Key highlights from Bajaj Auto Limited (BAJAJAUTO) Q3 FY22 Earnings Concall

Management Update:

-

In the exports business, Q3 retail was a record for the company and its highest ever quarterly retail achieved in the overseas markets combined.

-

The company saw a gain of market share on its retail basis and it was driven by its upgrade strategy. In 100 CC, the kickstart to electric start ratio moved from being 25% to 75% in FY ’21, to about 95% in Q3.

-

BAJAJAUTO expects to make new introductions at regular intervals over the next six to nine months, completely refreshing and upgrading its Pulsar portfolio.

-

In electric vehicles, under the Champion OEM incentive scheme of auto PLI, BAJAJAUTO expects to invest over INR1,000 crores in the next five years.

Q&A Highlights:

-

Raghunandhan NL of Emkay Global asked about the electric three wheeler segment and what the ecosystem would include for BAJAJAUTO. Rakesh Sharma, ED says that the company is putting up EV three wheelers for approval by end of this fiscal, and in the next quarter these will be launched. It will have comprehensive range in the cargo, small passenger, and the large passenger space.

-

Raghunandhan NL of Emkay Global also asked if the company is focusing on battery swapping model as like its competitors. Rakesh Sharma commented that it doesn’t make sense in the three-wheeler segment, which is the commercial segment to have a swappable approach.

-

Gunjan Prithyani from Bank of America asked about the problem areas on the supply chain side. Rakesh Sharma ED said that in 1H2020 the company’s global vendor supply chain arrangement collapsed that was mainly on the battery side. And this was due to over reliance on one-vendor system. However, now BAJAJAUTO has indigenized, and internalized a lot of the components and put in new supply chain arrangements.

-

Kapil Singh from Nomura asked about export markets and contrast in comparison to the Indian market where volumes have declined while in International improved. Rakesh Sharma ED answered that the company has seen a steady volume in export of three wheelers with new markets also being explored. However, in India the development comes only with discontinuity like the shift to CNG three wheeler.

-

Kapil Singh from Nomura asked about two wheeler export outlook. Rakesh Sharma said that in the short term it will remain steady. At the retail level exports are strong and the company is hoping to conclude the financial year with 2.5 million plus of exports, almost $2.3 billion and a good surge in Pulsar and Dominar models.

