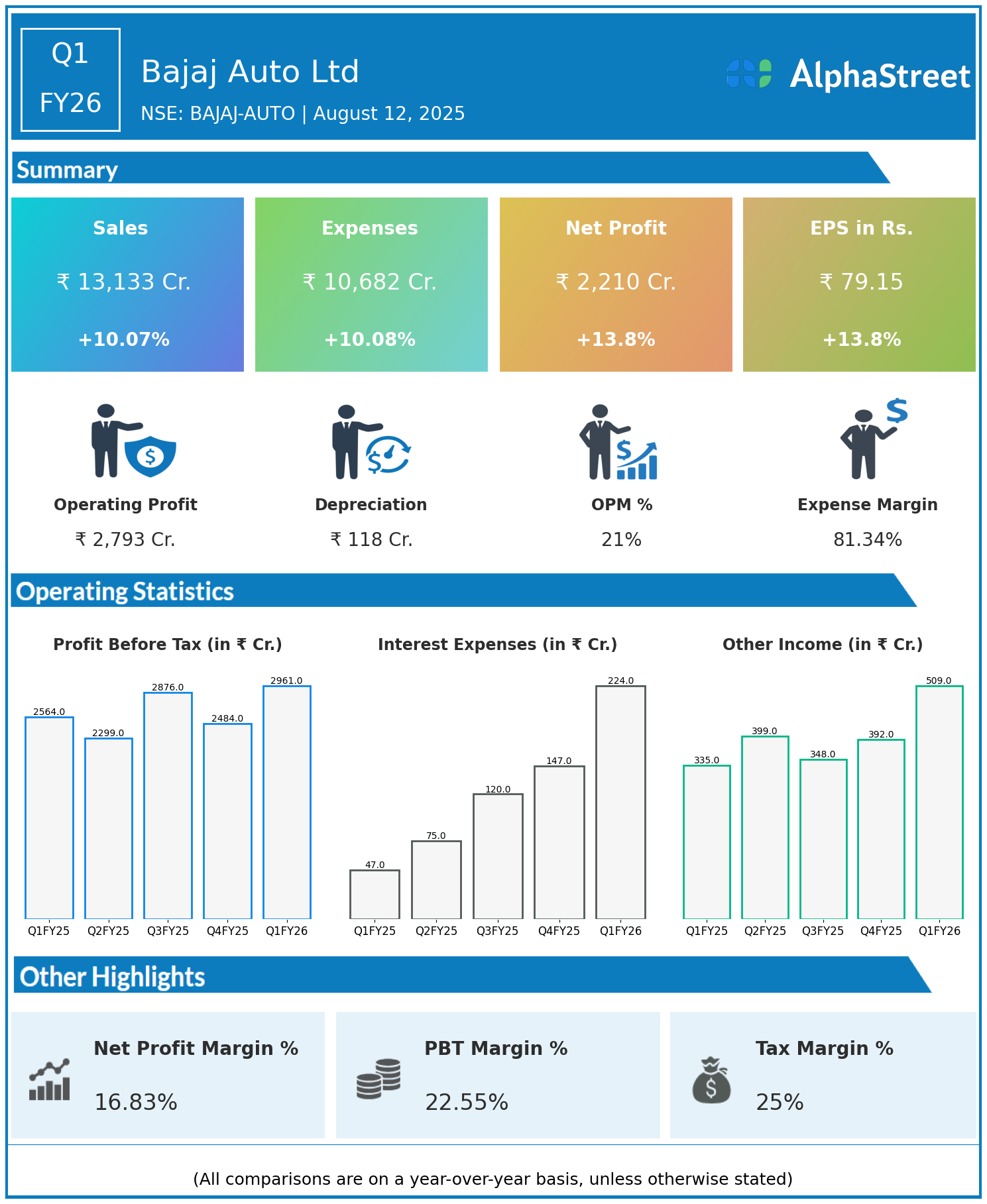

Q1 FY26 Earnings Results

- Revenue: ₹13,133 crore, up 10.07% year-on-year (YoY) from ₹11,932 crore in Q1 FY25.

- Total Expenses: ₹10,682 crore, up 10.08% YoY from ₹9,704 crore.

- Consolidated Net Profit (PAT): ₹2,210 crore, up 13.8% from ₹1,942 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹79.15, up 13.80% from ₹69.55 YoY.

Operational & Strategic Update

- Healthy Revenue Growth: The 10% increase in revenue was supported by solid domestic demand, strong export performance, and higher realisations in both two-wheeler and three-wheeler segments.

- Aligned Expense Growth: Expenses rose in line with revenues due to increased material costs, production expansion, and marketing spends, maintaining overall operating margin stability.

- Profitability Boost: Net profit and EPS grew nearly 14%, reflecting operational efficiencies, a favourable product mix, and strong export margins.

- Export Leadership: Bajaj Auto retained its strong foothold in global markets with resilient demand from Latin America, Southeast Asia, and Africa, contributing significantly to export revenues.

- Strategic Investments: The increased stake in KTM continues to strengthen the company’s presence in the premium motorcycle segment, offering long-term growth synergy and brand positioning advantages.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results highlight Bajaj Auto’s ability to sustain double-digit profit growth while preserving margins in a competitive market. Strategic product launches, export-led diversification, and strong brand positioning in both commuter and performance segments have been key factors in performance support.

Looking Ahead

Bajaj Auto Ltd aims to leverage its diversified product portfolio, robust export channels, and partnership with KTM to drive future growth. The company is expected to focus on premiumisation, expansion into new geographies, and adoption of emerging EV technologies to stay ahead of market trends and strengthen shareholder value through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.