Executive Summary

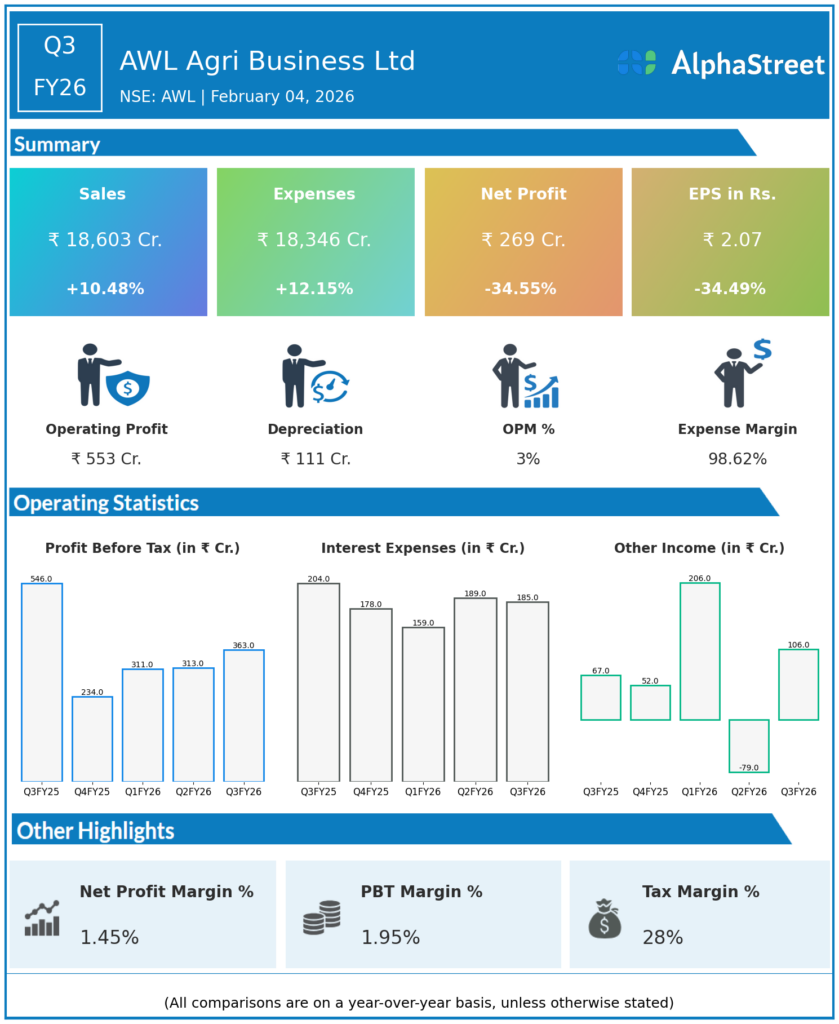

AWL Agri Business Ltd reported Q3FY26 revenues of ₹18,603 crore, up 10.48% YoY, but consolidated net profit declined 34.55% to ₹269 crore amid 12.15% expense growth. Record edible oil volumes offset new Labour Codes regulatory costs and muted festive demand across food segments.

Revenue & Growth

Revenues reached record ₹18,603 crore from ₹16,839 crore YoY, driven by 8% volume growth in edible oils (₹15,025 crore, 64% mix). Total expenses rose 12.15% YoY to ₹18,346 crore, exceeding revenue pace due to ₹25.83 crore exceptional Labour Codes provisions.

Profitability & Margins

Consolidated net profit fell 34.55% YoY to ₹269 crore from ₹411 crore, with EBITDA declining 20.16% to ₹685 crore. Basic EPS dropped 34.49% to ₹2.07 from ₹3.16; Food & FMCG grew to ₹1,648 crore while Industry Essentials dipped 8%.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

9M revenue hit ₹53,266 crore (+17% YoY) with PAT at ₹752 crore; edible oils sustained leadership while alternate channels boosted FMCG recovery amid regulatory implementation challenges.