-

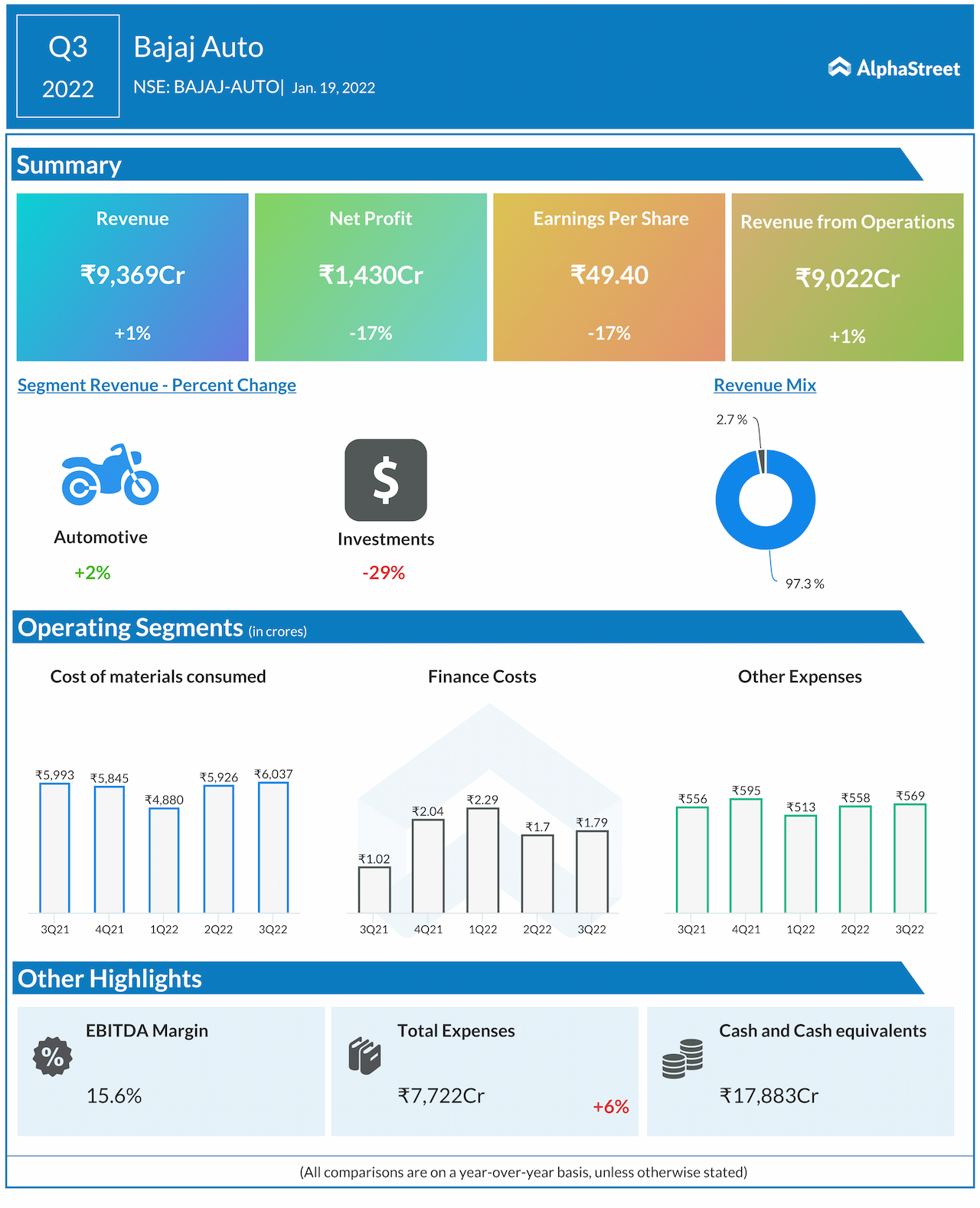

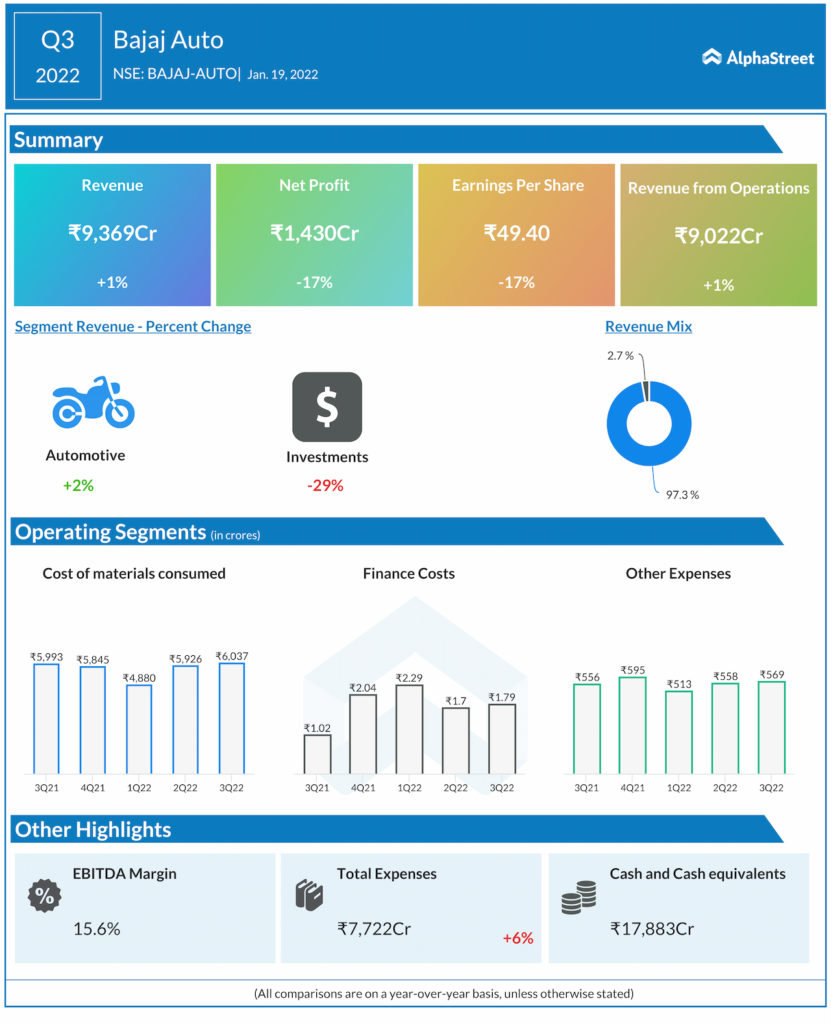

Binay Singh of Morgan Stanley enquired about the margins, considering the 5% price hike on the export front, which has expanded margins sequentially while sharply declining YoY. Kevin D’sa, CFO said that in Q3, the entire costs was passed on to customer and as a result of which margin improvement was reflected with material cost coming down by about 0.4%. In Q4, given the volume increase and a slight depreciation in the dollar, that there should be a marginal improvement in the margins from here.

-

Chirag Shah from Edelweiss asked about the three wheeler side, the breakup between CNG and other fuel in domestic as well as export markets. Rakesh Sharma ED answered that about 60% in domestic is CNG, which is passenger and cargo combined. Rakesh added that exports is much less but don’t have the number right now.

-

Nitij Mangal with Jefferies queried that on the commodity cost side, precious metal prices were down significantly and how much is that as a part of the company’s RM basket, especially rhodium. Rakesh Sharma ED said that it’s not very large compared to the major cost for a motorcycle, like steel, aluminum, and rubber in the tires. However, a fall over there would help BAJAJAUTO in the overall benefit on the material costs.