Key highlights from Axis Bank Ltd (AXISBANK) Q3 FY22 Earnings Concall

Management Update:

- At 0.77 million, the company achieved highest ever credit cards acquisition in 3Q22, up 174% YoY and became the second largest merchant acquiring bank in the country.

Q&A Highlights:

-

Mahrukh Adajania from Elara Capital asked that on the operating expenses side, what percenate of opex is tech spend. Puneet Sharma CFO said that the company’s tech spend to total opex is in the range of 7.8% to 8% of total expense.

-

Mahrukh Adajania Elara Capital also asked about the medium term ROE outlook. Puneet Sharma CFO answered that AXISBANKS aspirational ROE target is 18% and the visibility is of 16% to 16.5%.

-

Kunal Shah with ICICI Securities enquired about the movement of double BB and below, if there were any slippages coming in from there and the upgrades in that entire moment wherein BB and below has actually come off. Puneet Sharma CFO replied that the slippage from the BB pool was INR800 crores, which includes one technical slippage of INR160 crores, which is downgrade and upgrade in the same quarter, partially. The upgrades from NPA to BB pool is INR355 crores and all other downgrade plus balance reduction movement would be the balance INR194 crores.

-

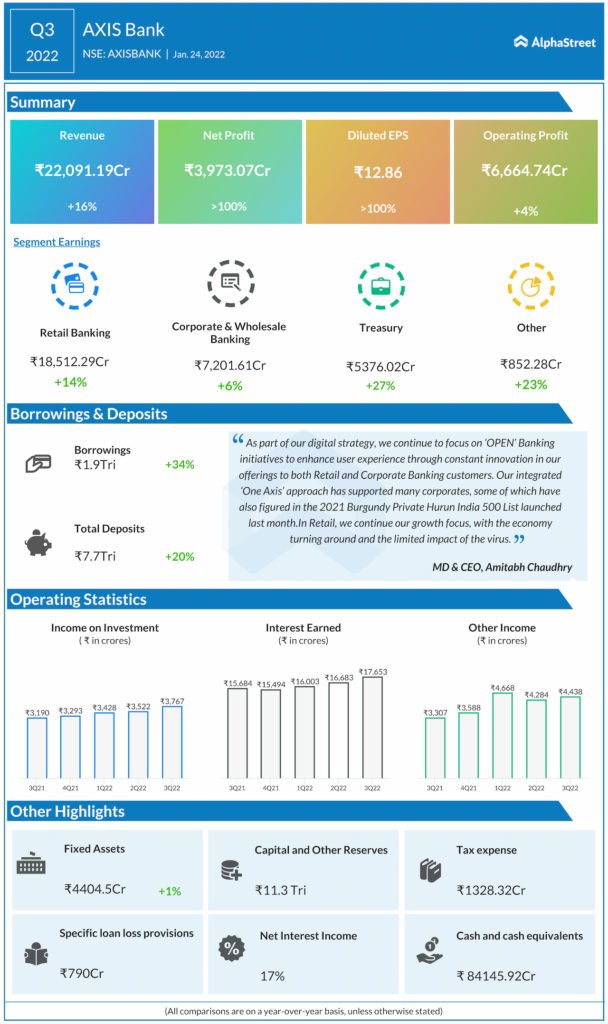

Gaurav Kochar of Mirae Asset asks about incremental borrowing and why it’s up sequentially. Puneet Sharma CFO said the company has firstly raised long-term infra bonds that has contributed to increased borrowings. Secondly there is a period impact. And thirdly, overall the company’s foreign currency trade book has gone up, aided by offshore borrowings.

-

Nitin Agarwal Motilal Oswal Securities enquired about the provisions of INR134 billion and when the company plans to utilize the COVID provision. Puneet Sharma CFO answered that breaking out the INR134 billion provision, INR5,012 crores is the COVID provision. And on utilization, AXISBANK’s current assessment is that there is risk module and consequently, the prudent provision continues to stand. The company does not expect to utilize that provision based on the result of the risk model in FY22. Longer term, AXISBANK expects to carry this provision structurally forward to lend strength to the balance sheet and utilize it even post-COVID.

-

Nitin Agarwal from Motilal Oswal Securities asked how much NPL aging provisions have been made in Q3 given higher slippages experienced a year back. Puneet Sharma CFO replied saying that 61% of the NPA provisions were on account of go forward. As for breakup of provisions, loan loss provisions are INR790 crores, 61% of that provision would have come from prior period flow forwards.

-

Anand Dama from Emkay Global asked about granularity in terms of tech spend and breakup on maintenance and new tech and how much it was last year. Puneet Sharma CFO answered that the company doesn’t give that level of granularity on tech spend. Current year, the company said it’s in the 7.8% to 8% range. It was lower last year. AXISBANK’s tech spends have grown by 40% on a YoY basis. So the proportion of the percentage will be lower in the past period.

-

Anand Dama from Emkay Global also asked about the strong growth in the rural book and which segments saw higher growth. Munish Sharda Group Executive answered that the company had a strong 3Q in the rural book, and in all product lines the company saw growth in disbursals and balance sheet. YoY, the company grew 56% and the growth came across all segments.