Azad Engineering Limited is a prominent manufacturer of precision-engineered aerospace components and turbines. The company supplies high-value, critical products to original equipment manufacturers (OEMs) in the aerospace, defense, energy, and oil & gas industries, establishing itself as a key supplier in global supply chains. Presenting below are its Q1 FY26 Earnings Results.

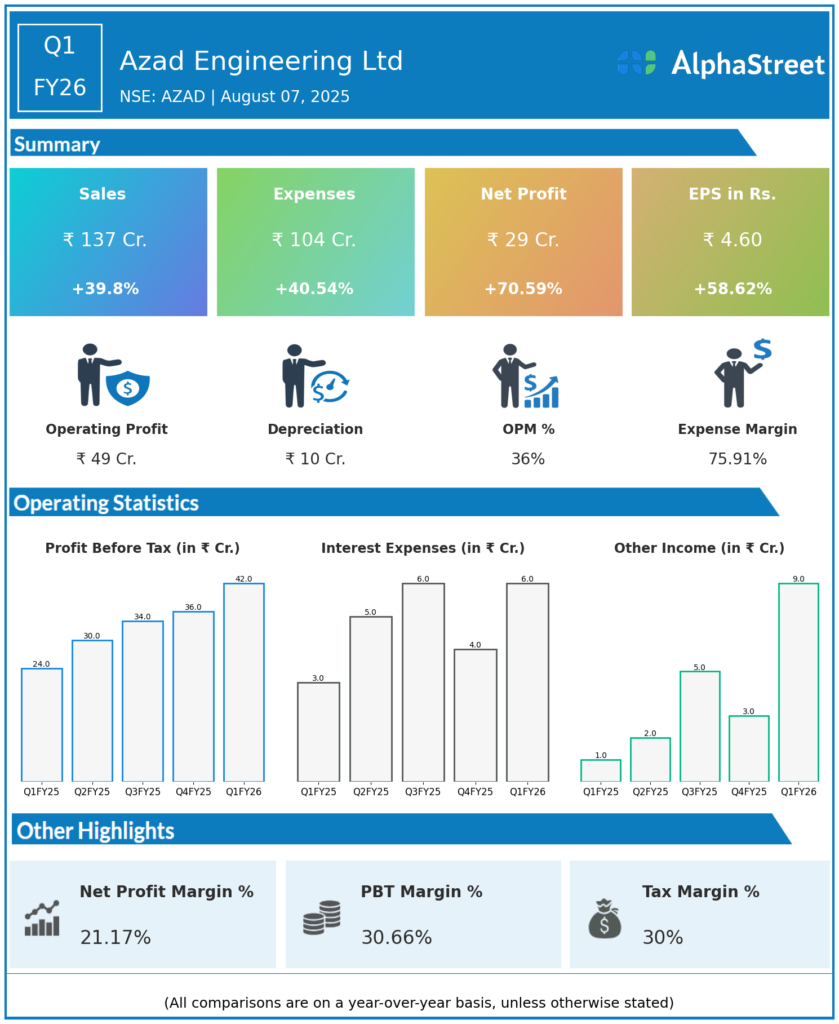

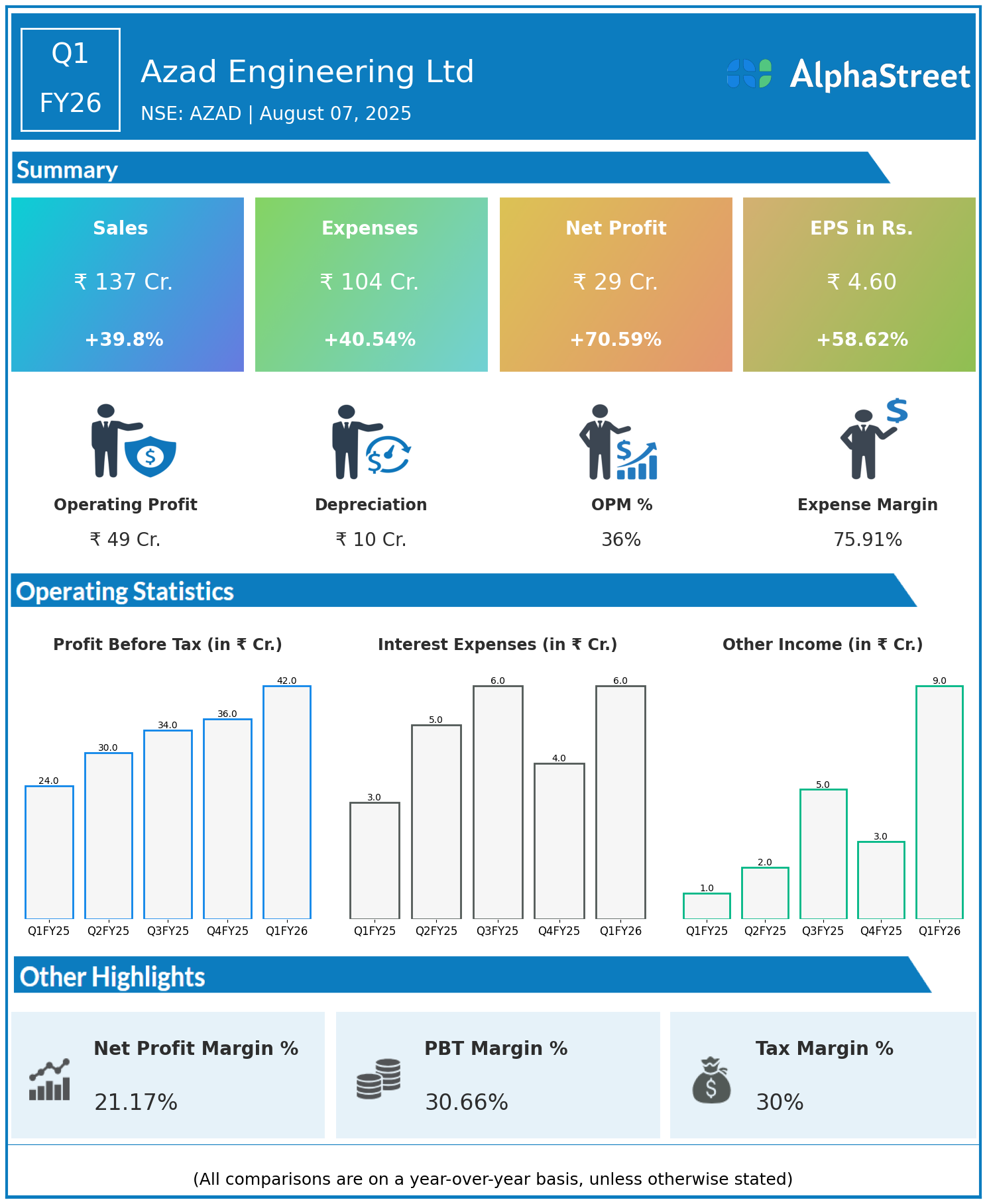

Q1 FY26 Earnings Results

- Revenue: ₹137 crore, up 39.8% year-on-year (YoY) from ₹98 crore in Q1 FY25.

- Total Expenses: ₹104 crore, up 40.54% YoY from ₹74 crore.

- Consolidated Net Profit (PAT): ₹29 crore, up 70.59% from ₹17 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹4.60, up 58.62% from ₹2.90 YoY.

Operational & Strategic Update

- Strong Revenue Growth: Azad Engineering delivered nearly 40% topline growth, reflecting robust demand from global OEM customers across aerospace, defense, energy, and oil & gas sectors. Increased order flows and the ramp-up of new contracts contributed to the expansion.

- Expense Dynamics: While total expenses also grew sharply, in line with higher activity and input costs, operating leverage from higher sales supported significant profit growth.

- Profitability Surge: Net profit and EPS showed a remarkable rise, with profit growth considerably outpacing revenue. This was driven by improved capacity utilization, execution of higher-value product contracts, and disciplined cost management.

- Product & Market Focus: The company continued to deliver advanced precision components to demanding segments, producing turbine blades, vanes, and other aero engine parts, benefiting from a diversified end-market presence.

- Quality & Certifications: Azad’s reputation for meeting stringent quality standards and holding global certifications enables it to sustain and grow business with leading international OEMs.

- Capacity & Innovation: Investments in advanced manufacturing processes, automation, and R&D have enhanced operational efficiency, innovation, and production scalability.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 marks an outstanding quarter for Azad Engineering Ltd, with strong growth in both revenue and profitability. The company’s results highlight execution excellence, solid client relationships, and strategic positioning in high-growth, high-precision sectors.

Looking Ahead

Azad Engineering Ltd is poised to leverage opportunities in global aerospace and defense manufacturing, with ongoing capacity expansions, deeper customer penetration, and continued innovation in precision engineering. The company’s focus on premium quality, process excellence, and strategic partnerships is expected to propel sustained growth and long-term value creation for stakeholders through FY26 and beyond.

To view Azad Engineering’s previous results: Click Here